Question: question I got wrong on a similar question Baker Street. Arthur Doyle is a currency trader for Baker Street, a private investment house in London.

question I got wrong on a similar question

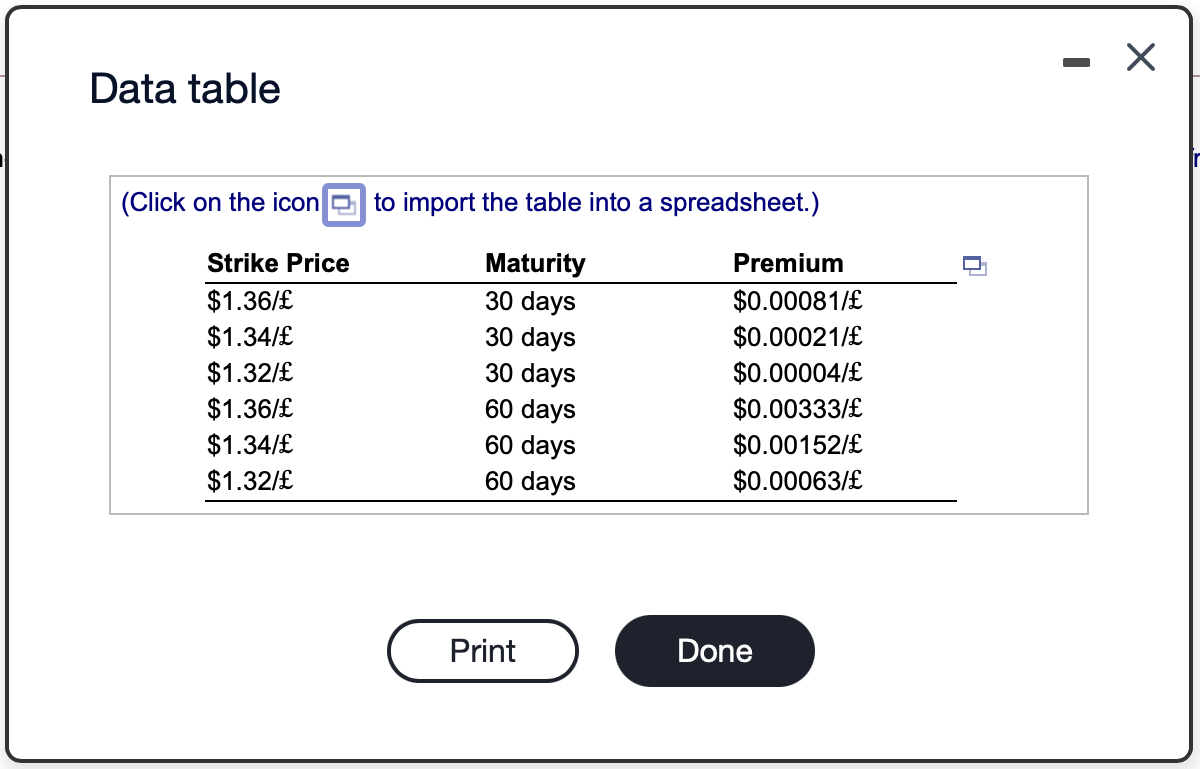

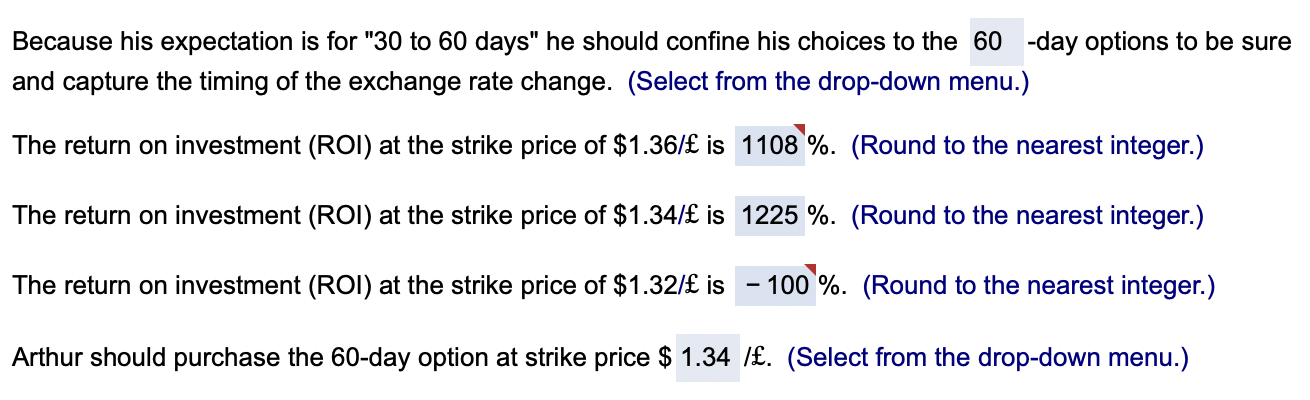

Baker Street. Arthur Doyle is a currency trader for Baker Street, a private investment house in London. Baker Street's clients are a collection of wealthy private investors who, with a minimum stake of 230,000 each, wish to speculate on the movement of currencies. The investors expect annual returns in excess of 25%. Although officed in London, all accounts and expectations are based in U.S. dollars. Arthur is convinced that the British pound will slide significantlypossibly to $1.3200/in the coming 30 to 60 days. The current spot rate is $1.4264 /. Arthur wishes to buy a put on pounds which will yield the 25% return expected by his investors. Which of the following put options, B, would you recommend he purchase? Prove your choice is the preferable combination of strike price, maturity, and up-front premium expense. Because his expectation is for "30 to 60 days" he should confine his choices to the -day options to be sure and capture the timing of the exchange rate change. (Select from the drop-down menu.) 30 60 90 Data table (Click on the icon to import the table into a spreadsheet.) Maturity 2 Strike Price $1.36/ $1.34/ $1.32/ $1.36/ $1.34/ $1.32/ 30 days 30 days 30 days 60 days 60 days 60 days Premium $0.00081/ $0.00021/ $0.00004/ $0.00333/ $0.00152/ $0.00063/ Print Done Because his expectation is for "30 to 60 days" he should confine his choices to the 60-day options to be sure and capture the timing of the exchange rate change. (Select from the drop-down menu.) The return on investment (ROI) at the strike price of $1.36/ is 1108 %. (Round to the nearest integer.) The return on investment (ROI) at the strike price of $1.34/ is 1225 %. (Round to the nearest integer.) The return on investment (ROI) at the strike price of $1.32/ is - 100%. (Round to the nearest integer.) Arthur should purchase the 60-day option at strike price $ 1.34 /. (Select from the drop-down menu.) Baker Street. Arthur Doyle is a currency trader for Baker Street, a private investment house in London. Baker Street's clients are a collection of wealthy private investors who, with a minimum stake of 230,000 each, wish to speculate on the movement of currencies. The investors expect annual returns in excess of 25%. Although officed in London, all accounts and expectations are based in U.S. dollars. Arthur is convinced that the British pound will slide significantlypossibly to $1.3200/in the coming 30 to 60 days. The current spot rate is $1.4264 /. Arthur wishes to buy a put on pounds which will yield the 25% return expected by his investors. Which of the following put options, B, would you recommend he purchase? Prove your choice is the preferable combination of strike price, maturity, and up-front premium expense. Because his expectation is for "30 to 60 days" he should confine his choices to the -day options to be sure and capture the timing of the exchange rate change. (Select from the drop-down menu.) 30 60 90 Data table (Click on the icon to import the table into a spreadsheet.) Maturity 2 Strike Price $1.36/ $1.34/ $1.32/ $1.36/ $1.34/ $1.32/ 30 days 30 days 30 days 60 days 60 days 60 days Premium $0.00081/ $0.00021/ $0.00004/ $0.00333/ $0.00152/ $0.00063/ Print Done Because his expectation is for "30 to 60 days" he should confine his choices to the 60-day options to be sure and capture the timing of the exchange rate change. (Select from the drop-down menu.) The return on investment (ROI) at the strike price of $1.36/ is 1108 %. (Round to the nearest integer.) The return on investment (ROI) at the strike price of $1.34/ is 1225 %. (Round to the nearest integer.) The return on investment (ROI) at the strike price of $1.32/ is - 100%. (Round to the nearest integer.) Arthur should purchase the 60-day option at strike price $ 1.34 /. (Select from the drop-down menu.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts