Question: question in photo. Thank you ! Problem 5-983 (Algorithmic) Determining Bad Debt Expense Using the Aging Method At the beginning of the year, Lennon Electronics

question in photo. Thank you !

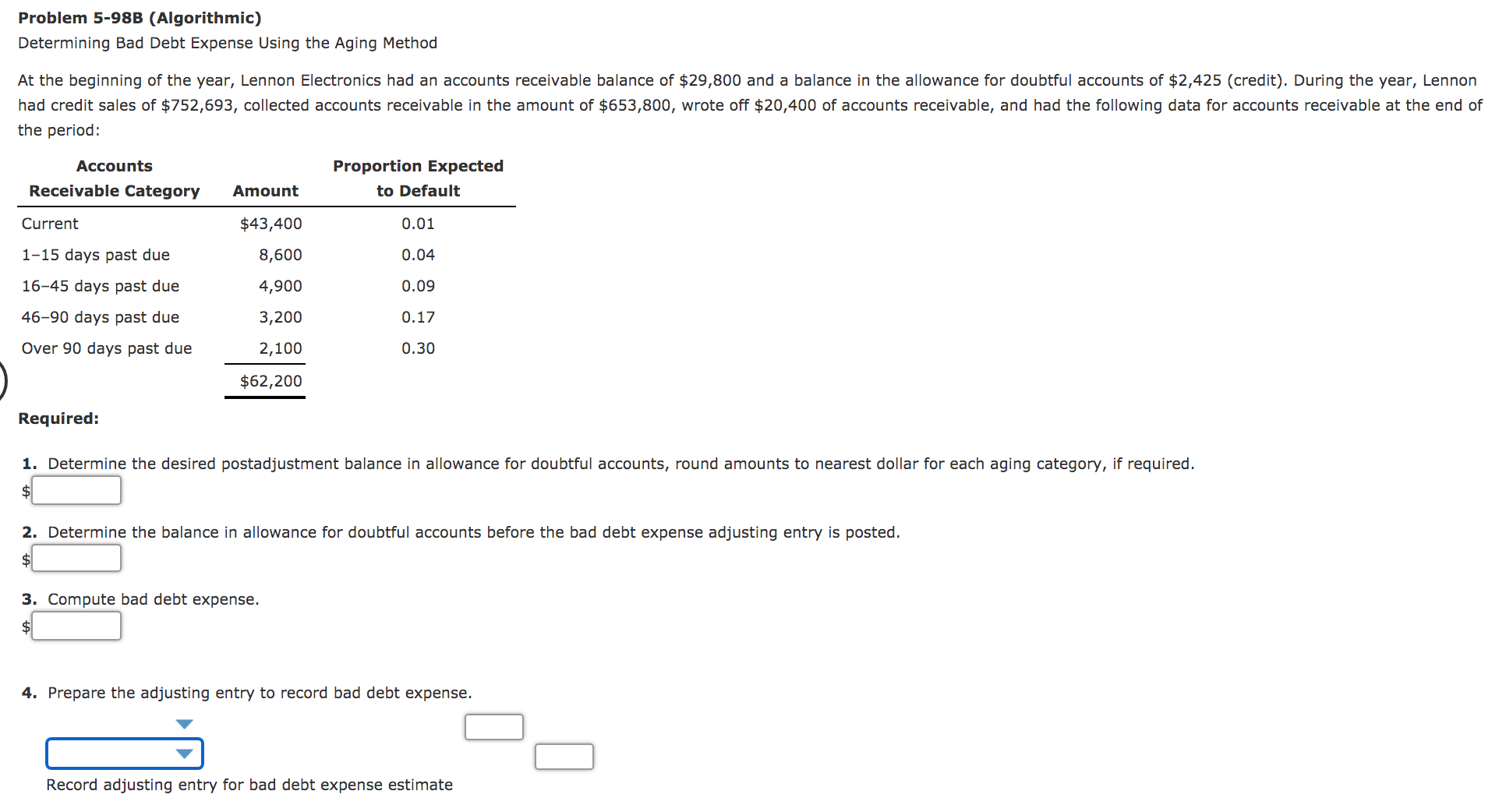

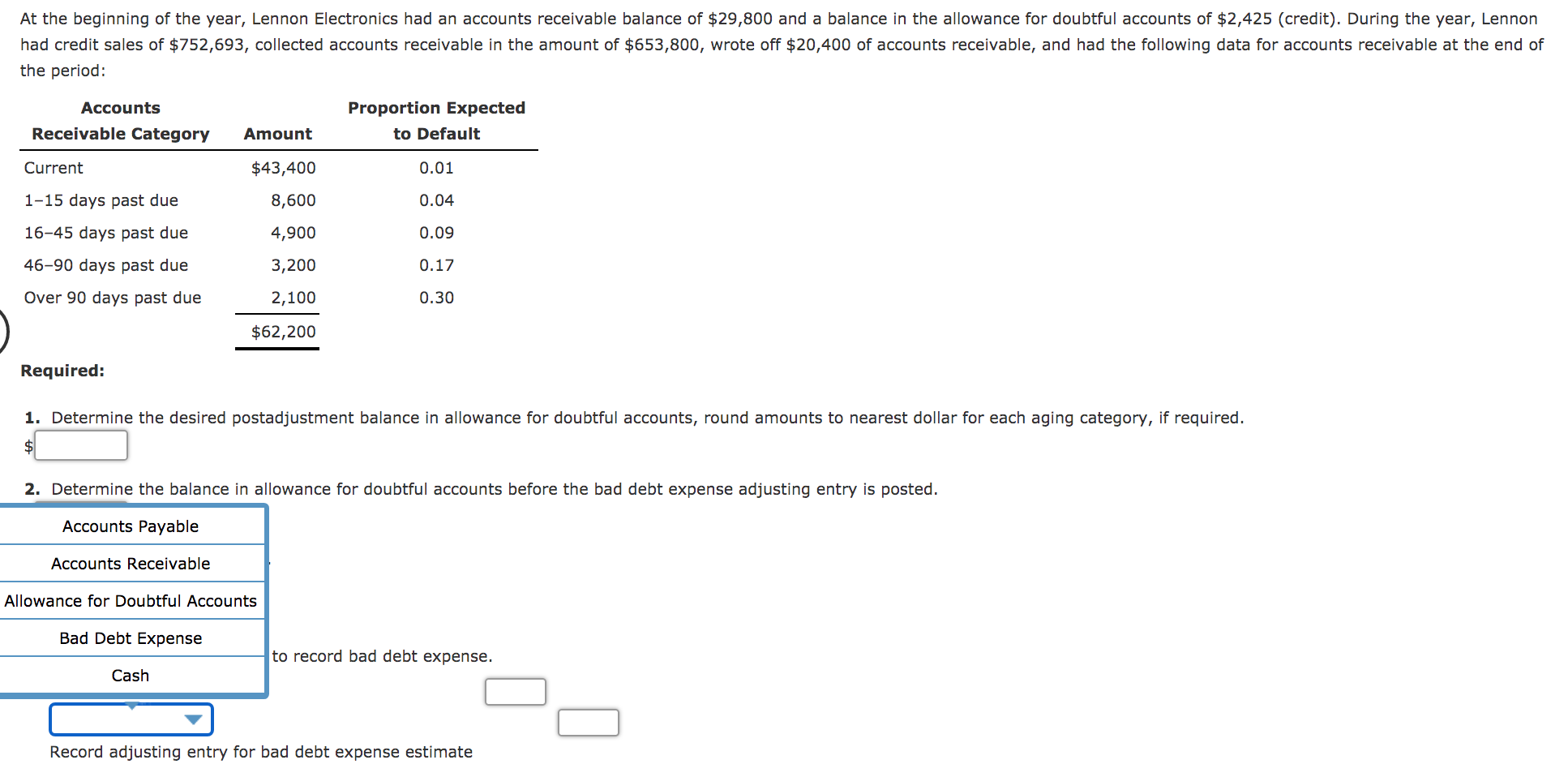

Problem 5-983 (Algorithmic) Determining Bad Debt Expense Using the Aging Method At the beginning of the year, Lennon Electronics had an accounts receivable balance of $29,800 and a balance in the allowance for doubtful accounts of $2,425 (credit). During the year, Lennon had credit sales of $752,693, collected accounts receivable in the amount of $653,800, wrote off $20,400 of accounts receivable, and had the following data for accounts receivable at the end of the period: Accounts Proportion Expected Receivable Category Amount to Default Current $43,400 0.01 115 days past clue 8,600 0.04 1645 days past due 4,900 0.09 4690 days past due 3,200 0.17 Over 90 days past due 2,100 0.30 ) $62,200 Required: 1. Determine the desired postadjustment balance in allowance for doubtful accounts, round amounts to nearest dollar for each aging category, if required. l: 2. Determine the balance in allowance for doubtful accounts before the bad debt expense adjusting entry is posted. 4: 3. Compute bad debt expense. $I: 4. Prepare the adjusting entry to record bad debt expense. ' E] Record adjusting entry for bad debt expense estimate At the beginning of the year, Lennon Electronics had an accounts receivable balance of $29,800 and a balance in the allowance for doubtful accounts of $2,425 (credit). During the year, Lennon had credit sales of $752,693, collected accounts receivable in the amount of $653,800, wrote off $20,400 of accounts receivable, and had the following data for accounts receivable at the end of the period: Accounts Proportion Expected Receivable Category Amount to Default Current $43,400 0.01 115 days past due 8,600 0.04 1645 days past due 4,900 0.09 46-90 days past due 3,200 0.17 Over 90 days past due 2,100 0.30 ) $62,200 Required: 1. Determine the desired postadjustment balance in allowance for doubtful accounts, round amounts to nearest dollar for each aging category, if required. $ 2. Determine the balance in allowance for doubtful accounts before the bad debt expense adjusting entry is posted. Accounts Payable Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense to record bad debt expense. Cash [:1 E Record adjusting entry for bad debt expense estimate