Question: Question Help If we know that a firm has a net profit margin of 4.6%, total asset turnover of 0.65, and a financial leverage multiplier

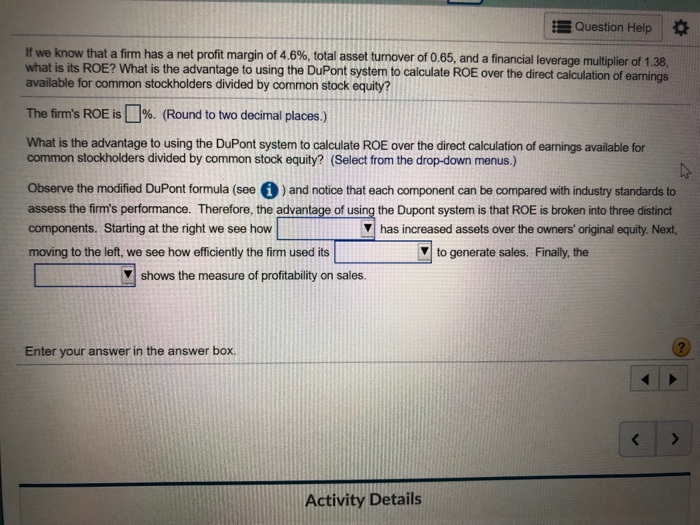

Question Help If we know that a firm has a net profit margin of 4.6%, total asset turnover of 0.65, and a financial leverage multiplier of 1.38. what is its ROE? What is the advantage to using the DuPont system to calculate ROE over the direct calculation of earnings available for common stockholders divided by common stock equity? The firm's ROE is %. (Round to two decimal places.) What is the advantage to using the DuPont system to calculate ROE over the direct calculation of earnings available for common stockholders divided by common stock equity? (Select from the drop-down menus.) Observe the modified DuPont formula (see () and notice that each component can be compared with industry standards to assess the firm's performance. Therefore, the advantage of using the Dupont system is that ROE is broken into three distinct components. Starting at the right we see how V has increased assets over the owners' original equity. Next, moving to the left, we see how efficiently the firm used its to generate sales. Finally, the V shows the measure of profitability on sales. Enter your answer in the answer box Activity Details

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts