Question: question P2-8 A, B, and C Calculate the current (2012) net profit margin, total asset turnover, assets-to-equity on total assets, and return on common equity

question P2-8 A, B, and C

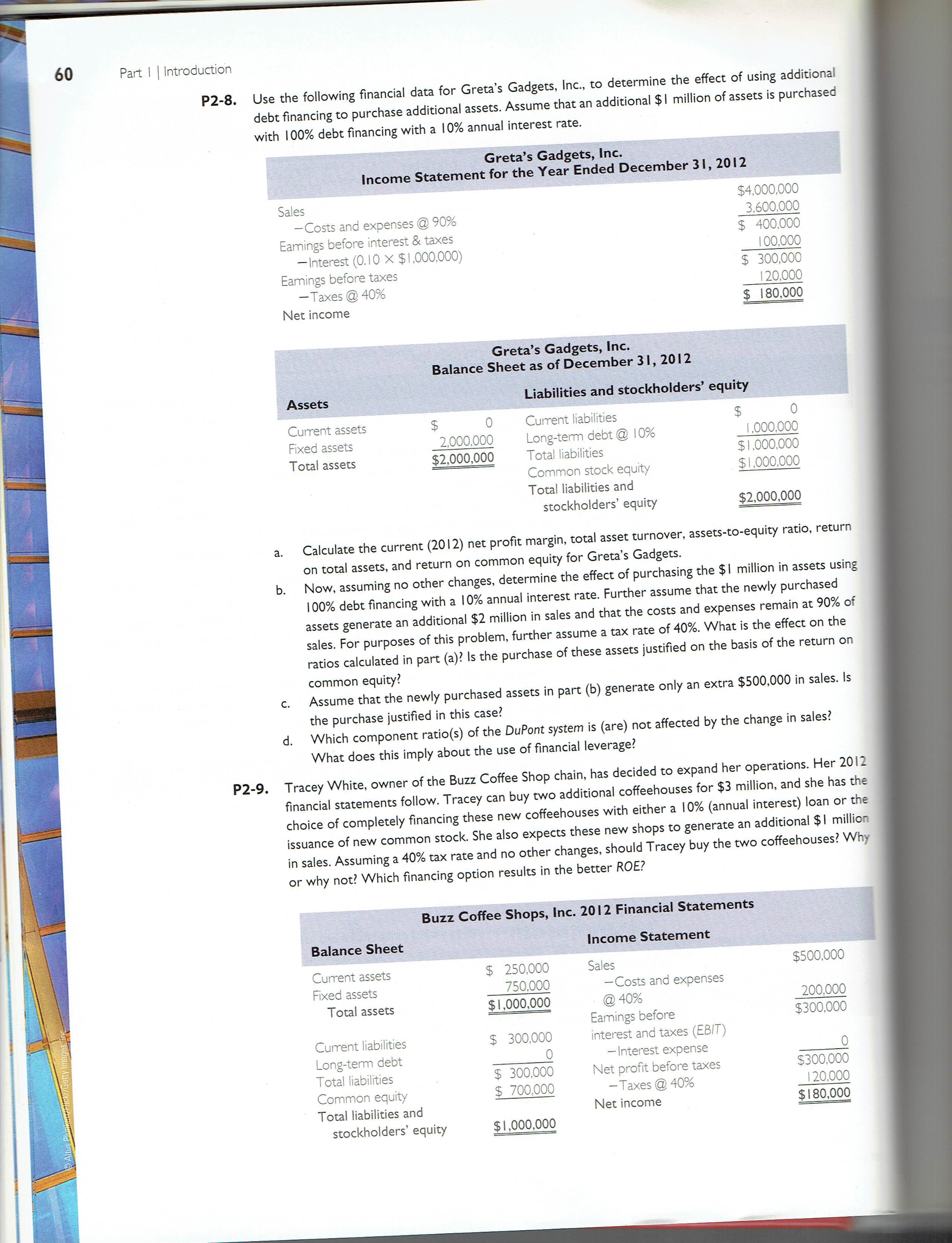

Calculate the current (2012) net profit margin, total asset turnover, assets-to-equity on total assets, and return on common equity for Greta's Gadgets. Now, assuming no other changes, determine the effect of purchasing the $1 million in assets using 100% debt financing with a 10% annual interest rate. Further assume that the newly purchased assets generate an additional $2 million in sales and that the costs and expenses remain at 90% of sales. For purpose of this problem, further assume a tax rate of 40%. What is the effect on the ratios calculated in part(a)? Is the purchase of these assets justified on the basis of the return on common equity? Assume that the why purchased assets in part (b) generate only an extra $500,000 in sales. Is the purchase justified in this case? Which component ratio(s) of the Dupont system is (are) not affected by the change in sales? What does this imply about the use of financial leverage. Tracey White, owner of the Buzz Coffee shop chain, has decided to expand her operations. Her 2012 financial statements follow. Tracy can buy two additional coffeehouses $3 million, and she has the choice of completely financing these new coffeehouses with either a 10% (annual interest) loan or the issuance of new common stock. She also expects these new shops to generate an additional $1 million in sales. Assuming a 40% tax rate and no other changes, should Tracy buy the two coffeehouses? why or why not! Which financing option results m the better ROE. Calculate the current (2012) net profit margin, total asset turnover, assets-to-equity on total assets, and return on common equity for Greta's Gadgets. Now, assuming no other changes, determine the effect of purchasing the $1 million in assets using 100% debt financing with a 10% annual interest rate. Further assume that the newly purchased assets generate an additional $2 million in sales and that the costs and expenses remain at 90% of sales. For purpose of this problem, further assume a tax rate of 40%. What is the effect on the ratios calculated in part(a)? Is the purchase of these assets justified on the basis of the return on common equity? Assume that the why purchased assets in part (b) generate only an extra $500,000 in sales. Is the purchase justified in this case? Which component ratio(s) of the Dupont system is (are) not affected by the change in sales? What does this imply about the use of financial leverage. Tracey White, owner of the Buzz Coffee shop chain, has decided to expand her operations. Her 2012 financial statements follow. Tracy can buy two additional coffeehouses $3 million, and she has the choice of completely financing these new coffeehouses with either a 10% (annual interest) loan or the issuance of new common stock. She also expects these new shops to generate an additional $1 million in sales. Assuming a 40% tax rate and no other changes, should Tracy buy the two coffeehouses? why or why not! Which financing option results m the better ROE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts