Question: QUESTION NUMBER 12 EXHIBIT 5 ANSWER THE FOLLOWING QUESTIONS BASED ON EXHIBIT 5 12. Assume that Company A was sold at the end of 2011

QUESTION NUMBER 12 EXHIBIT 5

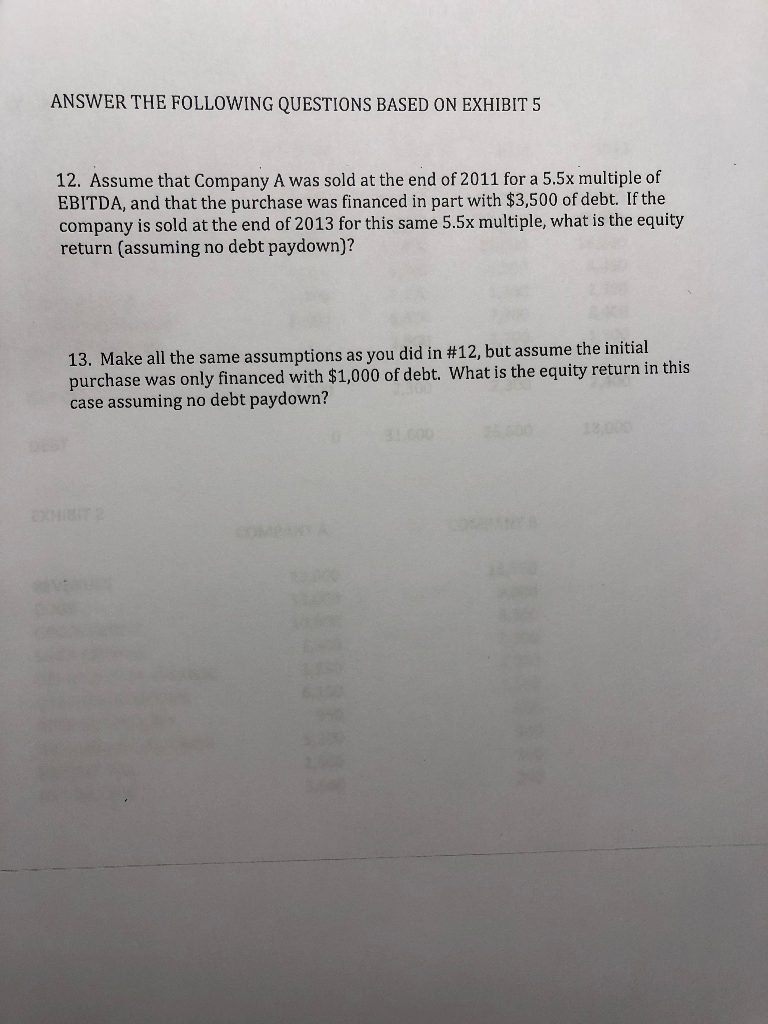

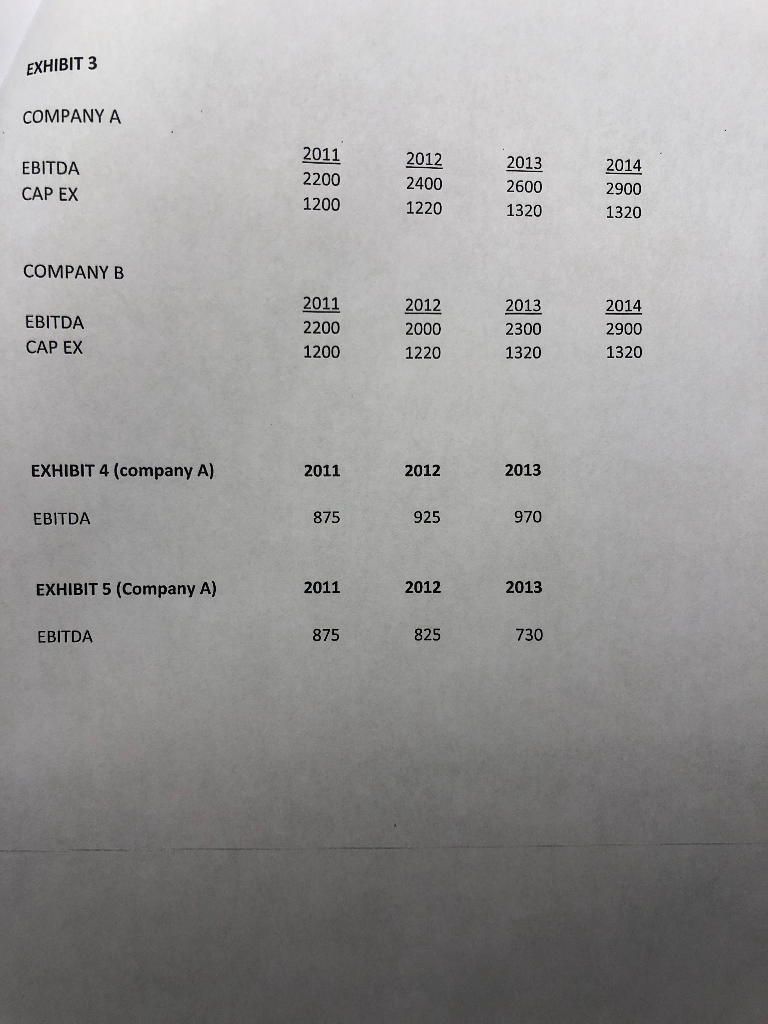

ANSWER THE FOLLOWING QUESTIONS BASED ON EXHIBIT 5 12. Assume that Company A was sold at the end of 2011 for a 5.5x multiple of EBITDA, and that the purchase was financed in part with $3,500 of debt. If the company is sold at the end of 2013 for this same 5.5x multiple, what is the equity return (assuming no debt paydown)? 13, Make all the same assumptions as you did in #12, but assume the initia purchase was only financed with $1,000 of debt. What is the equity return in this case assuming no debt paydown? EXHIBIT 3 COMPANYA EBITDA CAP EX 2011 2200 1200 2012 2400 1220 2013 2600 1320 2900 1320 COMPANY B EBITDA CAP EX 2011 2012 2013 2014 2200 1200 2000 1220 2300 1320 2900 1320 EXHIBIT 4 (company A) 2011 2012 2013 EBITDA 875 925 970 EXHIBIT 5 (Company A) 2011 2012 2013 EBITDA 875 825 730

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts