Question: Question list Question 1 Question 2 Question 3 Question 4 Question 5 Question 6 Question 7 Question 8 You are considering purchasing stock in a

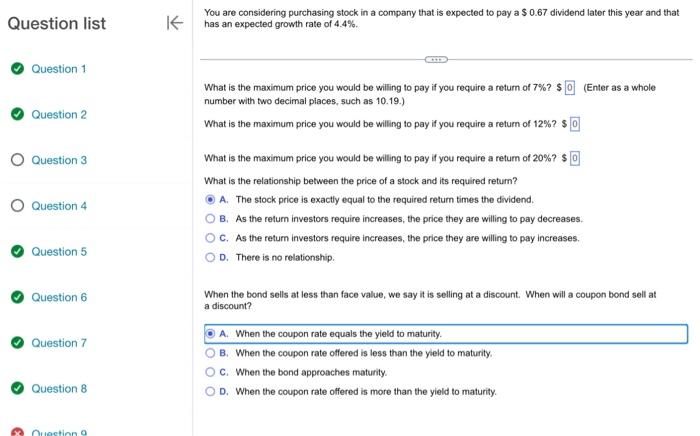

Question list Question 1 Question 2 Question 3 Question 4 Question 5 Question 6 Question 7 Question 8 You are considering purchasing stock in a company that is expected to pay a $0.67 dividend later this year and that has an expected growth rate of 4.4%. What is the maximum price you would be willing to pay if you require a retum of 7% ? $ (Enter as a whole number with two decimal places, such as 10.19.) What is the maximum price you would be willing to pay if you require a return of 12% ? What is the maximum price you would be willing to pay if you require a retum of 20% ? What is the relationship between the price of a stock and its required return? A. The stock price is exactly equal to the required retum times the dividend. B. As the return investors require increases, the price they are willing to pay decreases. C. As the retum investors require increases, the price they are willing to pay increases. D. There is no relationship. When the bond sells at less than face value, we say it is selling at a discount. When will a coupon bond sell at a discount? A. When the coupon rate equals the yield to maturity. B. When the coupon rate offered is less than the yield to maturity. C. When the bond approaches maturity. D. When the coupon rate offered is more than the yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts