Question: Question No. 6 (5 + 2 + 3 = 10) You are evaluating the performance of two portfolio managers, and you have gathered annual return

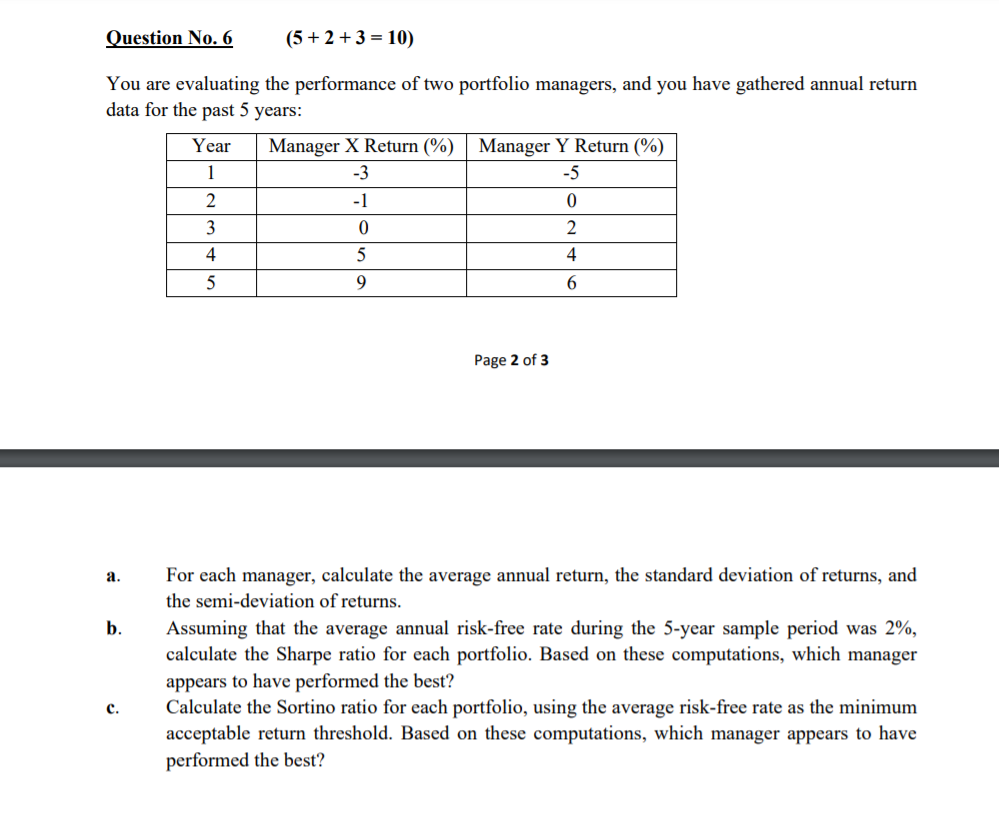

Question No. 6 (5 + 2 + 3 = 10) You are evaluating the performance of two portfolio managers, and you have gathered annual return data for the past 5 years: Year Manager X Return (%) Manager Y Return (%) 1 -3 -5 2 -1 0 3 0 2 4 5 4 5 9 6 Page 2 of 3 a. b. For each manager, calculate the average annual return, the standard deviation of returns, and the semi-deviation of returns. Assuming that the average annual risk-free rate during the 5-year sample period was 2%, calculate the Sharpe ratio for each portfolio. Based on these computations, which manager appears to have performed the best? Calculate the Sortino ratio for each portfolio, using the average risk-free rate as the minimum acceptable return threshold. Based on these computations, which manager appears to have performed the best? c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts