Question: question one: please answer the following question in the space provided, you can screenshot and fill in the blanks if needed! thank u Exercise 2:

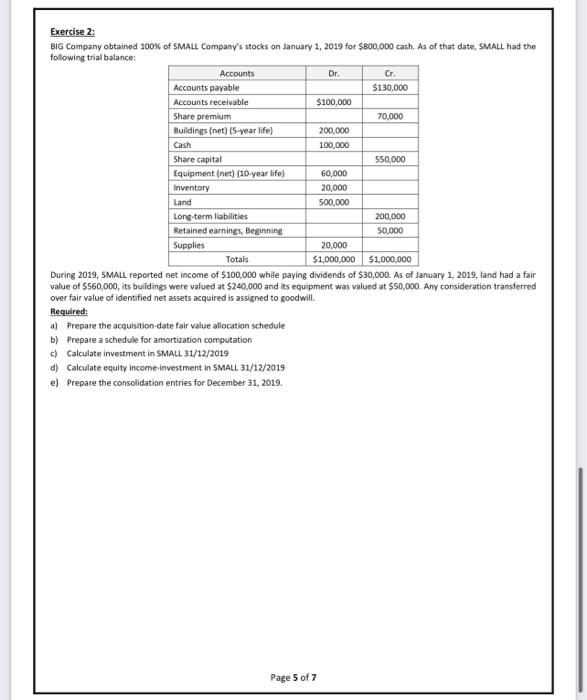

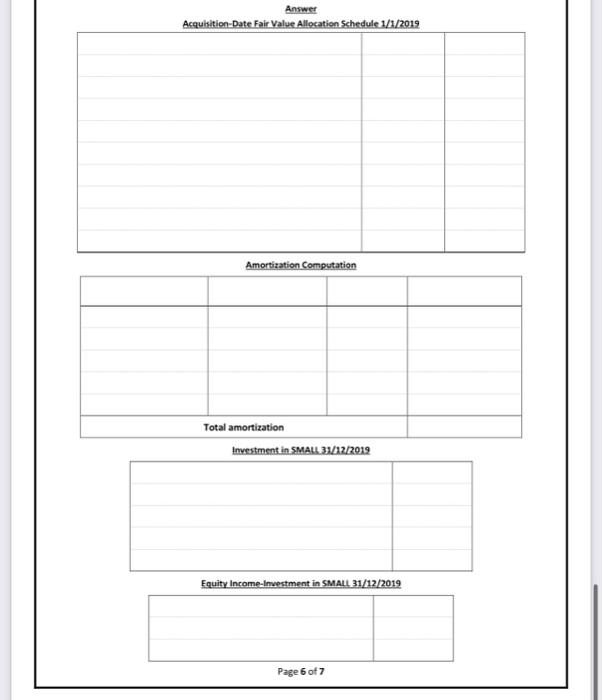

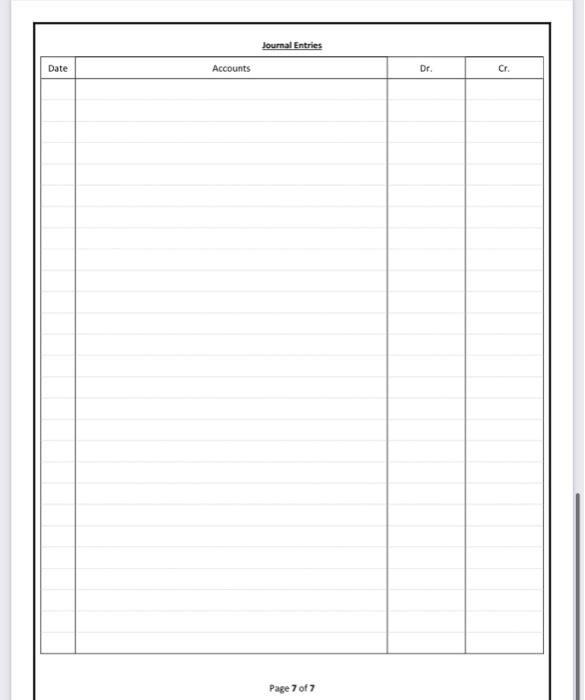

Exercise 2: BIG Company obtained 100% of SMALL Company's stocks on January 1, 2019 for $800,000 cash. As of that date, 5MALL had the following trial balance: During 2019, 5MALL reported net income of $100,000 while paying dividends of \$30,000. As of January 1, 2019, land had a fair value of $560,000, its buldings were valued at $240,000 and its equipment was valued at $50,000. Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill. Required: a) Prepare the acquisition date fair value allocation schedule b) Prepare a schedule for amortization computation c) Calculate invertment in SMALL 31/12/2019 d) Calculate equity income-investment in SMALL 31/12/2019 e) Prepare the consolidation entries for December 31, 2019. Answer Acquisition-Date Fair Value Allocation Schedule 1/1/2019 Amortization Computation Equity Income-lnwestment in SMALL 31/12/2019 Page 6 of 7 Journal Entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts