Question: QUESTION ONE ( 2 0 MARKS ) a . How different is a value - weighted index from a price - weighted index. ( 5

QUESTION ONE MARKS

a How different is a valueweighted index from a priceweighted index. Marks

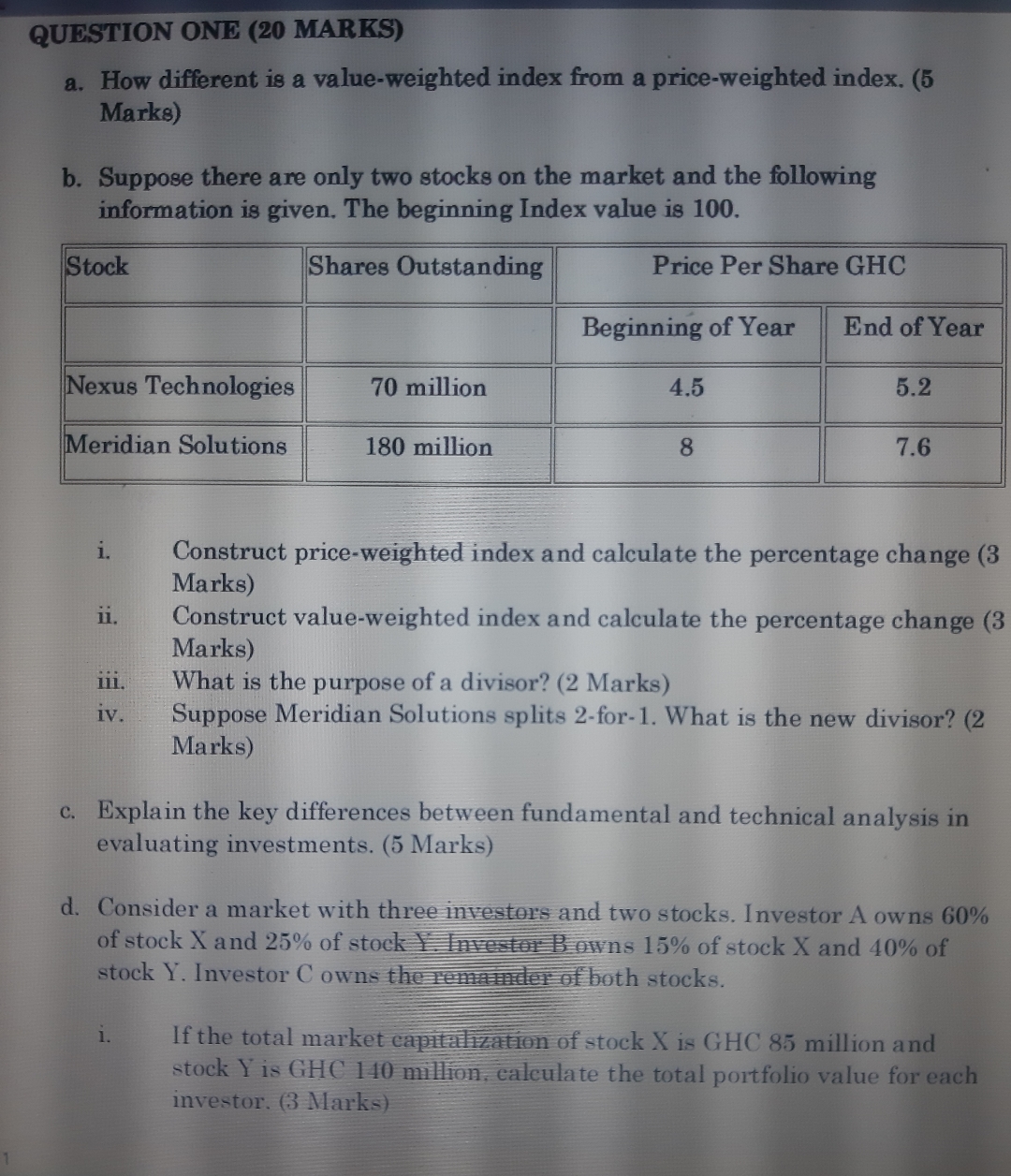

b Suppose there are only two stocks on the market and the following information is given. The beginning Index value is

tableStockShares Outstanding,Price Per Share GHCBeginning of Year,End of YearNexus Technologies, million,Meridian Solutions, million,

i Construct priceweighted index and calculate the percentage change Marks

ii Construct valueweighted index and calculate the percentage change Marks

iii. What is the purpose of a divisor? Marks

iv Suppose Meridian Solutions splits for What is the new divisor? Marks

c Explain the key differences between fundamental and technical analysis in evaluating investments. Marks

d Consider a market with three investors and two stocks. Investor A owns of stock X and of stock I Inves of stock X and of stock Y Investor C owns the remalilite of both stocks.

i If the total market capitalization of stock X is GHC million and stock Y is GHC million, calculate the total portfolio value for each investor. Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock