Question: please help with the true or false Twenty true-false statements appear below. You must answer all of them. For each statement, insert T or F

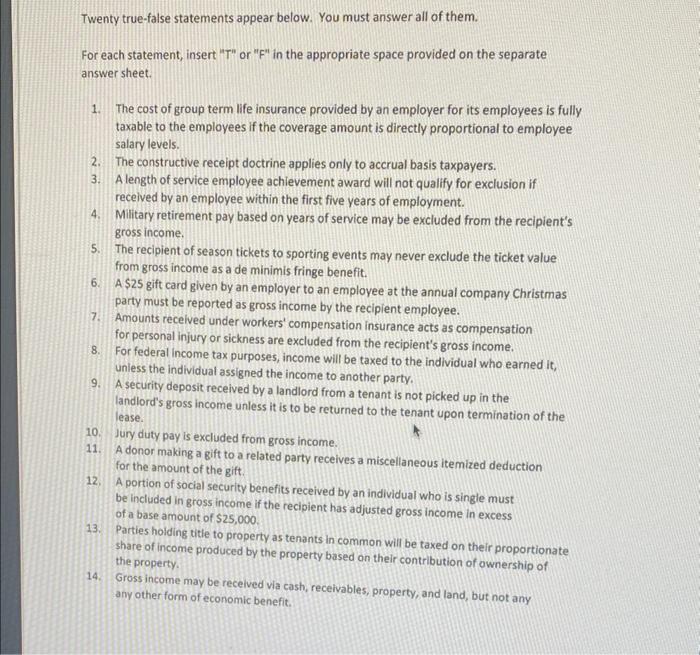

Twenty true-false statements appear below. You must answer all of them. For each statement, insert "T" or "F" in the appropriate space provided on the separate answer sheet. 1. The cost of group term life insurance provided by an employer for its employees is fully taxable to the employees if the coverage amount is directly proportional to employee salary levels. 2. The constructive receipt doctrine applies only to accrual basis taxpayers. 3. A length of service employee achlevement award will not qualify for exclusion if received by an employee within the first five years of employment. 4. Military retirement pay based on years of service may be excluded from the recipient's gross income. 5. The recipient of season tickets to sporting events may never exclude the ticket value from gross income as a de minimis fringe benefit. 6. A \$25 gift card given by an employer to an employee at the annual company Christmas party must be reported as gross income by the recipient employee. 7. Amounts received under workers' compensation insurance acts as compensation for personal injury or sickness are excluded from the recipient's gross income. 8. For federal income tax purposes, income will be taxed to the indlvidual who earned it, unless the individual assigned the income to another party. 9. A security deposit received by a landlord from a tenant is not picked up in the landlord's gross income unless it is to be returned to the tenant upon termination of the lease. 10. Jury duty pay is excluded from gross income. 11. A donor making a gift to a related party receives a miscellaneous itemized deduction for the amount of the gift. 12. A portion of social security benefits received by an individual who is single must be included in gross income if the recipient has adjusted gross income in excess of a base amount of $25,000. 13. Parties holding titie to property as tenants in common will be taxed on their proportionate share of income produced by the property based on their contribution of ownership of the property. 14. Gross income may be recelved via cash, receivables, property, and land, but not any any other form of economic benefit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts