Question: Question: Recommend the strategic asset allocation that Robert should present for approval at the asset allocation review. Case Background: Claudine Robert is treasurer and vice

Question: Recommend the strategic asset allocation that Robert should present for approval at the asset allocation review.

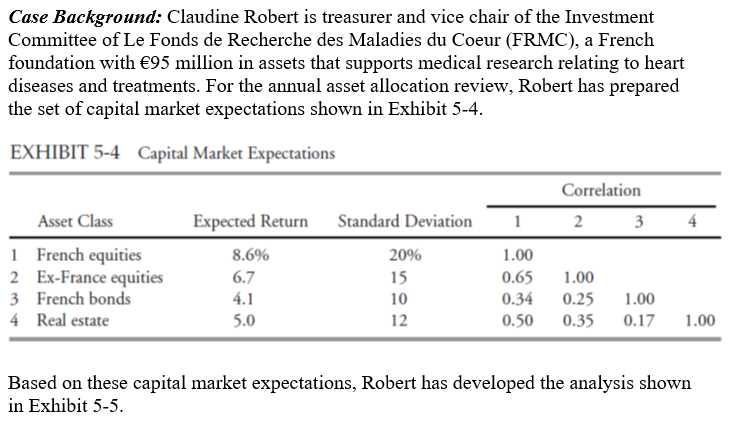

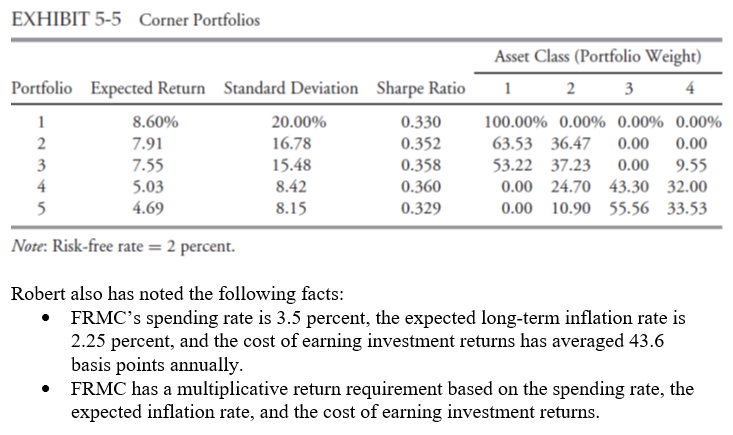

Case Background: Claudine Robert is treasurer and vice chair of the Investment Committee of Le Fonds de Recherche des Maladies du Coeur (FRMC), a French foundation with 95 million in assets that supports medical research relating to heart diseases and treatments. For the annual asset allocation review, Robert has prepared the set of capital market expectations shown in Exhibit 5-4. EXHIBIT 5-4 Capital Market Expectations Correlation 1 2 3 4 Asset Class French equities 2 Ex-France equities 3 French bonds 4 Real estate Expected Return 8.6% 6.7 Standard Deviation 20% 15 1.00 0.65 0.34 0.50 4.1 10 1.00 0.25 0.35 1.00 0.17 5.0 12 1.00 Based on these capital market expectations, Robert has developed the analysis shown in Exhibit 5-5. EXHIBIT 5-5 Corner Portfolios Asset Class (Portfolio Weight) 1 2 3 4 Portfolio Expected Return Standard Deviation Sharpe Ratio 1 8.60% 20.00% 0.330 2. 7.91 16.78 0.352 3 7.55 15.48 0.358 4 8.42 0.360 5 4.69 8.15 0.329 100.00% 0.00% 0.00% 0.00% 63.53 36.47 0.00 0.00 53.22 37.23 0.00 9.55 0.00 24.70 43.30 32.00 0.00 10.90 55.56 33.53 5.03 Note: Risk-free rate = 2 percent. Robert also has noted the following facts: FRMC's spending rate is 3.5 percent, the expected long-term inflation rate is 2.25 percent, and the cost of earning investment returns has averaged 43.6 basis points annually. FRMC has a multiplicative return requirement based on the spending rate, the expected inflation rate, and the cost of earning investment returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts