Question: Question No: 03 (15 This is a subjective question, hence you have to write your answer in the Text Field given below. As a treasury

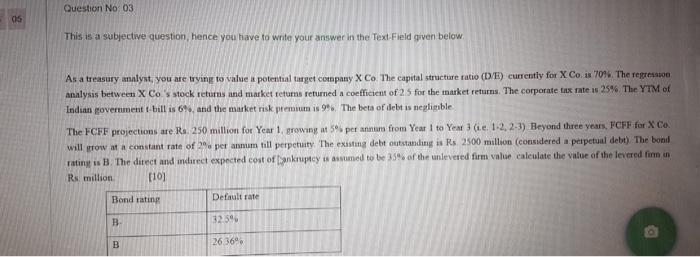

Question No: 03 (15 This is a subjective question, hence you have to write your answer in the Text Field given below. As a treasury analyst, you are trying to value is potential target company XCo. The capital structure ratio (D/E) currently for X Co. is 70% The regression analysis between X Co's stock returns and market returns returned a coefficient of 25 for the market returns. The corporate tax rate as 25% The YTM of Indian government bill is 6%, and the market risk premium is 9% The beta of debt is negligible The FCFF projections are Rs 250 million for Year 1 growing at 5% per annam from Year I to Year (ie. 1-2, 2-3) Beyond three years, FCFF for X Co. will grow at a constant rate of 2% per annum till perpetuity The existing debt outstanding is Rs 2500 million (considered a perpetual debt) The bond rating i B. The direct and indirect expected cost of ankruptcy s med to be 35% of the unlevered firm value calculate the value of the levered from on Rs million [10] Bond rating Default rate B 3259 B 26 36 Question No: 03 (15 This is a subjective question, hence you have to write your answer in the Text Field given below. As a treasury analyst, you are trying to value is potential target company XCo. The capital structure ratio (D/E) currently for X Co. is 70% The regression analysis between X Co's stock returns and market returns returned a coefficient of 25 for the market returns. The corporate tax rate as 25% The YTM of Indian government bill is 6%, and the market risk premium is 9% The beta of debt is negligible The FCFF projections are Rs 250 million for Year 1 growing at 5% per annam from Year I to Year (ie. 1-2, 2-3) Beyond three years, FCFF for X Co. will grow at a constant rate of 2% per annum till perpetuity The existing debt outstanding is Rs 2500 million (considered a perpetual debt) The bond rating i B. The direct and indirect expected cost of ankruptcy s med to be 35% of the unlevered firm value calculate the value of the levered from on Rs million [10] Bond rating Default rate B 3259 B 26 36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts