Question: How negative correlation affect those factors? If the returns from Projects A, B, and C had strong negative correlation with the normal expected earnings of

How negative correlation affect those factors?

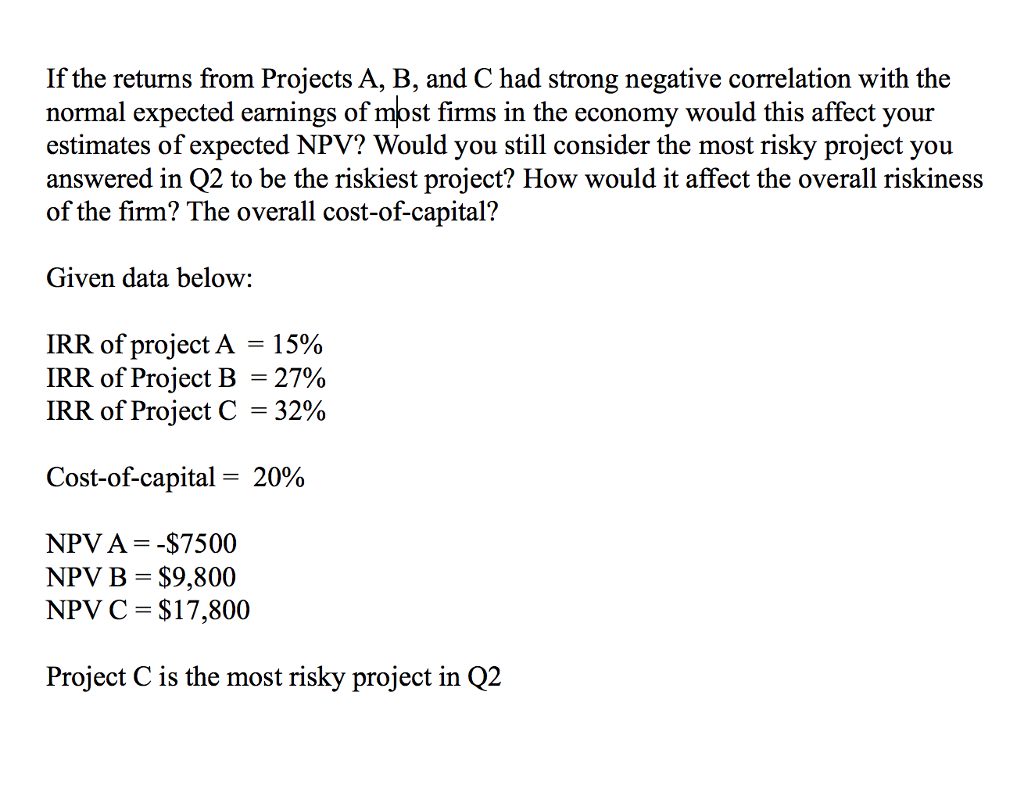

If the returns from Projects A, B, and C had strong negative correlation with the normal expected earnings of mpst firms in the economy would this affect your estimates of expected NPV? Would you still consider the most risky project you answered in Q2 to be the riskiest project? How would it affect the overall riskiness of the firm? The overall cost-of-capital? Given data below: IRR ofprojectA-15% IRR of Project B-27% IRR of Project C-32% Cost-of-capital= 20% NPV A--$7500 NPV B $9.800 NPV C $ 17,800 Project C is the most risky project in Q2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts