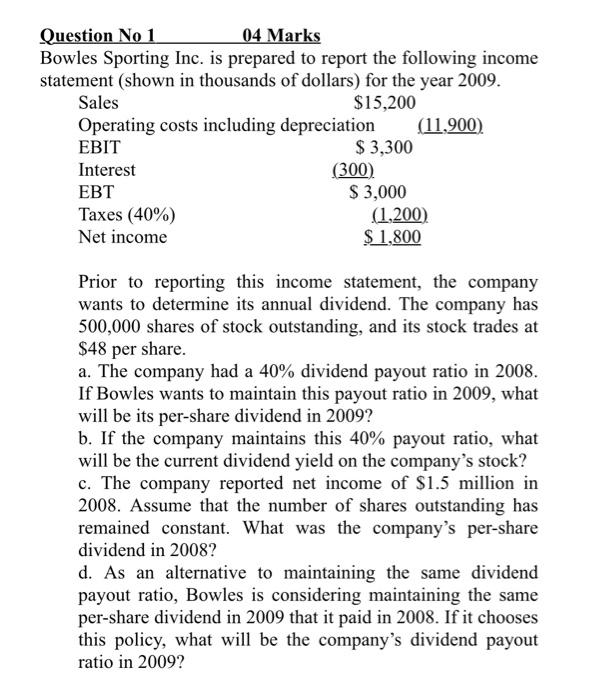

Question: Question No 1 04 Marks Bowles Sporting Inc. is prepared to report the following income statement (shown in thousands of dollars) for the year 2009.

Question No 1 04 Marks Bowles Sporting Inc. is prepared to report the following income statement (shown in thousands of dollars) for the year 2009. Sales $15,200 Operating costs including depreciation (11,900) EBIT $3,300 Interest (300) EBT $3,000 Taxes (40%) (1,200) Net income $ 1,800 Prior to reporting this income statement, the company wants to determine its annual dividend. The company has 500,000 shares of stock outstanding, and its stock trades at $48 per share. a. The company had a 40% dividend payout ratio in 2008. If Bowles wants to maintain this payout ratio in 2009, what will be its per-share dividend in 2009? b. If the company maintains this 40% payout ratio, what will be the current dividend yield on the company's stock? c. The company reported net income of $1.5 million in 2008. Assume that the number of shares outstanding has remained constant. What was the company's per-share dividend in 2008? d. As an alternative to maintaining the same dividend payout ratio, Bowles is considering maintaining the same per-share dividend in 2009 that it paid in 2008. If it chooses this policy, what will be the company's dividend payout ratio in 2009

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts