Question: Bonnie works as an instructor at the local college. She has a gross salary of $5,200 per month. Bonnie's average tax rate is 25%.

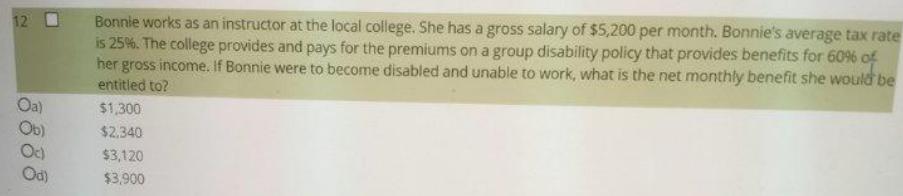

Bonnie works as an instructor at the local college. She has a gross salary of $5,200 per month. Bonnie's average tax rate is 25%. The college provides and pays for the premiums on a group disability policy that provides benefits for 60% of her gross income. If Bonnie were to become disabled and unable to work, what is the net monthly benefit she would be entitled to? 12 0 Oa) Ob) Oc) Od) $1,300 $2.340 $3,120 $3,900

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts