Question: Question: Repeat problem 2.30 for continuous compounding. ans. (a) $9476.60 ; (b) $10226.83 you are not solving 2.30! use problem 2.30 information to solve for

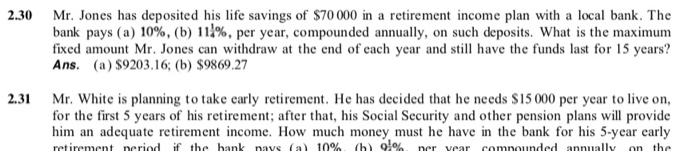

2.30 Mr. Jones has deposited his life savings of $70 000 in a retirement income plan with a local bank. The bank pays (a) 10%, (b) 11/%, per year, compounded annually, on such deposits. What is the maximum fixed amount Mr. Jones can withdraw at the end of each year and still have the funds last for 15 years? Ans. (a) $9203.16; (b) $9869.27 2.31 Mr. White is planning to take carly retirement. He has decided that he needs S15 000 per year to live on, for the first 5 years of his retirement, after that, his Social Security and other pension plans will provide him an adequate retirement income. How much money must he have in the bank for his 5-year early retirement neriod if the bank navs (al 10% (h) 0% ner vear comnounded annually on the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts