Question: Question (i) 1 year yield = S1 = 3.5% 2 year yield = S2 = 4.5% 3 year yield = S3 = 5% 4 year

Question (i)

1 year yield = S1 = 3.5%

2 year yield = S2 = 4.5%

3 year yield = S3 = 5%

4 year yield = S4 = 5.5%

One year implied rate for 3 years = 1F3

Formula :

(1+S4)^4 = (1+S1)^1 * (1+1F3)^3

So

(1+1F3)^3 = (1+S4)^4 / (1+S1)

(1+1F3)^3 = (1.055)^4 / (1.035)

1F3 = 6.175%

What's the answer to (ii)?

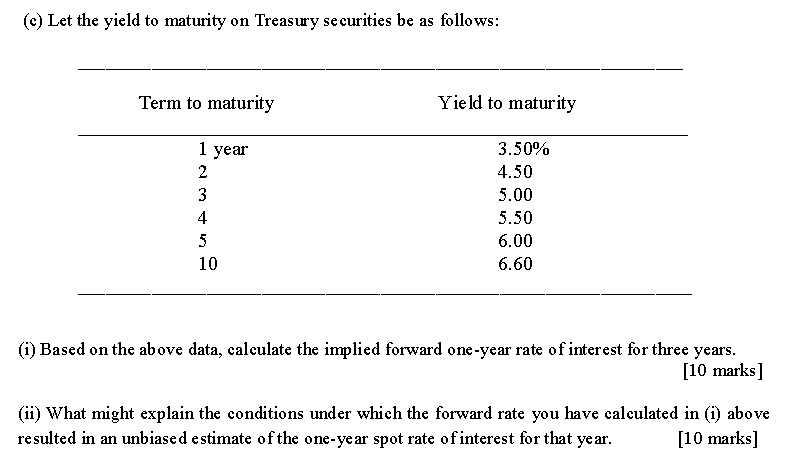

(e) Let the yield to maturity on Treasuy seeuries be as follows: Term to maturity Yield to maturity 3.50% 4.50 5.00 5.50 6.00 6.60 1 year 4 10 (i) Based on the above data, calculate the implied forward one-year rate ofinterest for three years. [10 marks] (ii) what might explain the conditions under which the forward rate you have calculated in (i) above resulted in an unbiased estimate of the one-year spot rate of interest for that year.[10 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts