Question: Question No: 02 This is a subjective question, hence you have to write your answer in the Text-Field given below. A Venture Capital firm (VC

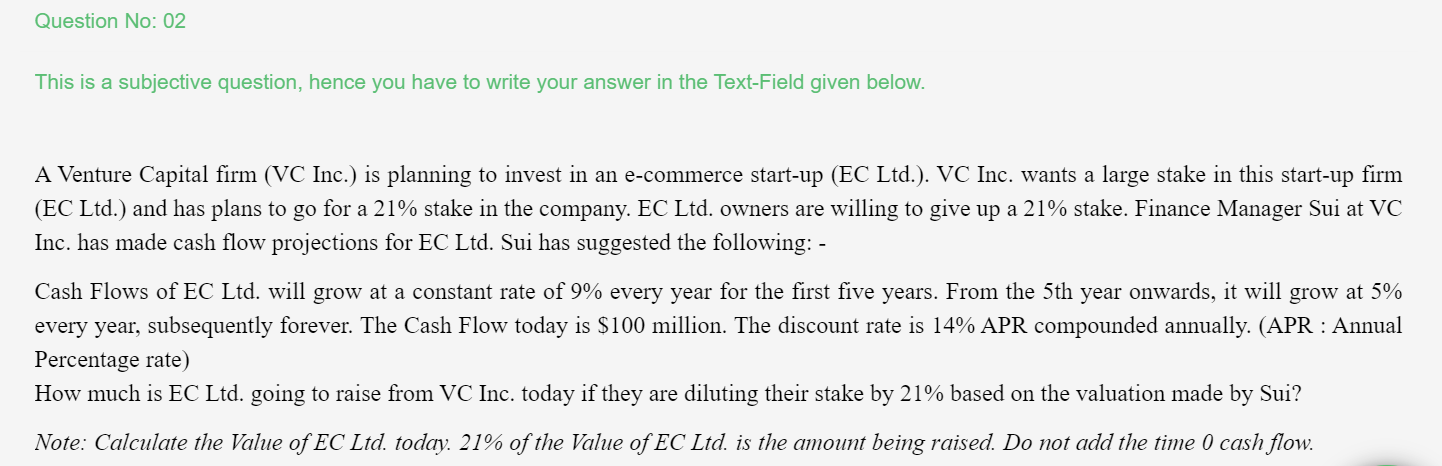

Question No: 02 This is a subjective question, hence you have to write your answer in the Text-Field given below. A Venture Capital firm (VC Inc.) is planning to invest in an e-commerce start-up (EC Ltd.). VC Inc. wants a large stake in this start-up firm (EC Ltd.) and has plans to go for a 21% stake in the company. EC Ltd. owners are willing to give up a 21% stake. Finance Manager Sui at VC Inc. has made cash flow projections for EC Ltd. Sui has suggested the following: - Cash Flows of EC Ltd. will grow at a constant rate of 9% every year for the first five years. From the 5th year onwards, it will grow at 5% every year, subsequently forever. The Cash Flow today is $100 million. The discount rate is 14% APR compounded annually. (APR : Annual Percentage rate) How much is EC Ltd. going to raise from VC Inc. today if they are diluting their stake by 21% based on the valuation made by Sui? Note: Calculate the Value of EC Ltd. today. 21% of the Value of EC Ltd. is the amount being raised. Do not add the time 0 cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts