Question: Question is the Zero coupon yields on U . S . treasury shown down below the spot rate ( also known as zero rates )

Question is the Zero coupon yields on US treasury shown down below the spot rate also known as zero rates of these treasuries. so all I need to do is readjust the spot rate by adding the risk premium BP and calculate the bond price in semiannual terms

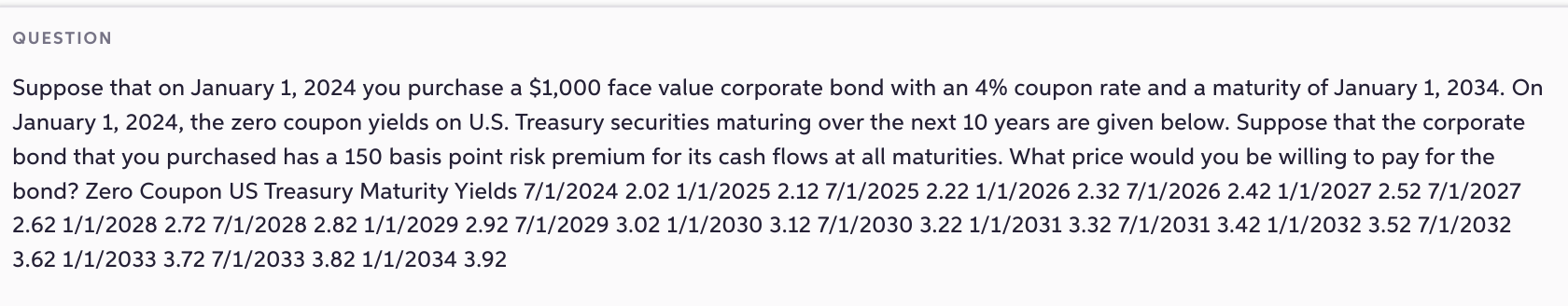

Suppose that on January you purchase a $ face value corporate bond with an coupon rate and a maturity of January On

January the zero coupon yields on US Treasury securities maturing over the next years are given below. Suppose that the corporate

bond that you purchased has a basis point risk premium for its cash flows at all maturities. What price would you be willing to pay for the

bond? Zero Coupon US Treasury Maturity Yields

Maturity Zero coupon treasury yields

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock