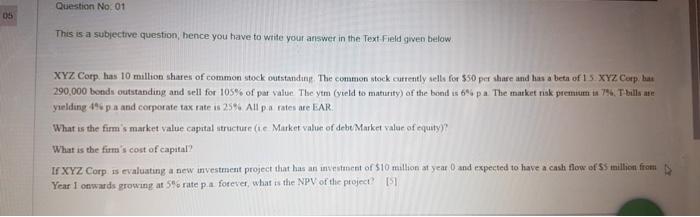

Question: Question No. 01 05 This is a subjective question, hence you have to write your answer in the Text Field given below XYZ Corp, has

Question No. 01 05 This is a subjective question, hence you have to write your answer in the Text Field given below XYZ Corp, has 10 million shares of common stock outstanding. The common stock currently sells for $50 per share and has a beta of 15 XYZ. Corp, but 290,000 bonds outstanding and sell for 105% of pat value. The ytm (yield to maturity) of the bond is ofspa The market nuk premium in 79. Tbilleme yielding 49 pn and corporate tax rate is 25% All pa rates are EAR. What is the firm s market value capital structure (ie Market value of debe Market value of equityy? What is the firm's cost of capital? IF XYZ Corp is evaluating a new investment project that has an investment of $10 million a year and expected to have a cash flow of 5 million from Year 1 onwards growing at 5% rate p a forever, what is the NPV of the project? [31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts