Question: Question: Prepare a schedule calculating depreciation for each year under both methods Information As the controller for IBCOOL, Inc., you are contemplating changing the depreciation

Question: Prepare a schedule calculating depreciation for each year under both methods

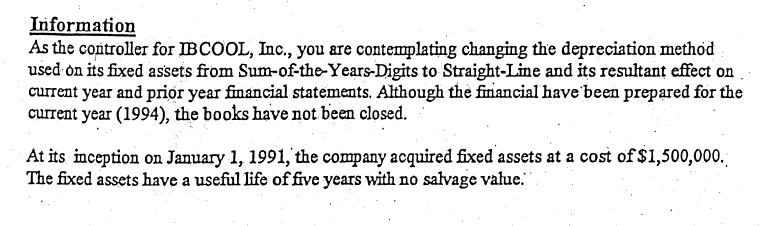

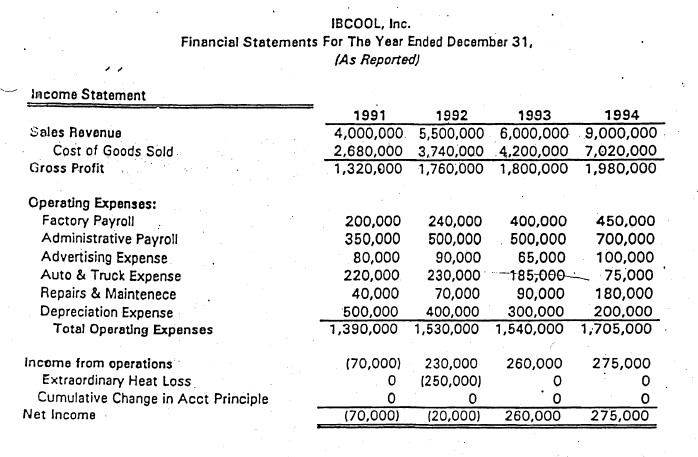

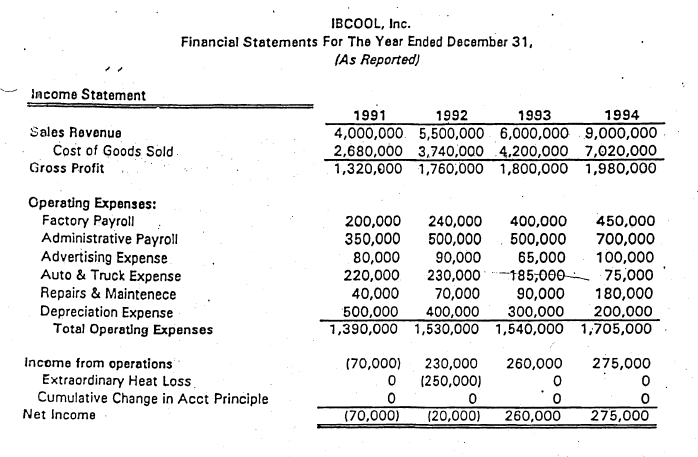

Information As the controller for IBCOOL, Inc., you are contemplating changing the depreciation method used on its fixed assets from Sum-ofthe Years-Digits to Straight-Line and its resultant effect on current year and prior year financial statements. Although the financial have been prepared for the current year (1994), the books have not been closed. At its inception on January 1, 1991, the company acquired fixed assets at a cost of $1,500,000. The fixed assets have a usefullife of five years with no salvage vahue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts