Question: Question is from Intermediate Accounting volume 2, 12th edition by Kieso. Please provide calculations for your answers below. Sage Corporation showed the following information on

Question is from Intermediate Accounting volume 2, 12th edition by Kieso.

Please provide calculations for your answers below.

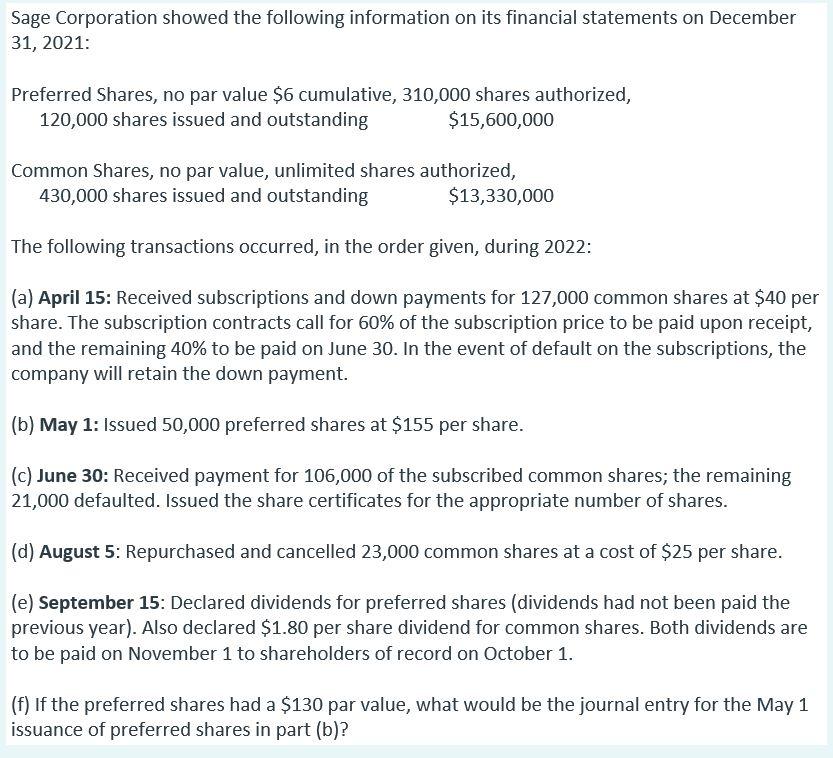

Sage Corporation showed the following information on its financial statements on December 31, 2021: Preferred Shares, no par value $6 cumulative, 310,000 shares authorized, 120,000 shares issued and outstanding $15,600,000 Common Shares, no par value, unlimited shares authorized, 430,000 shares issued and outstanding $13,330,000 The following transactions occurred, in the order given, during 2022: (a) April 15: Received subscriptions and down payments for 127,000 common shares at $40 per share. The subscription contracts call for 60% of the subscription price to be paid upon receipt, and the remaining 40% to be paid on June 30. In the event of default on the subscriptions, the company will retain the down payment. (b) May 1: Issued 50,000 preferred shares at $155 per share. (C) June 30: Received payment for 106,000 of the subscribed common shares; the remaining 21,000 defaulted. Issued the share certificates for the appropriate number of shares. (d) August 5: Repurchased and cancelled 23,000 common shares at a cost of $25 per share. (e) September 15: Declared dividends for preferred shares (dividends had not been paid the previous year). Also declared $1.80 per share dividend for common shares. Both dividends are to be paid on November 1 to shareholders of record on October 1. (f) If the preferred shares had a $130 par value, what would be the journal entry for the May 1 issuance of preferred shares in part (b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts