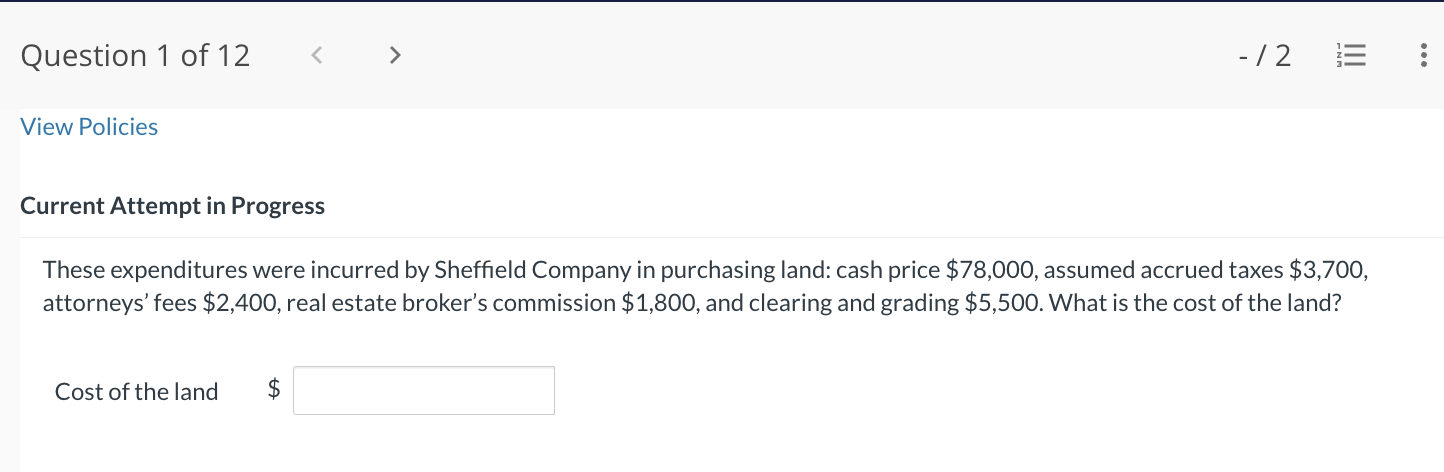

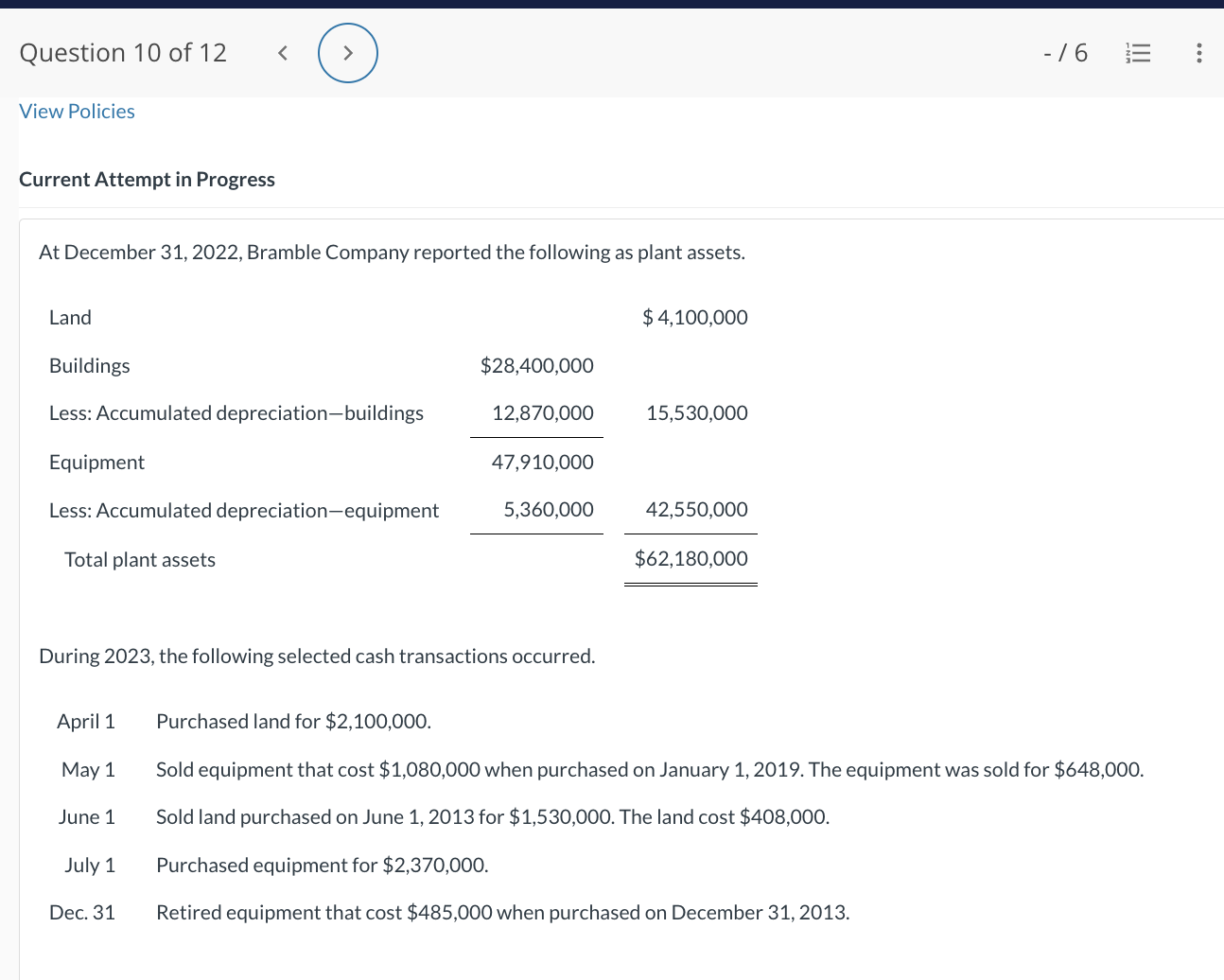

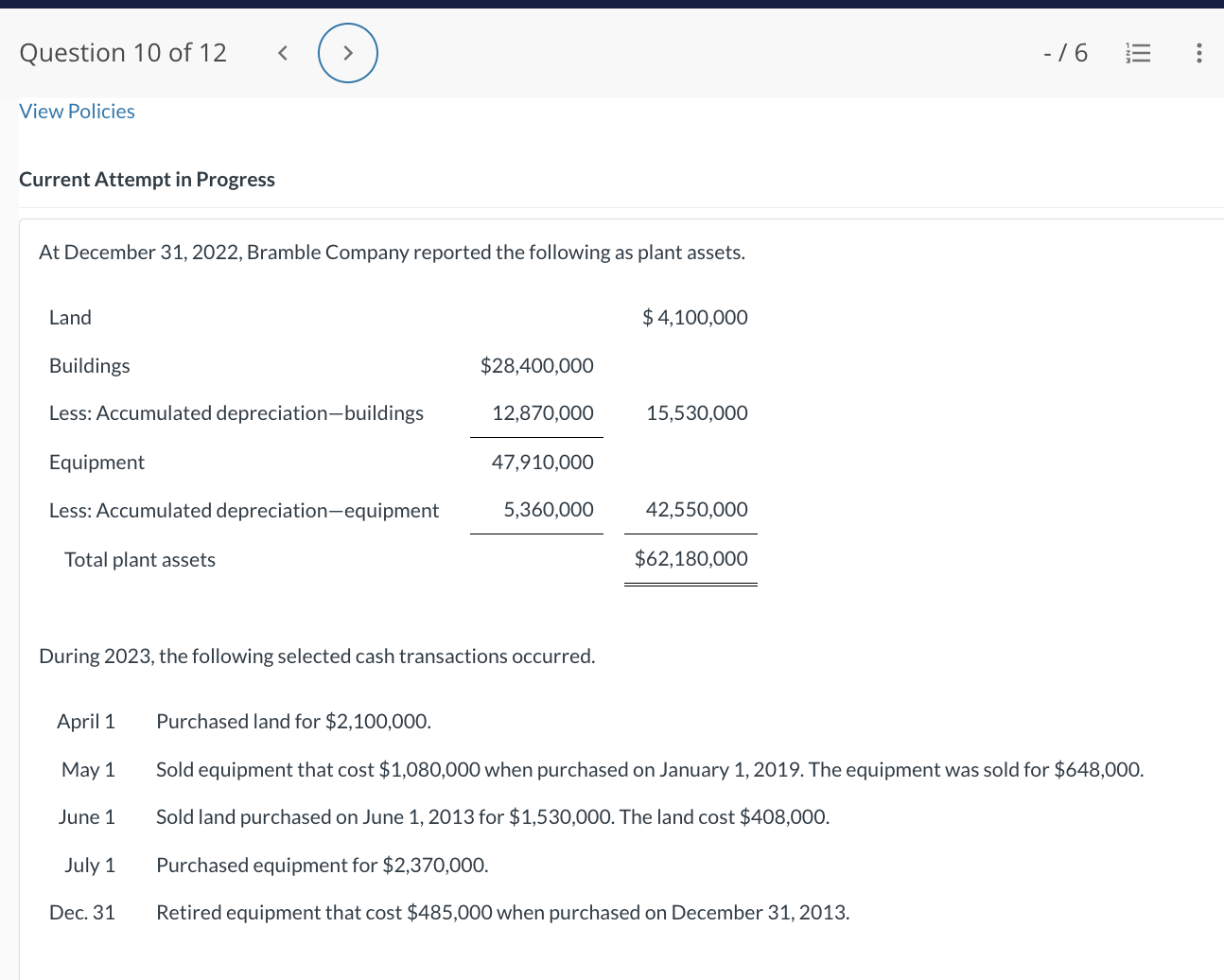

Question: Question I of12 > -/2 E View Policies Current Attempt in Progress These expenditures were incurred by Shefeld Company in purchasing land: cash price $78,000,

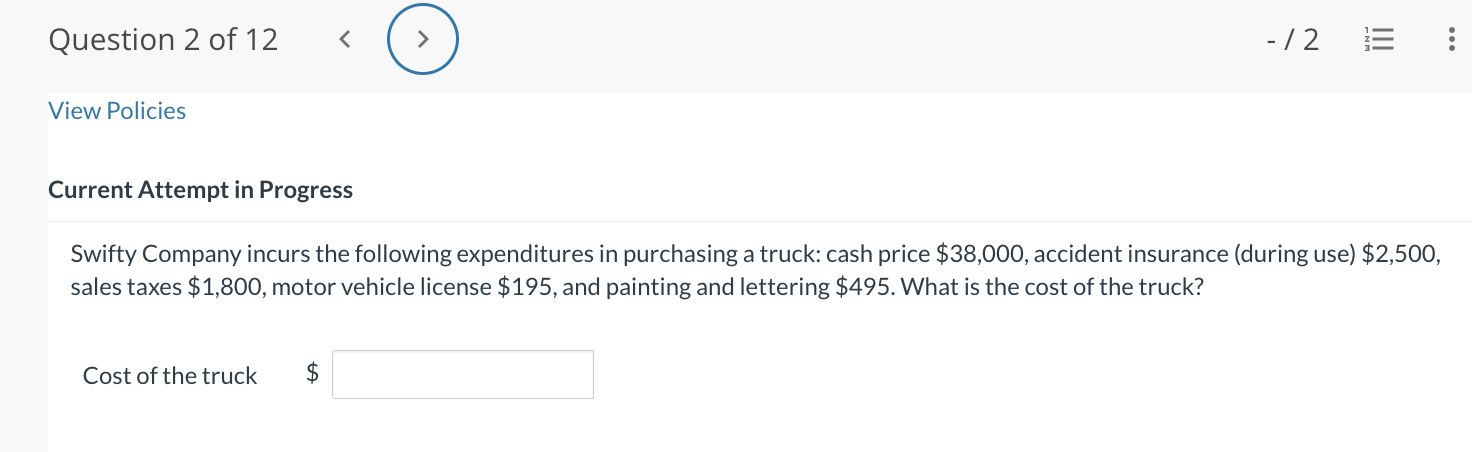

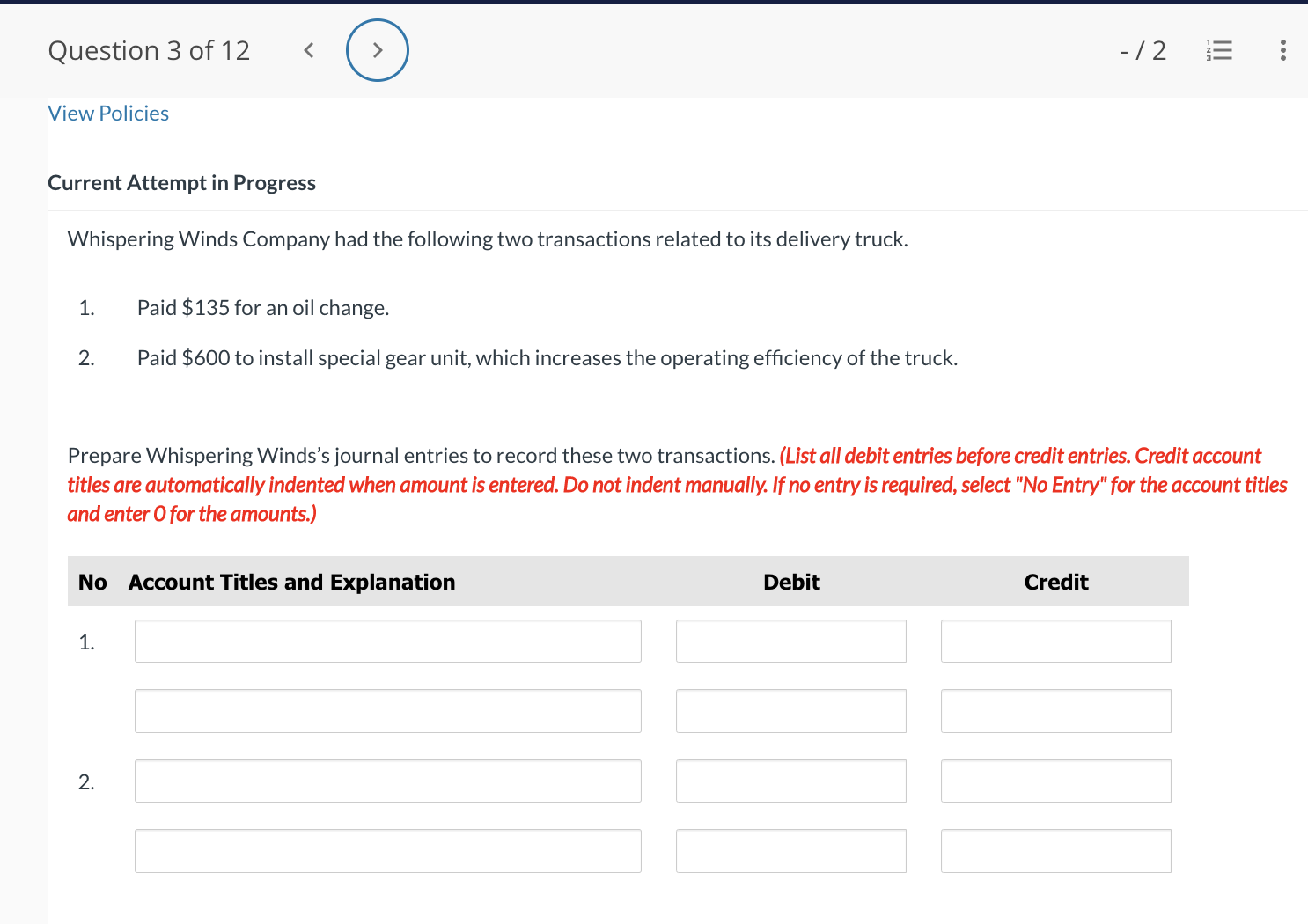

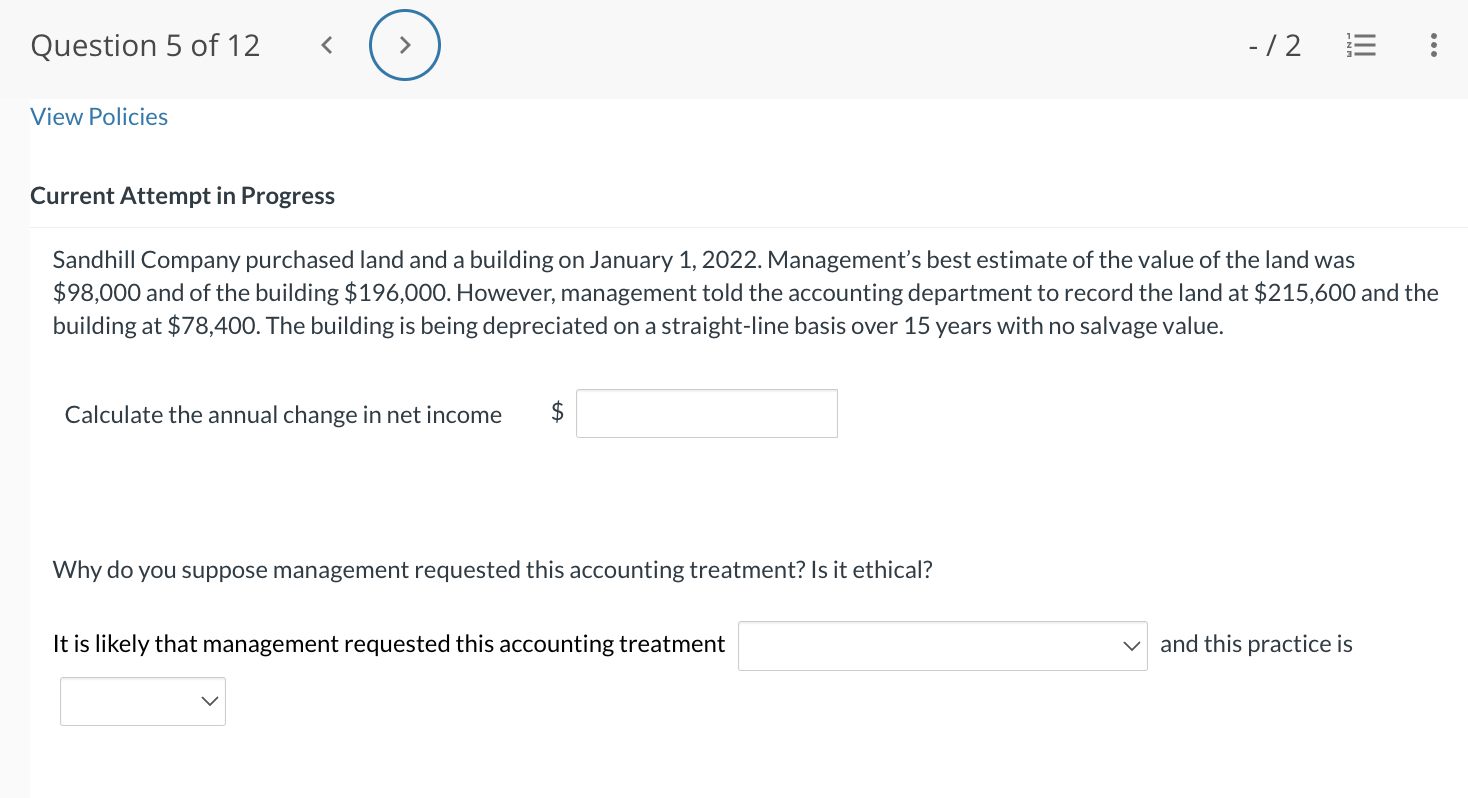

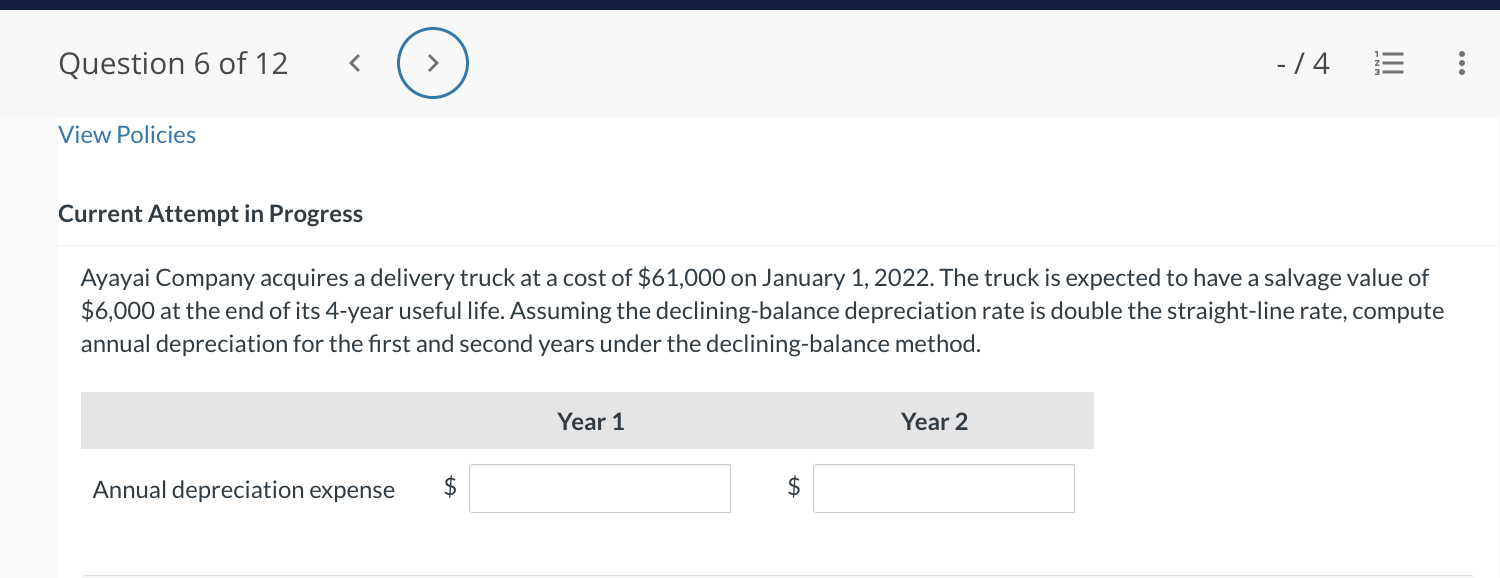

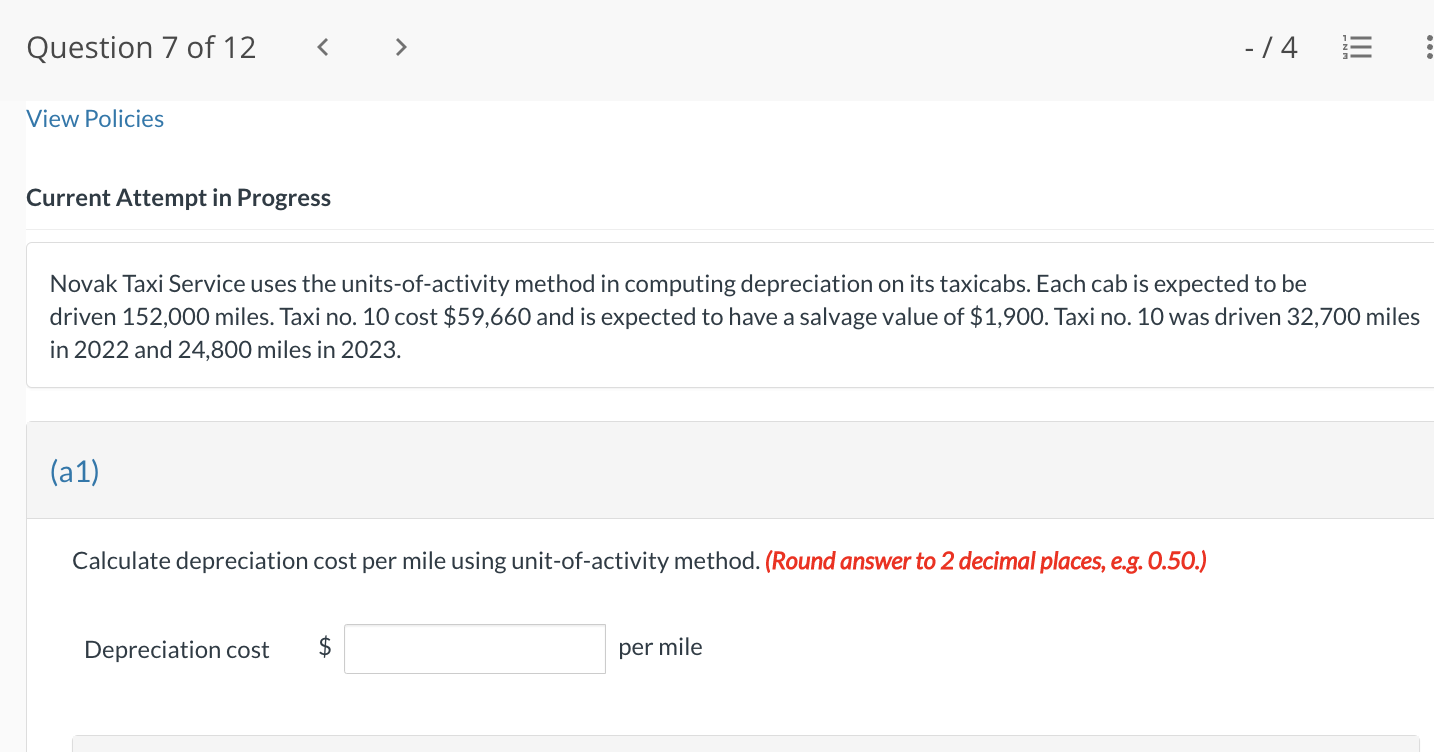

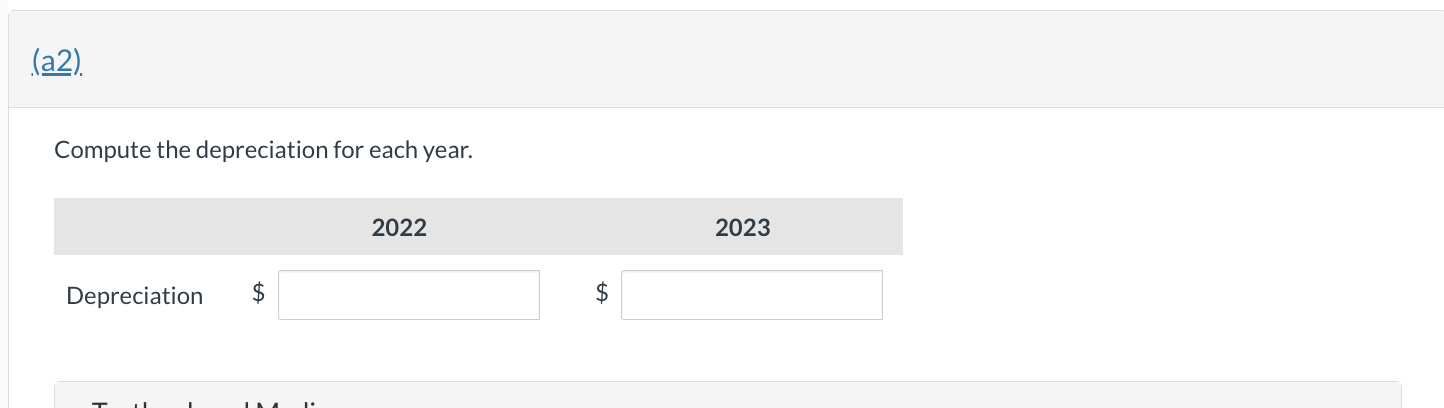

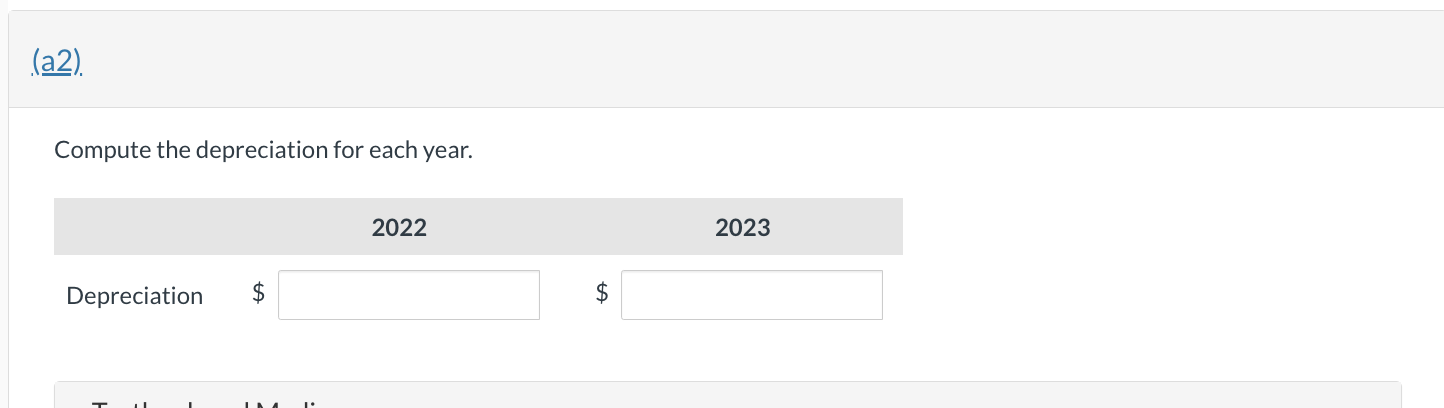

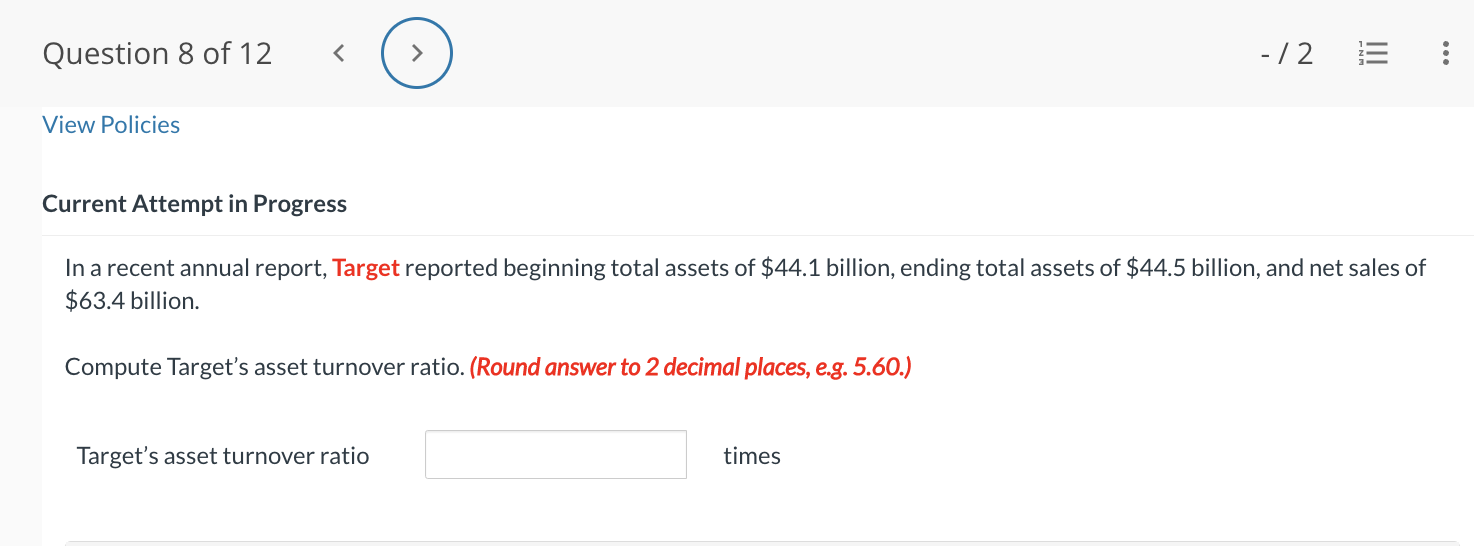

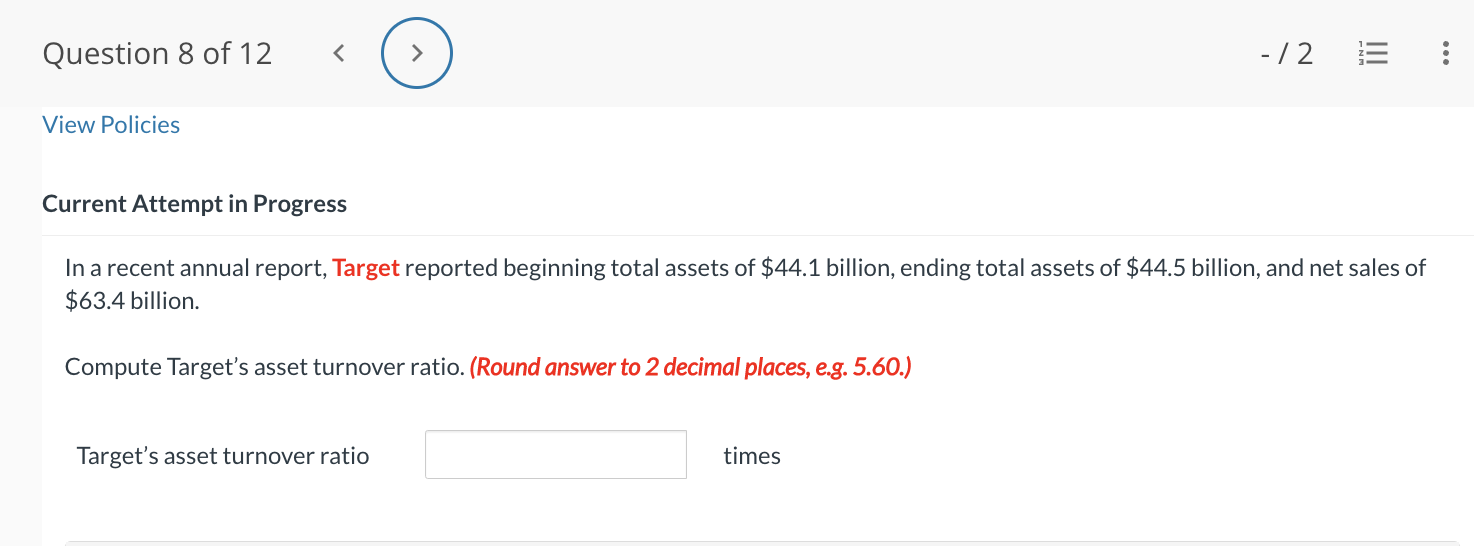

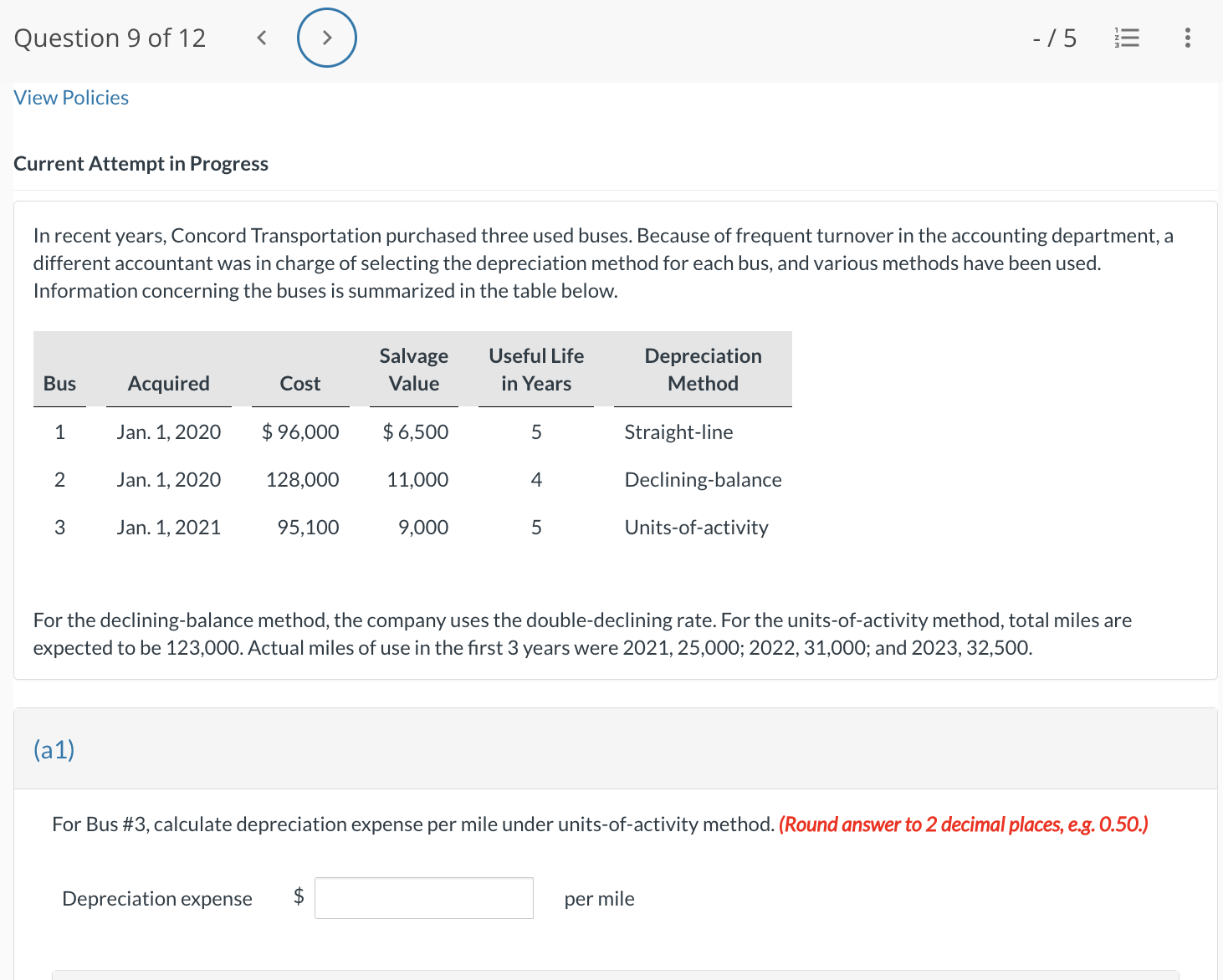

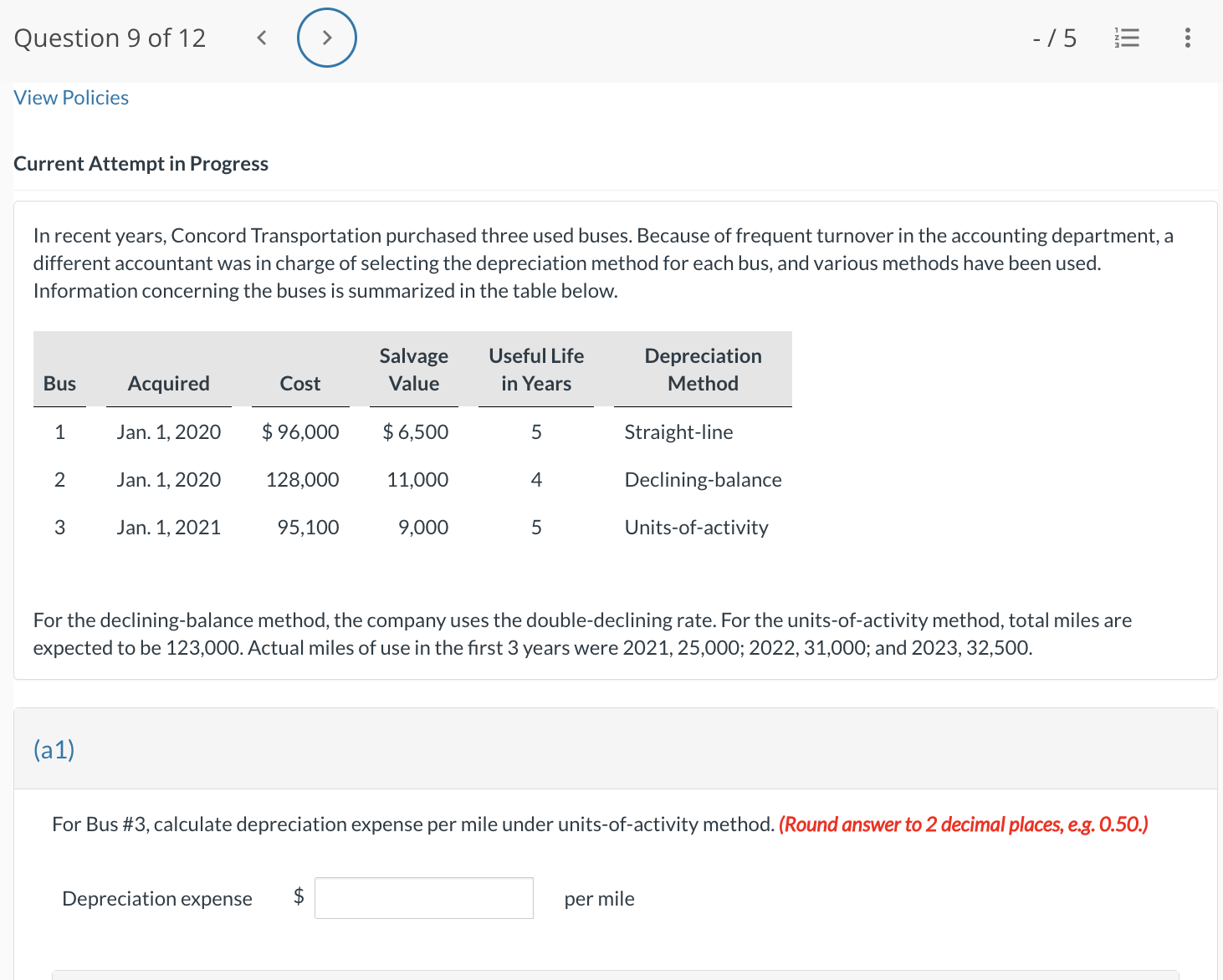

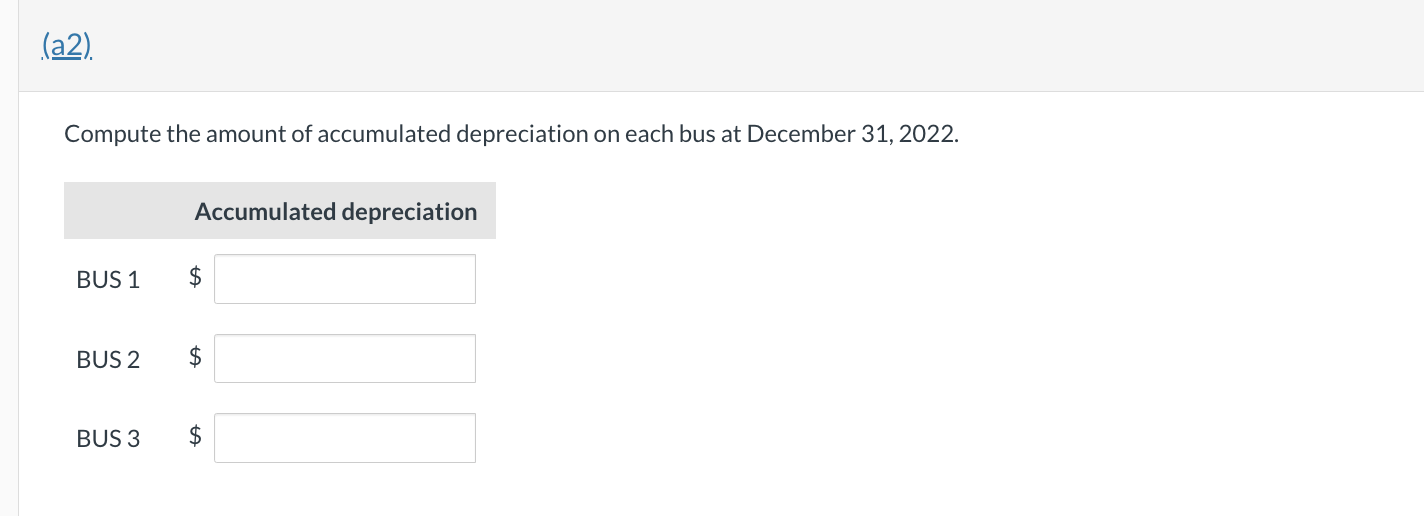

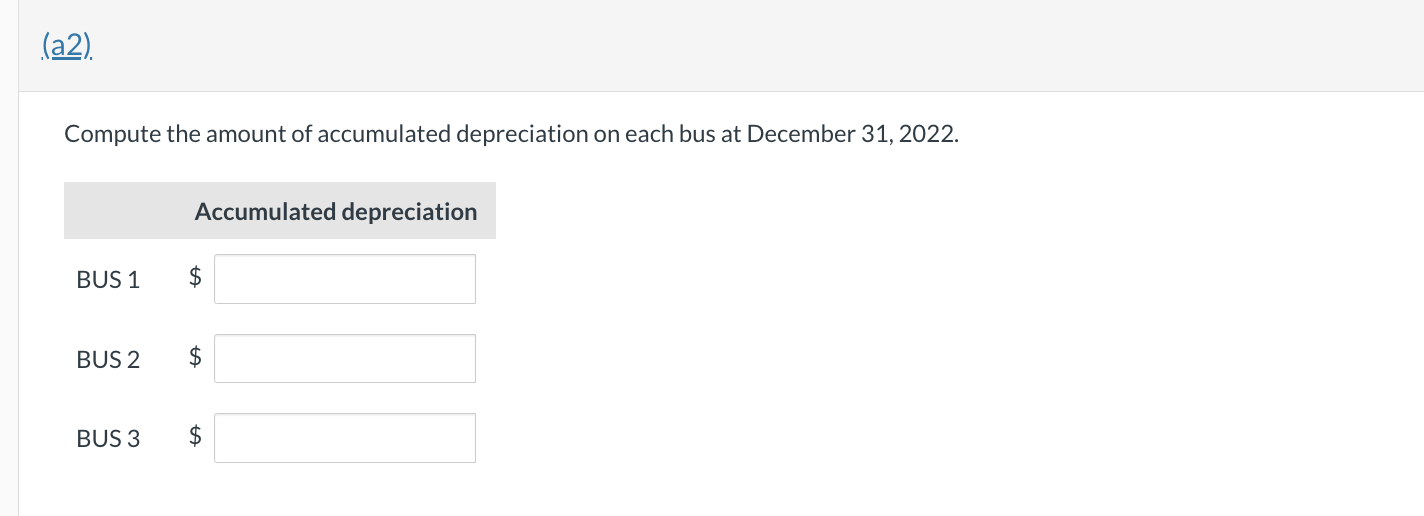

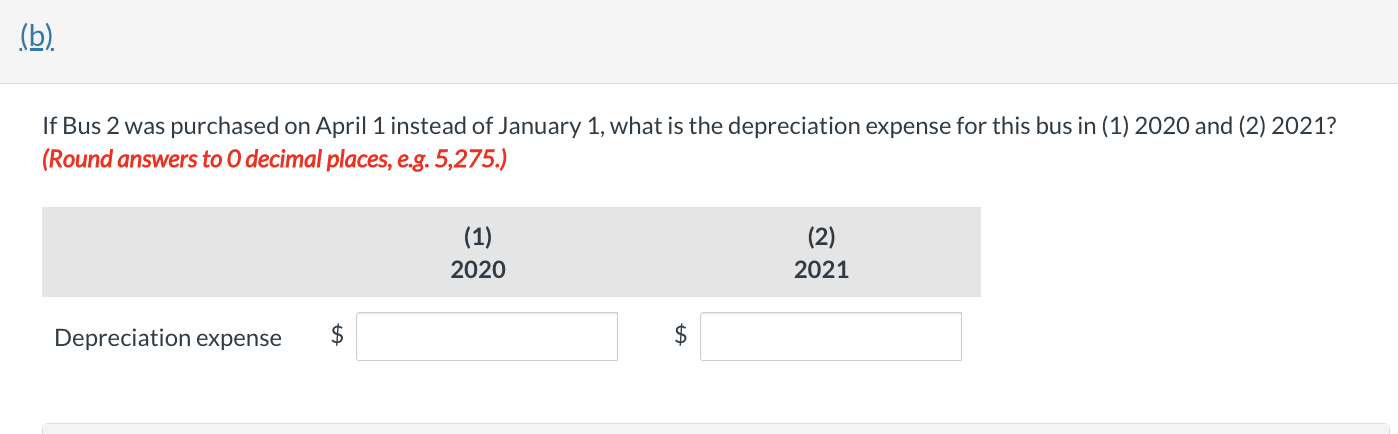

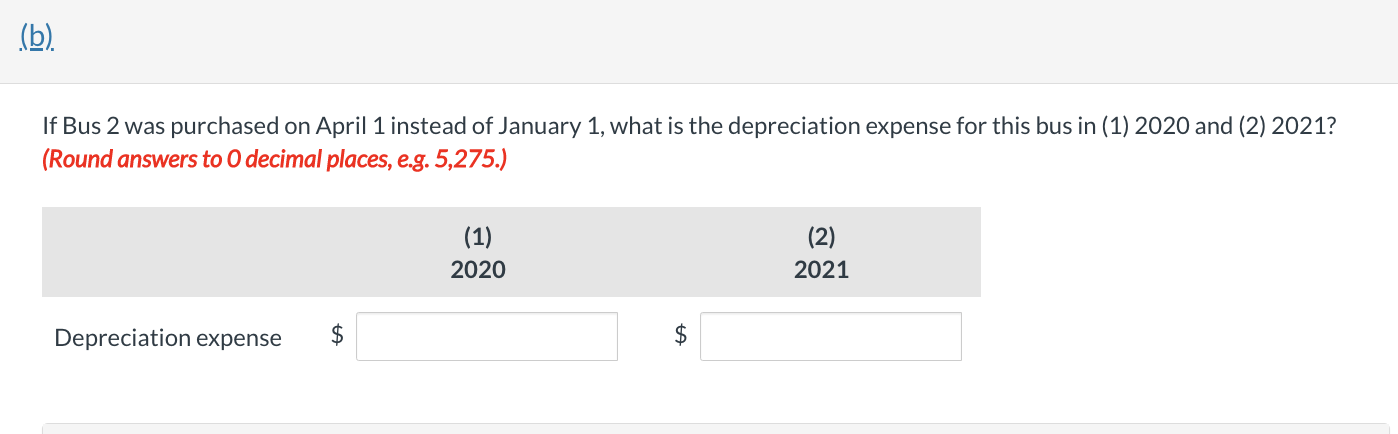

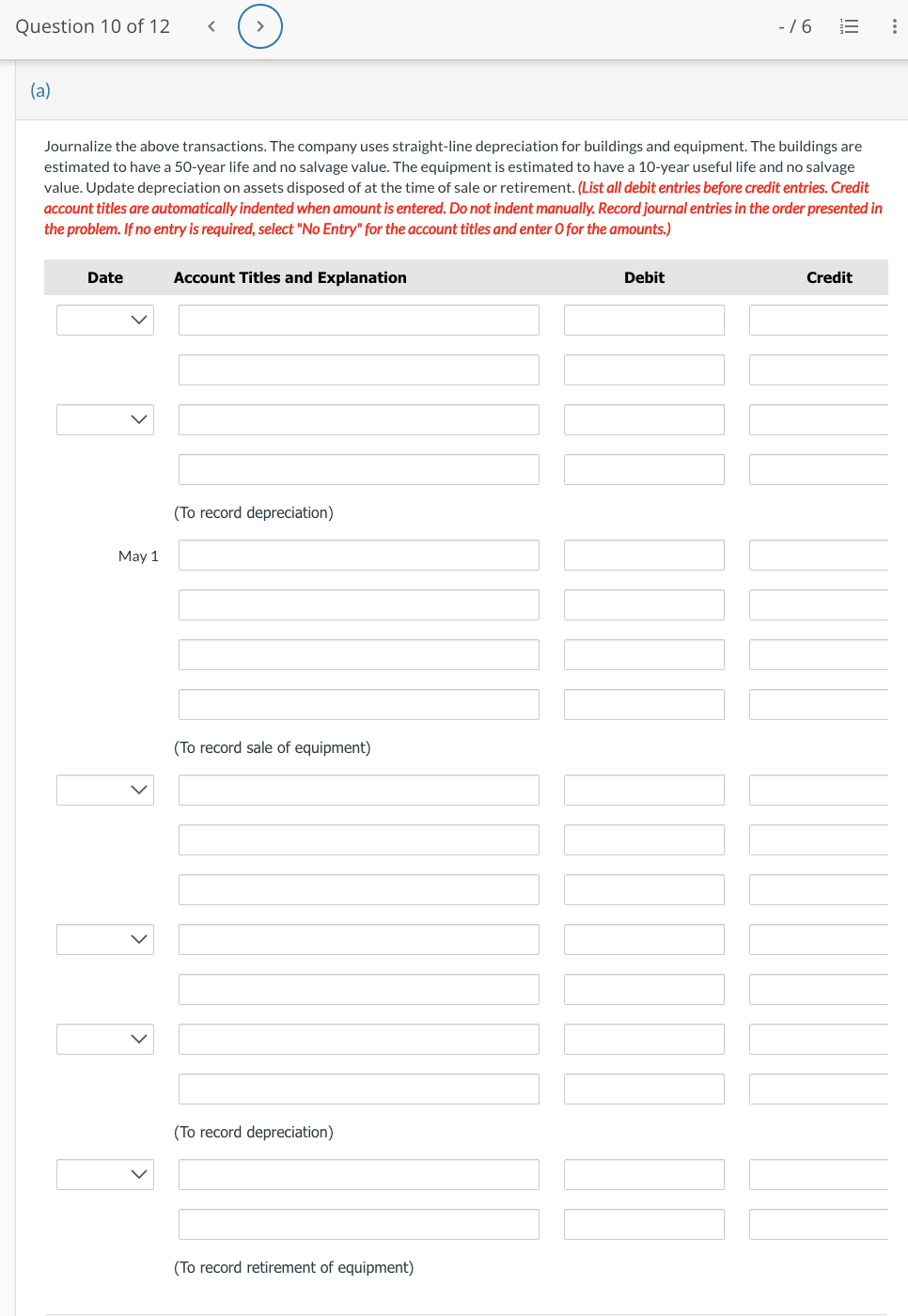

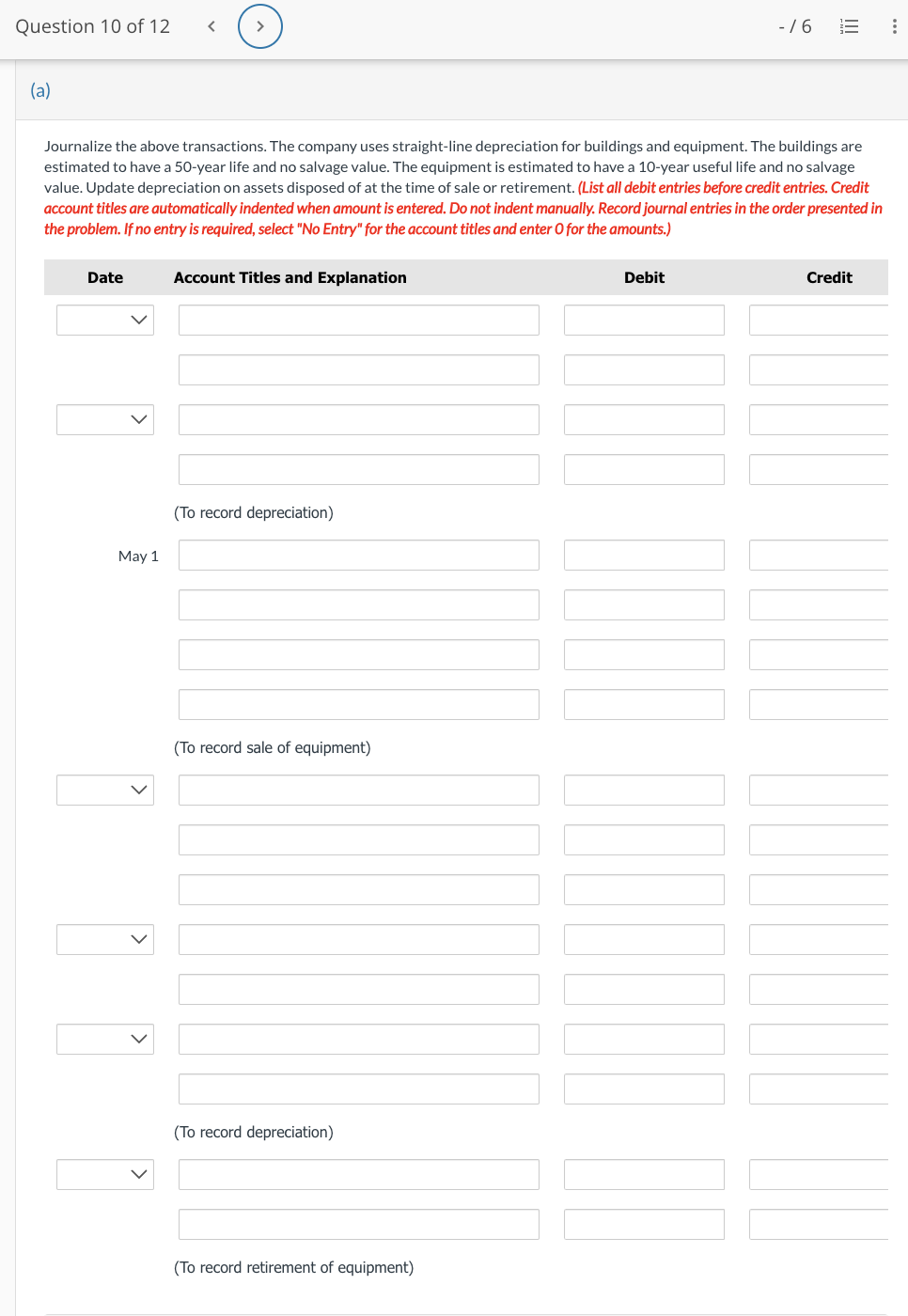

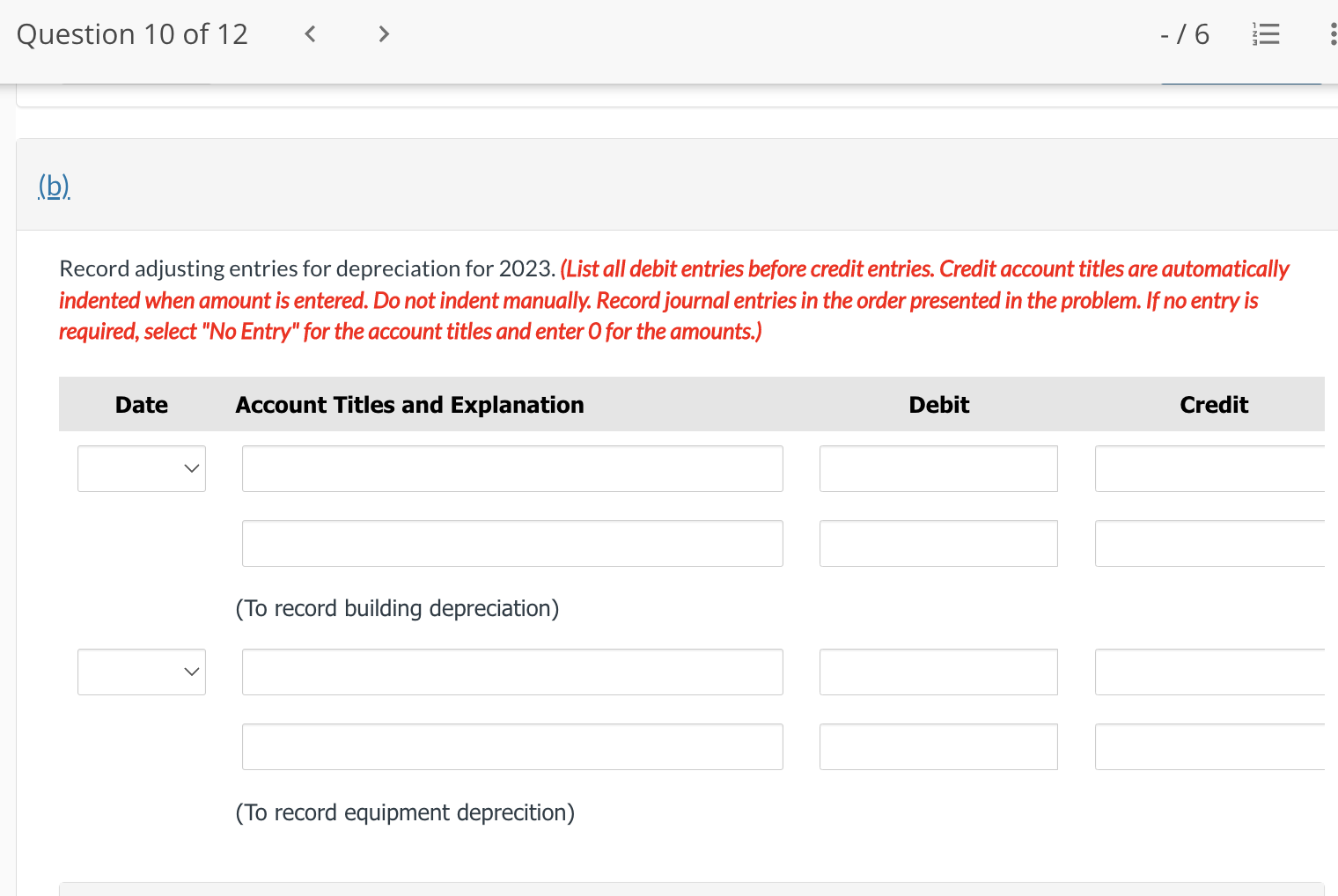

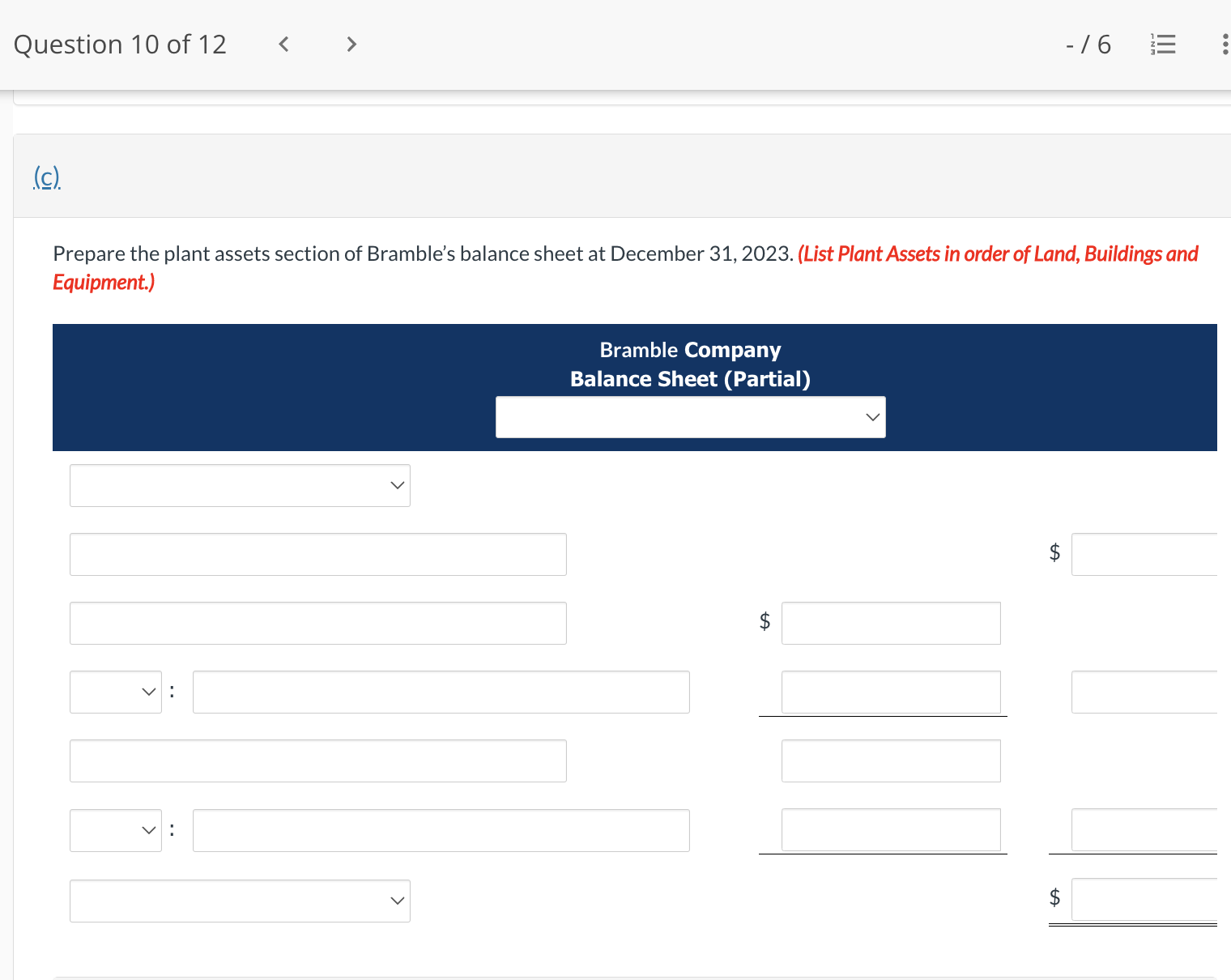

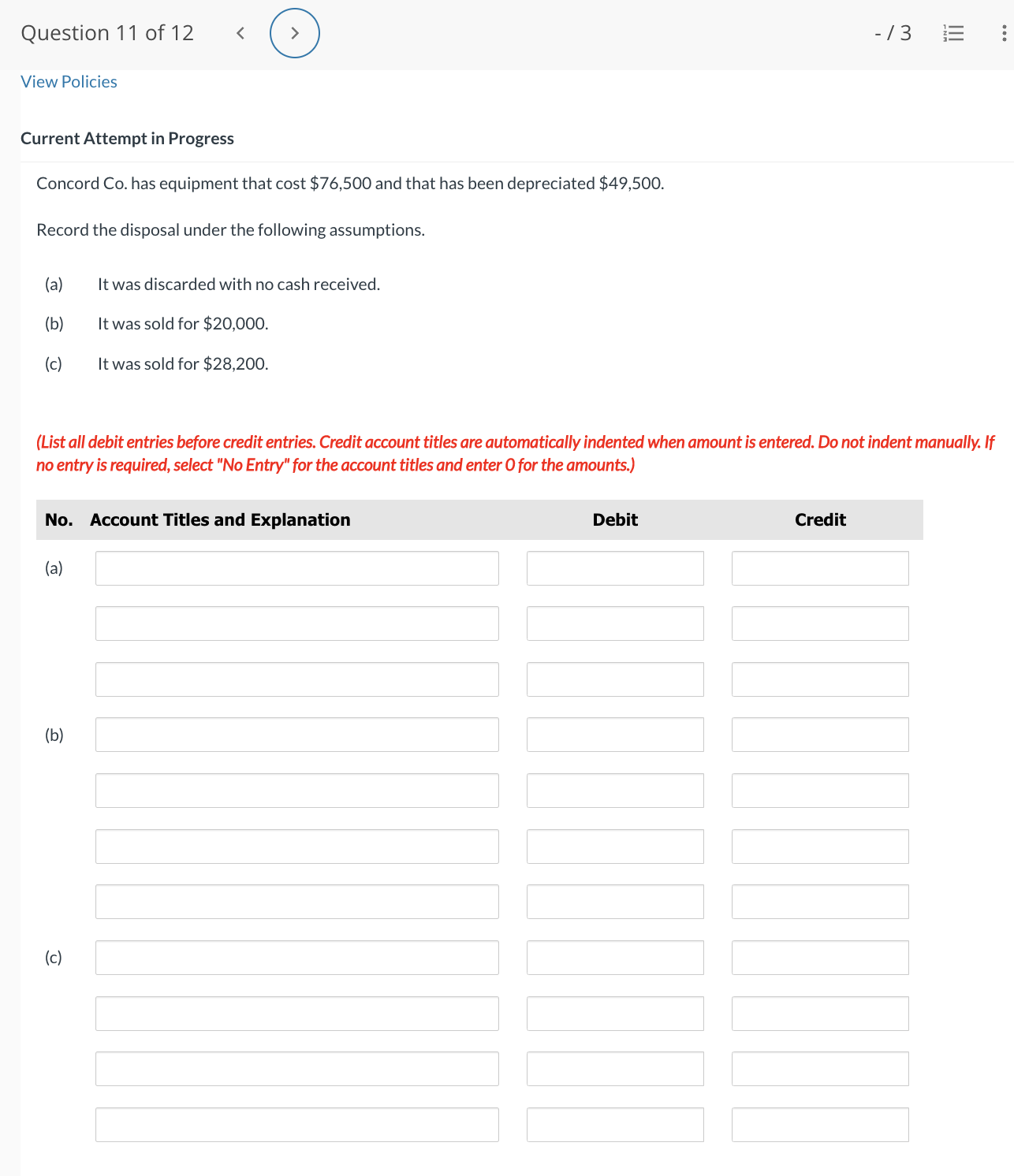

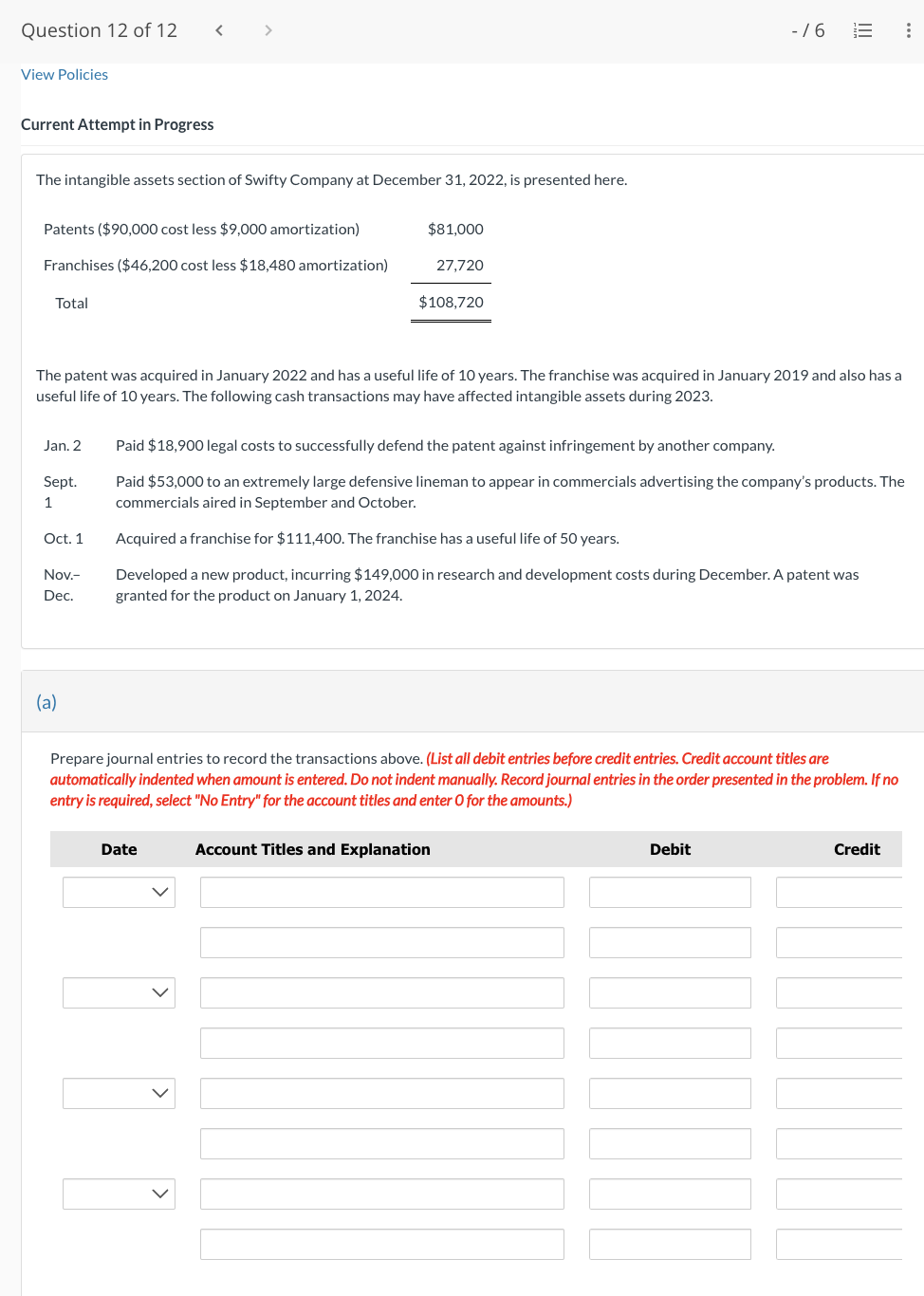

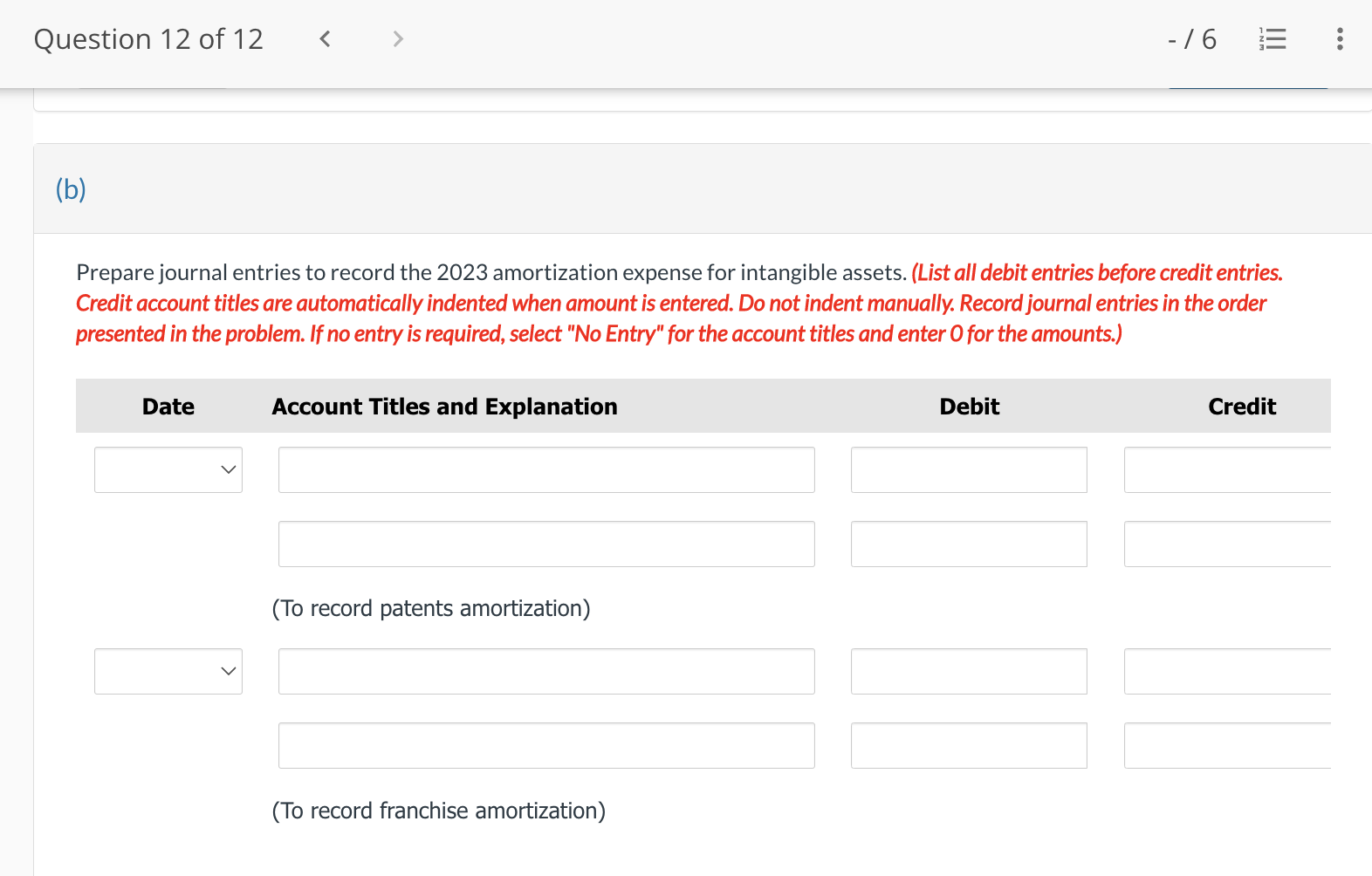

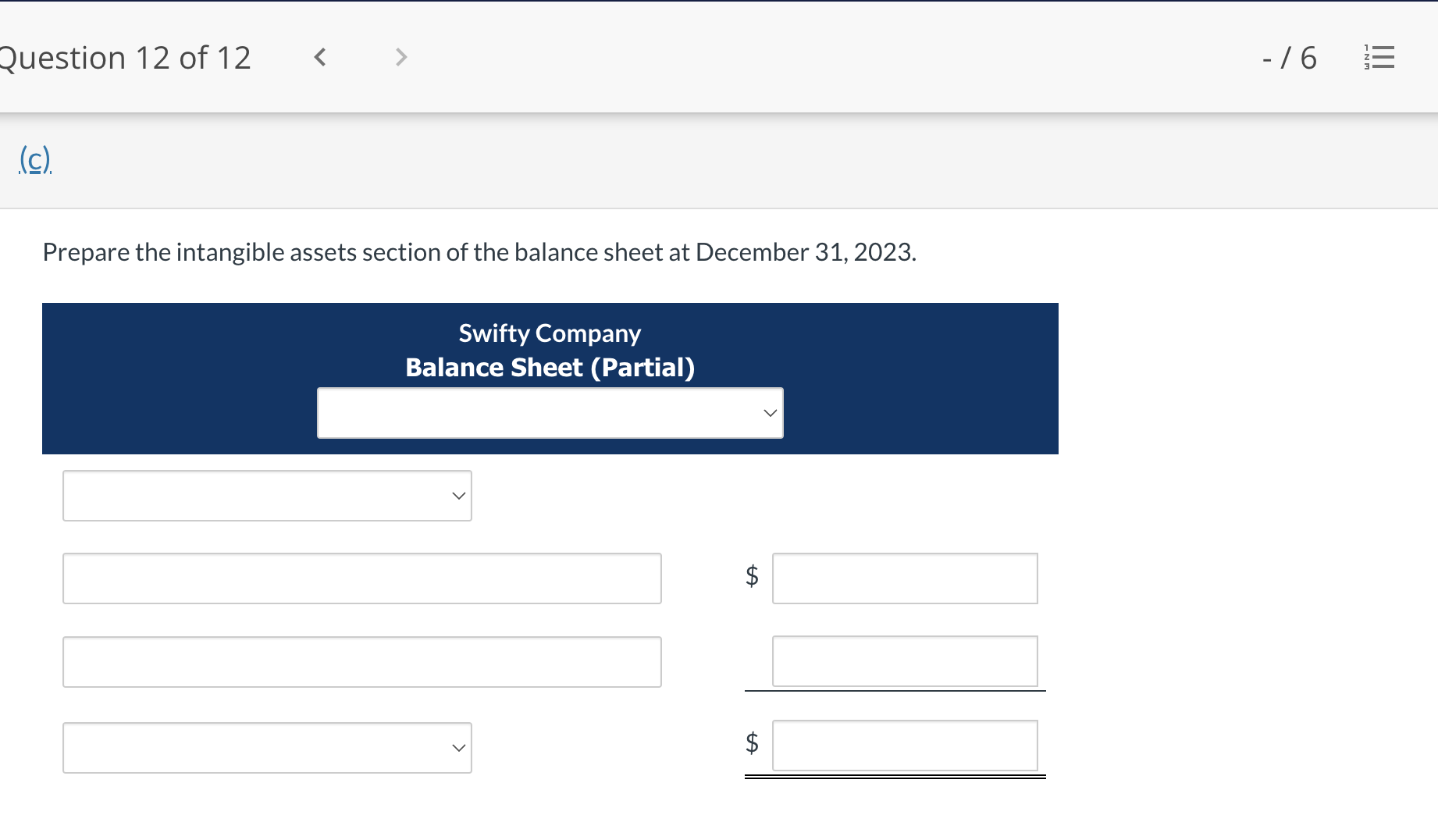

Question \"I of12 > -/2 E View Policies Current Attempt in Progress These expenditures were incurred by Shefeld Company in purchasing land: cash price $78,000, assumed accrued taxes $3,700, attorneys' fees $2,400, real estate broker's commission $1,800, and clearing and grading $5,500. What is the cost of the land? Cost ofthe land $ .00 Question 2 0f12 - l 4 E View Policies Current Attempt in Progress Novak Taxi Service uses the units-of-activity method in computing depreciation on its taxicabs. Each cab is expected to be driven 152,000 miles. Taxi no. 10 cost $59,660 and is expected to have a salvage value of $1,900. Taxi no. 10 was driven 32,700 miles in 2022 and 24,800 miles in 2023. (all Calculate depreciation cost per mile using unit-of-activity method. (Round answer to 2 decimaipiaces, as. 0.50.) Depreciation cost $ per mile .00 \f\fQuestion 8 of12 - / 6 '55 ('2). Record adjusting entries for depreciation for 2023. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. if no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit (To record building depreciation) (To record equipment deprecition) DOC Question 10 of12 -/6 E .(c). Prepare the plant assets section of Bramble's balance sheet at December 31, 2023. (List PlantAssets in order of Land, Buildings and Equipment.) Bramble Company Balance Sheet (Partial) on. Question 11 of12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts