Question: QUESTION: Please share the functions for how d1 and d2 are calculated in excel for the problem below: Higgs Bassoon Corporation is a custom manufacturer

QUESTION: Please share the functions for how d1 and d2 are calculated in excel for the problem below:

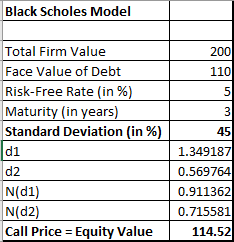

Higgs Bassoon Corporation is a custom manufacturer of bassoons and other wind instruments. Its current value of operations, which is also its value of debt plus equity, is estimated to be $200 million. Higgs has $110 million face value, zero coupon debt that is due in 3 years. The risk-free rate is 5%, and the standard deviation of returns for similar companies is 60%. The owners of Higgs Bassoon view their equity investment as an option and would like to know the value of their investment.

a. Using the Black-Scholes Option Pricing Model, how much is the equity worth?

Black Scholes Model Total Firm Value Face Value of Debt Risk-Free Rate (in %) Maturity (in years) Standard Deviation (in %) d1 d2 N(D1) N(D2) Call Price = Equity Value 45 1.349187 0.569764 0.911362 0.715581

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts