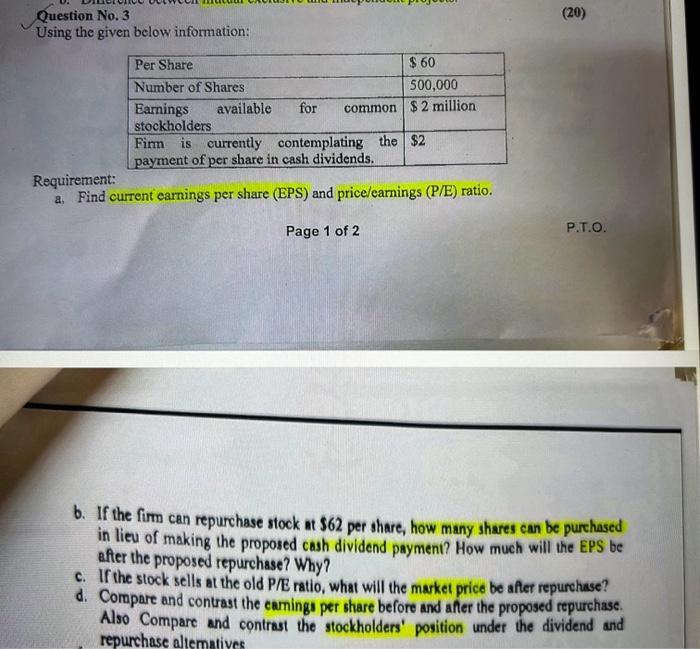

Question: Question No. 3 Using the given below information: Per Share $60 Number of Shares 500,000 Earnings available for common $2 million stockholders Firm is currently

Question No. 3 (20) Using the given below information: Requirement: a. Find current earnings per share (EPS) and price/earnings (P/E) ratio. Page 1 of 2 P.T.O. b. If the firm can repurchase stock at \\( \\$ 62 \\) per share, how many shares can be purchased in lieu of making the proposed cash dividend payment? How much will the EPS be after the proposed repurchase? Why? c. If the stock sells at the old P/E ratio, what will the market price be after repurchase? d. Cormpare and contrast the camings per share before and anter the proposed repurchase. Also Compare and contrast the stockholders' position under the dividend and repurchase altematives

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts