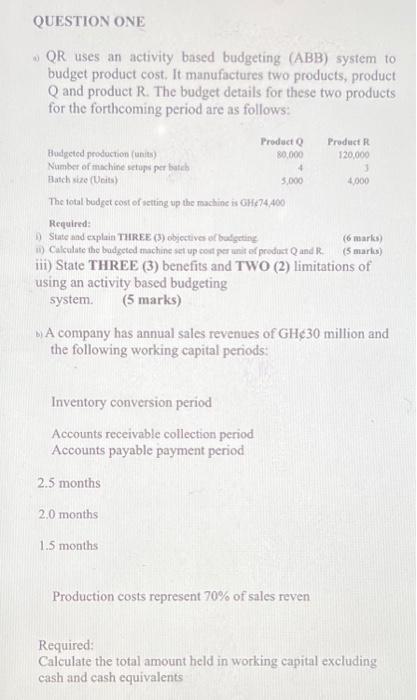

Question: QUESTION ONE 80.000 + QR uses an activity based budgeting (ABB) system to budget product cost. It manufactures two products, product Q and product R.

QUESTION ONE 80.000 + QR uses an activity based budgeting (ABB) system to budget product cost. It manufactures two products, product Q and product R. The budget details for these two products for the forthcoming period are as follows: Producto Product Hudgeted production (unit) 120,000 Number of machine setups per boleh Batch size (Units) 5,000 4.000 The total budget cost of setting up the machine is GH474,400 Required: State and explain THREE (3) objectives of budgeting (6 marks) 1) Calculate the budgeted machine set up cost per unit of product Q and R. (5 mars) iii) State THREE (3) benefits and TWO (2) limitations of using an activity based budgeting system. (5 marks) A company has annual sales revenues of GH30 million and the following working capital periods: Inventory conversion period Accounts receivable collection period Accounts payable payment period 2.5 months 2.0 months 1.5 months Production costs represent 70% of sales reven Required: Calculate the total amount held in working capital excluding cash and cash equivalents

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts