Question: Question No. 1 What do you mean by Capital Structure? Briefly explain the Net Income Theory and Operating Net Income Theory of Capital Structure? What

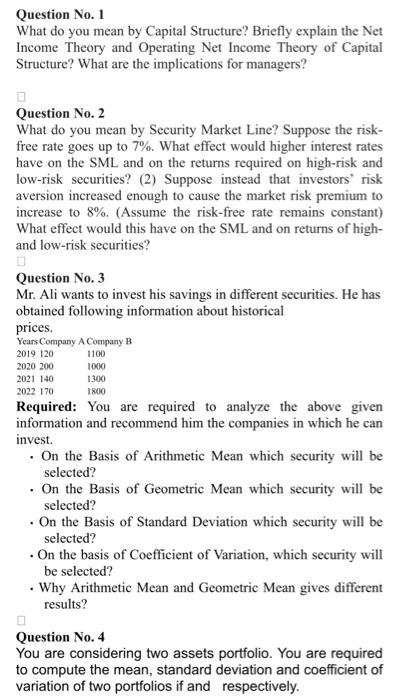

Question No. 1 What do you mean by Capital Structure? Briefly explain the Net Income Theory and Operating Net Income Theory of Capital Structure? What are the implications for managers? Question No. 2 What do you mean by Security Market Line? Suppose the riskfree rate goes up to 7%. What effect would higher interest rates have on the SML and on the returns required on high-risk and low-risk securities? (2) Suppose instead that investors' risk aversion increased enough to cause the market risk premium to increase to 8%. (Assume the risk-free rate remains constant) What effect would this have on the SML and on returns of highand low-risk securities? Question No. 3 Mr. Ali wants to invest his savings in different securities. He has obtained following information about historical prices. Required: You are required to analyze the above given information and recommend him the companies in which he can invest. - On the Basis of Arithmetic Mean which security will be selected? - On the Basis of Geometric Mean which security will be selected? - On the Basis of Standard Deviation which security will be selected? - On the basis of Coefficient of Variation, which security will be selected? - Why Arithmetic Mean and Geometric Mean gives different results? Question No. 4 You are considering two assets portfolio. You are required to compute the mean, standard deviation and coefficient of variation of two portfolios if and respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts