Question: Question Number One Twenty true - false statements appear below. You must answer all of them. For each statements you answer, insert T

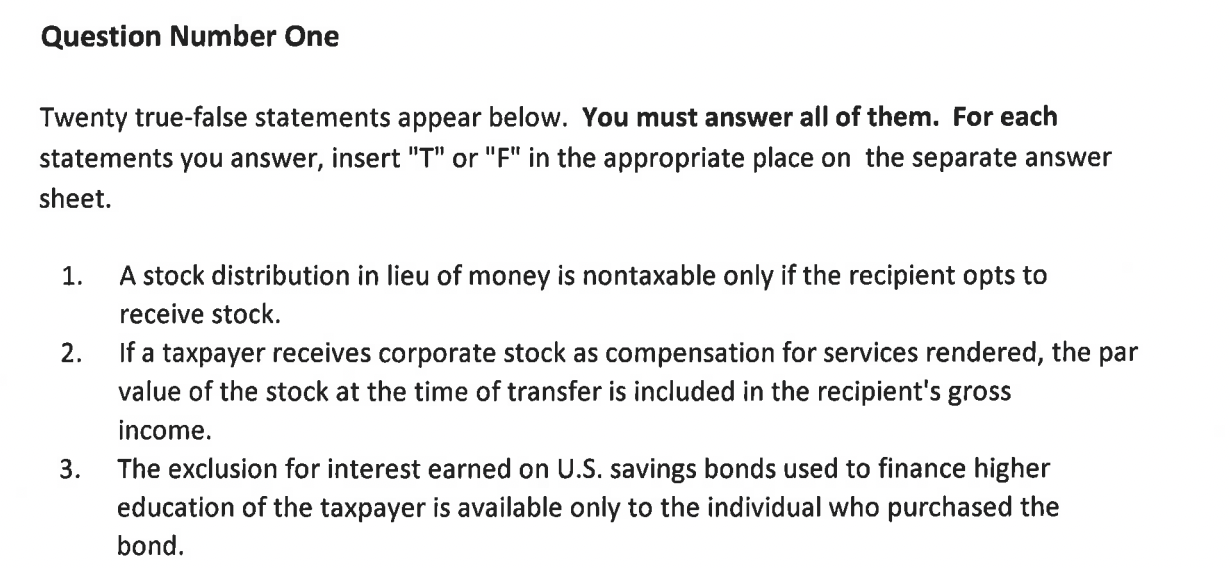

Question Number One

Twenty truefalse statements appear below. You must answer all of them. For each statements you answer, insert T or F in the appropriate place on the separate answer sheet.

A stock distribution in lieu of money is nontaxable only if the recipient opts to receive stock.

If a taxpayer receives corporate stock as compensation for services rendered, the par value of the stock at the time of transfer is included in the recipient's gross income.

The exclusion for interest earned on US savings bonds used to finance higher education of the taxpayer is available only to the individual who purchased the bond.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock