Question: Question: Indicate whether the following statements are true or false. False Section 1231 allows individuals to deduct personal property losses against ordinary income. True Sec.

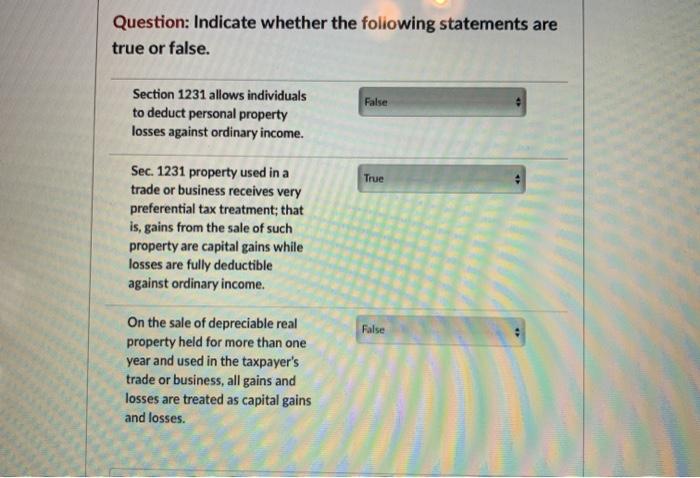

Question: Indicate whether the following statements are true or false. False Section 1231 allows individuals to deduct personal property losses against ordinary income. True Sec. 1231 property used in a trade or business receives very preferential tax treatment; that is, gains from the sale of such property are capital gains while losses are fully deductible against ordinary income. False On the sale of depreciable real property held for more than one year and used in the taxpayer's trade or business, all gains and losses are treated as capital gains and losses

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock