Question: Question in Finance: Note: Please help by using Time Value Money Formula. Apple Inc. pays quarterly dividends. The next dividend will be paid 2 months

Question in Finance:

Note: Please help by using Time Value Money Formula.

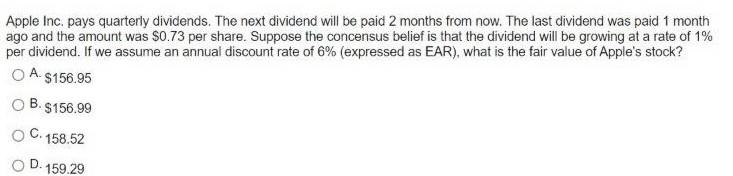

Apple Inc. pays quarterly dividends. The next dividend will be paid 2 months from now. The last dividend was paid 1 month ago and the amount was $0.73 per share. Suppose the concensus belief is that the dividend will be growing at a rate of 1% per dividend. If we assume an annual discount rate of 6% (expressed as EAR), what is the fair value of Apple's stock? O A $156.95 B. $156.99 158.52 OD. 159.29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts