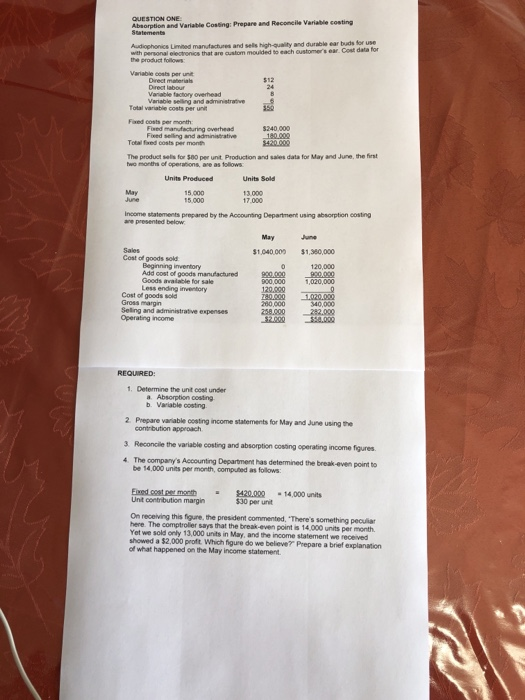

Question: QUESTION ONE Absorption and Variable Costing: Prepare and Reconcile Variable costing Statements Audiophonics Limted manufactures and sells high-quality and durable ear buds for use with

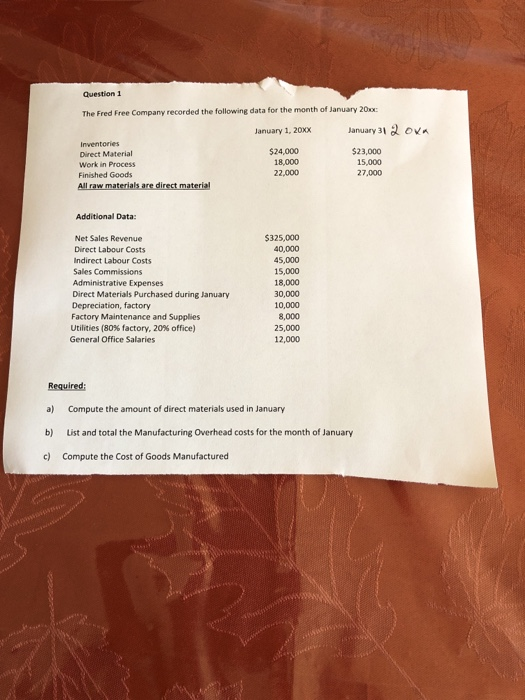

QUESTION ONE Absorption and Variable Costing: Prepare and Reconcile Variable costing Statements Audiophonics Limted manufactures and sells high-quality and durable ear buds for use with personal electronics that are oustom mouided to each oustomer's ear Cost data for the product follows Variable cests per unit iah $12 24 8 Drect ab Variable factory overhead Variable selling and administrative Total variable costs per unit 350 Faxed costs per month Fd turing overhead Total fixed costs per month s240.000 180 000 $420.000 ministrative- The product selis for $00 per unit Production and sales data for May and June, the first two months of operations, are as folows Units Produced Units Sold 15,000 May June 13.000 17.000 15,000 Income statements prepared by the Accounting Department using absorption costing are presented below May June Sales Cost of goods sold $1,360,000 $1,04000% Beginning inventory Add cost of goods manufactured Goods available for sale Less ending inventory 120.000 g00,000 1,020,000 900,000 900,000 120,000 780.000 200,000 258,000 $2.000 Cost of goods sold 1,020,000 340,000 282.0004 S50.000 ross margin Seling and administrative expenses Operating income REQUIRED: 1. Determine the unit cost under a Absorption costing b. Variable o0sting 2. Prepare variable costing income statements for May and June using the contrbution approach Reconcile the variable costing and absorption cosing operating income figures 3 The company's Accounting Department has determined the break-even point to be 14,000 units per month, computed as follows 4 Eixed cost per monthy Unit contribution margin $420.000 $30 per unit 14,000 units On receiving this figure, the president commentted, There's something peculiar here The comptroler says that the break-even point is 14.000 units per month. Yet we sold only 13,000 units in May, and the income statement we received showed a $2,000 proft. Which figure do we beleve? Prepare a brief explanation of what happened on the May income statement Question 1 The Fred Free Company recorded the following data for the month of January 20xx January 3 January 1, 20xx Inventories $24,000 $23,000 Direct Material Work in Process 18.000 15,000 22.000 27,000 Finished Goods All raw materials are direct material Additional Data: $325,000 Net Sales Revenue Direct Labour Costs 40,000 Indirect Labour Costs 45,000 Sales Commissions 15,000 Administrative Expenses Direct Materials Purchased during January Depreciation, factory Factory Maintenance and Supplies Utilities (80% factory, 20 % office) 18,000 30,000 10,000 8,000 25,000 General Office Salaries 12,000 Required a) Compute the amount of direct materials used in January List and total the Manufacturing Overhead costs for the month of January b) c) Compute the Cost of Goods Manufactured

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts