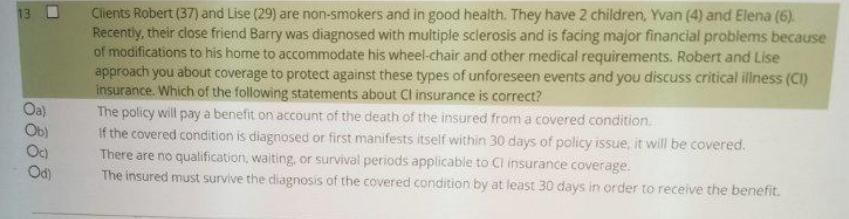

Question: Clients Robert (37) and Lise (29) are non-smokers and in good health. They have 2 children, Yvan (4) and Elena (6). Recently, their close

Clients Robert (37) and Lise (29) are non-smokers and in good health. They have 2 children, Yvan (4) and Elena (6). Recently, their close friend Barry was diagnosed with multiple sclerosis and is facing major financial problems because of modifications to his home to accommodate his wheel-chair and other medical requirements. Robert and Lise approach you about coverage to protect against these types of unforeseen events and you discuss critical illness (CI) insurance. Which of the following statements about Cl insurance is correct? The policy will pay a benefit on account of the death of the insured from a covered condition. If the covered condition is diagnosed or first manifests itself within 30 days of policy issue, it will be covered. There are no qualification, waiting, or survival periods applicable to Cl insurance coverage. The insured must survive the diagnosis of the covered condition by at least 30 days in order to receive the benefit. 13 0 Oa) Ob) Oc) Od) l3888

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

option d is correct insurer must survive diagnosi... View full answer

Get step-by-step solutions from verified subject matter experts