Question: Question: Perform a bond structuring strategy for MoGen Inc CASE STUDY: Mogen, Inc. On January 10, 2006, the managing director of Merrill Lynchs Equity-Linked Capital

Question: Perform a bond structuring strategy for MoGen Inc

CASE STUDY: Mogen, Inc. On January 10, 2006, the managing director of Merrill Lynchs Equity-Linked Capital Markets Group, Dar Maanavi, was reviewing the final drafts of a proposal for a convertible debt offering by MoGen, Inc. As a leading biotechnology company in the United States, MoGen had become an important client for Merrill Lynch over the years. In fact, if this deal were to be approved by MoGen at $5 billion, it would represent Merrill Lynchs third financing for MoGen in four years with proceeds raised totaling $10 billion. Moreover, this convert would be the largest such single offering in history. The proceeds were earmarked to fund a variety of capital expenditures, research and development (R&D) expenses, working capital needs, as well as a share repurchase program. The Merrill Lynch team had been working with MoGens senior management to find the right tradeoff between the conversion feature and the coupon rate for the bond. Maanavi knew from experience that there was no free lunch, when structuring the pricing of a convertible. Issuing companies wanted the conversion price to be as high as possible and the coupon rate to be as low as possible; whereas investors wanted the opposite: a low conversion price and a high coupon rate. Thus, the challenge was to structure the convert to make it attractive to the issuing company in terms of its cost of capital, while at the same time selling for full price in the market. Maanavi was confident that the right balance in the terms of the convert could be found, and he was also confident that the convert would serve MoGens financing needs better than a straight bond or equity issuance. But, he needed to make a decision about the final terms of the issue in the next few hours, as the meeting with MoGen was scheduled for early the next morning.

Pricing Strategy Dar Maanavi was excited by the prospect that Merrill Lynch would be the lead book runner of the largest convertible offering in history. At $5 billion, MoGens issue would represent more than 12% of the total proceeds for convertible debt in the United States during 2005. Although the convert market was quite liquid and the Merrill Lynch team was confident that the issue would be well received, the unprecedented size heightened the need to make it as marketable as possible. Maanavi knew that MoGen wanted a maturity of five years, but was less certain as to what he should propose regarding the conversion premium and coupon rate. These two terms needed to be satisfactory to MoGens senior management team while at the same time being attractive to potential investors in the marketplace. Exhibit 7 shows the terms of the offering that had already been determined. Most convertibles carried conversion premiums in the range of 10% to 40%. The coupon rates for a convertible depended upon many factors, including the conversion premium, maturity, credit rating, and the markets perception of the volatility of the issuing companys stock. Issuing companies wanted low coupon rates and high conversion premiums, whereas investors wanted the opposite: high coupons and low conversion premiums. Companies liked a high conversion premium, because it effectively set the price at which its shares would be issued in the future. For example, if MoGens bond was issued with a conversion price of $109, it would represent a 40% conversion premium over its current stock price of $77.98. Thus, if the issue were eventually converted, the number of MoGen shares issued would be 40% less than what MoGen would have issued at the current stock price. Of course, a high conversion premium also carried with it a lower probability that the stock would ever reach the conversion price. To compensate investors for this reduced upside potential, MoGen would need to offer a higher coupon rate. Thus, the challenge for Maanavi was to find the right combination of conversion premium and coupon rate that would be acceptable to MoGen management as well as desirable to investors. There were two types of investor groups for convertibles: fundamental investors and hedge funds. Fundamental investors liked convertibles, because they viewed them as a safer form of equity investment. Hedge fund investors viewed convertibles as an opportunity to engage in an arbitrage trading strategy that typically involved holding long positions of the convertible and short positions of the common stock. Companies preferred to have fundamental investors, because they took a longer-term view of their investment than hedge funds. If the conversion premium was set above 40%, fundamental investors tended to lose interest because the convertible became a more speculative investment with less upside potential. Thus, if the conversion premium were set at 40% or higher, it could be necessary to offer an abnormally high coupon rate for a convertible. In either case, Maanavi thought a high conversion premium was not appropriate for such a large offering. It could work for a smaller, more volatile stock, but not for MoGen and not for a $5 billion offering. Early in his conversations with MoGen, Maanavi had discussed the accounting treatment required for convertibles. Recently, most convertibles were being structured to use the treasury stock method, which was desirable because it reduced the impact upon the reported fully diluted EPS. To qualify for the treasury stock method the convertible needed to be structured as a net settled security. This meant that investors would always receive cash for the principal amount of $1,000 per bond, but could receive either cash or shares for the excess over $1,000 upon conversion. The alternative method of accounting was the if-converted method, which would require MoGen to compute fully diluted EPS, as if investors received shares for the full amount of the bond when they converted; which is to say the new shares equaled the principal amount divided by the conversion price per share. The treasury stock method, however, would allow MoGen to report far fewer fully diluted shares for EPS purposes because it only included shares representing the excess of the bonds conversion value over the principal amount. Because much of the issues proceeds would be used to fund the stock repurchase program, MoGens management felt that using the treasury stock method would be a better representation to the market of MoGens likely EPS, and therefore agreed to structure the issue accordingly (see conversion rights in Exhibit 7). In light of MoGen managements objectives, Maanavi decided to propose a conversion premium of 25%, which was equivalent to conversion price of $97.000.6 MoGen management would appreciate that the conversion premium would appeal to a broad segment of the market, which was important for a $5 billion offering. On the other hand, Maanavi knew that management would be disappointed that the conversion premium was not higher. Management felt that the stock was selling at a depressed price and represented an excellent buy. In fact, part of the rationale for having the stock repurchase program was to take advantage of the stock price being low. Maanavi suspected that management would express concern that a 25% premium would be sending a bad signal to the market: a low conversion premium could be interpreted as managements lack of confidence in the upside potential of the stock. For a five-year issue, the stock would only need to rise by 5% per year to reach the conversion price by maturity. If management truly believed the stock had strong appreciation potential, then the conversion premium should be set much higher. If Maanavi could convince MoGen to accept the 25% conversion premium, then choosing the coupon rate was the last piece of the pricing puzzle to solve. Because he was proposing a mid-range conversion premium, investors would be satisfied with a modest coupon. Based on MoGens bond rating, the company would be able to issue straight five-year bonds with a 5.75% yield. Therefore, Maanavi knew that the convertible should carry a coupon rate noticeably lower than 5.75%. The challenge was to estimate the coupon rate that would result in the debt being issued at exactly the face value of $1,000 per bond.

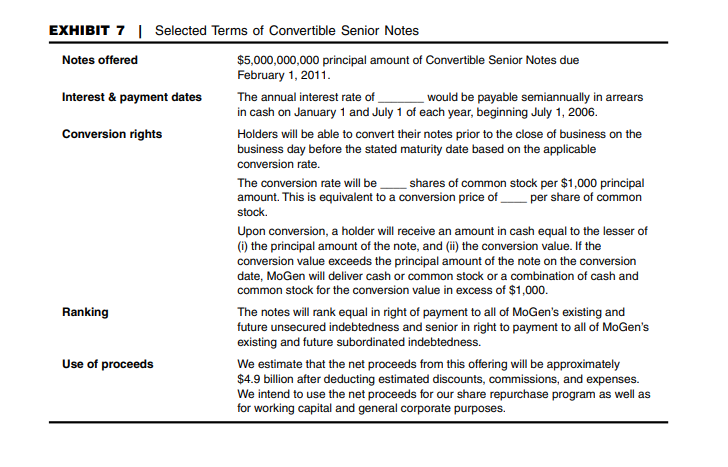

EXHIBIT 7 Selected Terms of Convertible Senior Notes Notes offered $5,000,000,000 principal amount of Convertible Senior Notes due February 1, 2011. Interest & payment dates The annual interest rate of would be payable semiannually in arrears in cash on January 1 and July 1 of each year, beginning July 1, 2006. Conversion rights Holders will be able to convert their notes prior to the close of business on the business day before the stated maturity date based on the applicable conversion rate. The conversion rate will be shares of common stock per $1,000 principal amount. This is equivalent to a conversion price of per share of common stock. Upon conversion, a holder will receive an amount in cash equal to the lesser ) the principal amount of the note, and (ii) the conversion value. If the conversion value exceeds the principal amount of the note on the conversion date, MoGen will deliver cash or common stock or a combination of cash and common stock for the conversion value in excess of $1,000. Ranking The notes will rank equal in right of payment to all of MoGen's existing and future unsecured indebtedness and senior in right to payment to all of MoGen's existing and future subordinated indebtedness. Use of proceeds We estimate that the net proceeds from this offering will be approximately $4.9 billion after deducting estimated discounts, commissions, and expenses. We intend to use the net proceeds for our share repurchase program as well as for working capital and general corporate purposes. a EXHIBIT 7 Selected Terms of Convertible Senior Notes Notes offered $5,000,000,000 principal amount of Convertible Senior Notes due February 1, 2011. Interest & payment dates The annual interest rate of would be payable semiannually in arrears in cash on January 1 and July 1 of each year, beginning July 1, 2006. Conversion rights Holders will be able to convert their notes prior to the close of business on the business day before the stated maturity date based on the applicable conversion rate. The conversion rate will be shares of common stock per $1,000 principal amount. This is equivalent to a conversion price of per share of common stock. Upon conversion, a holder will receive an amount in cash equal to the lesser ) the principal amount of the note, and (ii) the conversion value. If the conversion value exceeds the principal amount of the note on the conversion date, MoGen will deliver cash or common stock or a combination of cash and common stock for the conversion value in excess of $1,000. Ranking The notes will rank equal in right of payment to all of MoGen's existing and future unsecured indebtedness and senior in right to payment to all of MoGen's existing and future subordinated indebtedness. Use of proceeds We estimate that the net proceeds from this offering will be approximately $4.9 billion after deducting estimated discounts, commissions, and expenses. We intend to use the net proceeds for our share repurchase program as well as for working capital and general corporate purposes. a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts