Question: question help with 5d and 5e pls analysts expect dividends to increase 7% per year for the nex 3 years and then drop to 3%

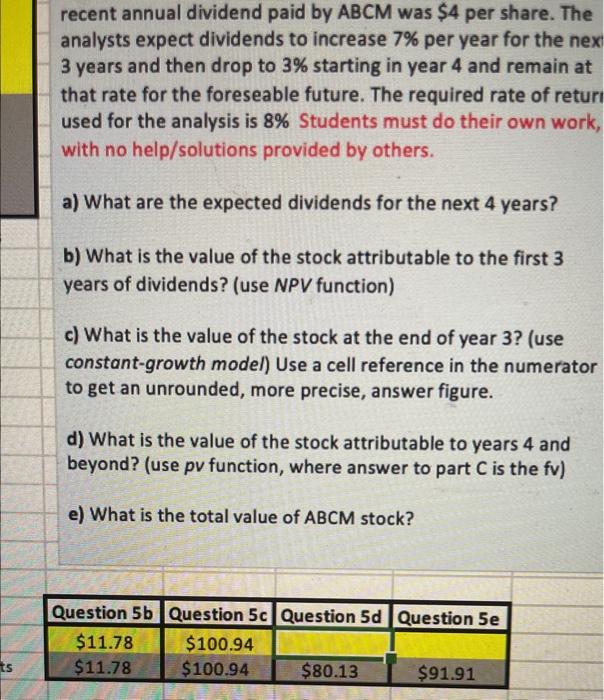

analysts expect dividends to increase 7% per year for the nex 3 years and then drop to 3% starting in year 4 and remain at that rate for the foreseable future. The required rate of retur used for the analysis is 8% Students must do their own work, with no help/solutions provided by others. a) What are the expected dividends for the next 4 years? b) What is the value of the stock attributable to the first 3 years of dividends? (use NPV function) c) What is the value of the stock at the end of year 3 ? (use constant-growth model) Use a cell reference in the numerator to get an unrounded, more precise, answer figure. d) What is the value of the stock attributable to years 4 and beyond? (use pv function, where answer to part C is the fv) e) What is the total value of ABCM stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts