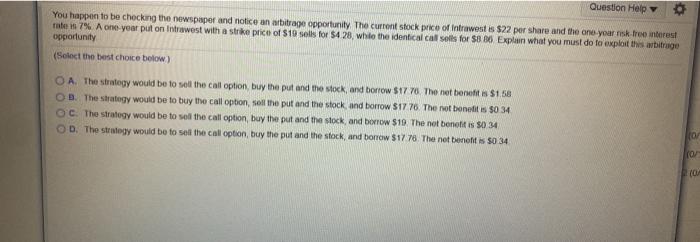

Question: Question Help You happen to be checking the newspaper and notice an arbitrage opportunity. The current stock price of intrawest is $22 per share and

Question Help You happen to be checking the newspaper and notice an arbitrage opportunity. The current stock price of intrawest is $22 per share and the one yoarisk free interest tot 17% A one-year put on Intrawest with a strike price of $19 solls for $4 28, while the identical cal sells for $886 Explain what you must do fo exploit this arbitrage opportunity (Select the best choice below) O A. The strategy would be to sell the call option buy the put and the stock, and borrow $1776. The net benefits $158 OB. The strategy would be to buy the call option, sell the put and the stock, and borrow $1776. The not benefits $0 34 OC. The strategy would be to sell the call option, buy the put and the stock and borrow $19 The net benefit is 5034 OD. The strategy would be to sell the call option, buy the put and the stock, and borrow $1778. The net beneft is 50 34 0 ro (OM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts