Question: Question: Respond to this question below (maximum of 2 pages) 1. What would the SWOT chart look like for Sketchers if you were to create

Question:

Respond to this question below (maximum of 2 pages)

1. What would the SWOT chart look like for Sketchers if you were to create one? Please create a SWOT chart and explain each section.

Skechers: The case of a rapid growth strategy for the new global economy

Abstract

In this case study a review of the international growth strategy pursued by the California footware company Skechers is performed. The firm has experienced incredible revenue growth in the past five years, much of it attributable to international expansion. Moreover, the firm has been launching a wide range of new brands that appeal to many different potential target markets which has bolstered the firms image. Nonetheless, Skechers has maintained a keen strategic focus of quality and comfort and a price point that is perceived as a good value relative to direct and indirect competitors. In addition to an analysis of Skechers strategy and product portfolio, the firms company history, growth alternatives and possible future strategic options are proposed and assessed.

Skechers: The case of a rapid growth strategy for the new global economy

In early 2018, Skechers USA Inc.s CEO Robert Greenbergmust have been excited to see how the companyhas expanded over the last few years into a truly global enterprise. The firm experienced extensive international growth in a relatively short period of time. Although top line revenue growth was overall strong, the company was suffering from rising costs which negatively impacted shareholder opinions (Skechers form 10K 2017). The decline in shareholder confidence was certainly an area of concern yet the senior leadership team must have been excited about the new international presence. One key issue the firm faced was the possibility that international sales were too concentrated in select regions of the world. Further, didthe company expanded too quickly internationally without the operational foundation for such growth? And was the current distribution and manufacturing model the right fit forSkechers favor or did it need to be changed in order tocontinue maintain the current growth trajectory?

Recent History

Skechers global growth in the past decade has been extremely impressive. As of January 2018, Skechers employedover 9800 workersglobally, which included 214 factory outlets and 139 warehouse outlets worldwide.Skechers improved its brand reputation by establishing endorsements with celebrities and high profile athletes across many different markets. These include musicians such as Demi Lovato and Meghan Trainor; television personalities such as Kelly Brook; sports legends Joe Montana and David Ortiz among others. Most notably they worked with Olympian Meb Keflezighi to expand awareness of their athletic performance division. A shining moment occurred for the firm when Meb wore Skechers as he won the Boston Marathon in 2014. He was the first American to win the Boston Marathon since Greg Meyer in 1983. More remarkably, Mebs time of 2:08:37 was one of the fastest times ever for a 38 year old and he was the oldest person ever to win Boston. The general public took notice. Skeckers stock rose 1.9% the day after the marathon (Bloomberg news 2014). It certainly appeared that Skechers signing of Meb help promote their Gorun line of shoes paid off.

Long Term History and Ownership Structure

Skechers U.S.A, Inc. was founded in 1992 and is headquartered in Manhattan Beach, CA. Robert Greenberg, current Skechers CEO and founder, had significant experience in the footwear industry. He founded LA Gear in 1983 and had tremendous success in the first decade of the firm. Yet he was pushed out of the company by 1999 due to declining sales and market share, as well as a few challenges related to the overall perception of the brand. After his departure from LA Gear, he founded Skechers originally as a distributor of Dr. Martens shoes. Building off his experience at LA Gear, Greenberg expanded Skechers into men and womens athletic footwear. Today Skechers designs and sells more than 3,000 styles of lifestyle and athletic footwear. In addition to the Skechers brand, the company offers fashion and street focused footwear under Marc Eko, Zoo York, and Mark Nason brands. Its largest competitors include Timberland, Nike, and C&J Clark.

Skechers went public in 1999 raising more than $88 million. As of early 2018, 88% of the shares were designated as institutional ownership with the remainder owned by senior management.

International Growth

Skechers international business has been booming with 59% of sales attributed to non-US operations in 2017, an increase of 52% over 2016. One dominant market was China with 4.4 million pairs of shoes shipped in the first quarter of 2018. China had a retail base of 800 Skechers stores with 2,400 points of sale, and a strong e-commerce business. To continue to expand internationally, Skechers decided to expand its distribution network to include partners in Scandinavia, Turkey, and Russia. A major challenge of this larger global footprint was rapidly changing political environments. In the first quarter of 2018, the Middle East and South African distribution suffered a decline given the regional economic challenges.

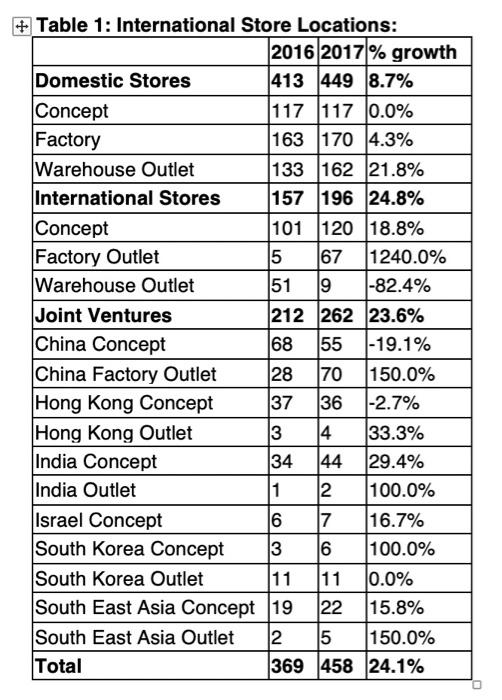

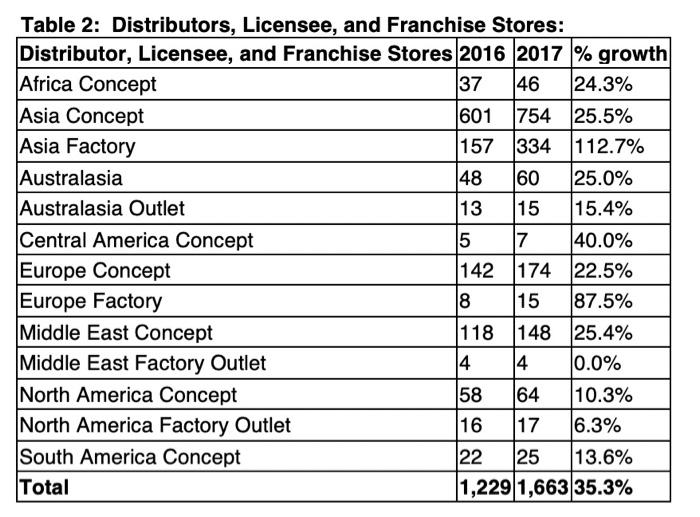

Insert Tables 1 and 2 here

The firms recent growth had a keen focus international markets with approximately 475 new third-party owned stores to slated to open in 2018. The company believed that global expansion had more potential to grow the top line at a faster pace than the domestic business. Following a strong 2017, Skechers witnessed a growth in both the teen and fashion-forward audiences to which they increased marketing support and investment in relevant brand influencers and ambassadors. To manage this growth, the company had to maintain its innovation, development, and distribution. In 2018 the company expected to make additional significant investments in operations and logistics worldwide.

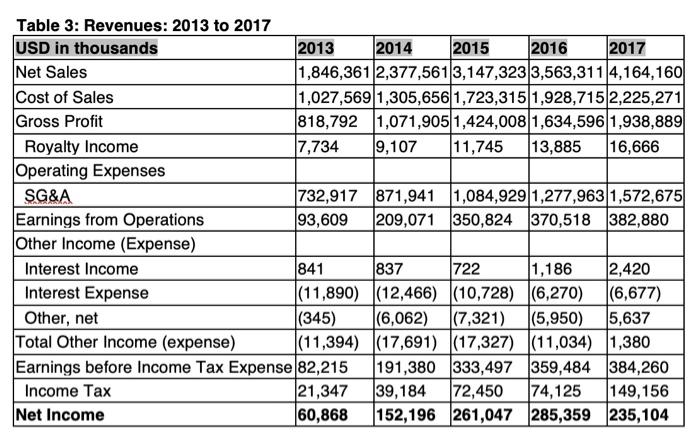

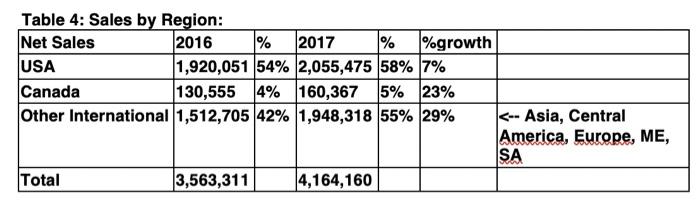

Insert Tables 3 and 4 here

With a burgeoning worldwide footprint, Skechers indeed faced many challenges. One of the challenges the company faced was its order shifting from the front half to the second half of the year. In 2018, the biggest issue was likely to be weather in North America which has led to slower first half of 2018. With more products focused on the teen and young adult markets, stores were preparing earlier for the back-to-school season shifting timing earlier. In addition, each region of the world hadseen a timeline shift which impacts backlogs and incoming order rates throughout the year.

Insert Figure 1 here

A second challenge was the rising costs of its global operations. Expenses had grown to a level which could absorb the capacity of the business that was anticipated. E-commerce had been a big part of rising costs as the company continued to build the infrastructure to ship one pair of shoes at a time compared to large shipments to stores. Skechers was experiencing the growing pains of maintaining its distribution efficiency.

A third issue is inventory management. As the company focuses on a larger retail model, especially in China, Skechers is building inventory earlier. This has been useful to support its growing online presence; however, just like in-stores, if the product isnt sold, the company has to store it at higher costs. Nonetheless, one of the best benefits of Skechers distribution model is that the company does not hold third-party distributor inventory, they buy direct from factory. This is an opportunity the company has to increase its brand exposure without increasing its costs.

Product Lines:

Skechers has a plethora of products and brands. Under lifestyle brands there is: Skechers USA, Skechers Sport, Skechers Active and Sport Active; Skechers Originals, and Skecher BOBs. For performance brands there is: GOrun, GoWalk, GOtrain, GOtrail, GOGolf. Skechers target consumer is an active, youthful and style-savvy individual from the ages of 12 to 24. They also offer products with a broader appeal of 5 to 50-year old customer. Skechers performance products are for professional and recreational athlete who want a more technical fitness shoe. These multiple product lines of lifestyle and athletic performance shoes is a huge strength to the company in a saturated market.

Production and Distribution:

Like many other footwear brands, Skechers independently contracts its manufacturers. In 2016, 51% of total purchases came from 5 contract manufacturers. These manufacturers are mostly located in China and Vietnam. This allows Skechers to keep its capital investments low and flexibility in manufacturing and production capacity. However, this places a large dependence on its suppliers. Skechers keeps its agreements with suppliers relatively short (30 to 60 days), yet it has long-standing relationships with several for continuity and reliability. When Skechers looks for a new supplier, the focus is on manufacturers with previous footwear experience. The design process begins about 9 months prior to the next season by in-house design staff. These staff design and monitor products from the US, China, and Vietnam with inspection teams located in China and Vietnam.

Skechers distributes through two major channels: wholesale and retail stores. Wholesale includes department stores, specialty stores, and independent retailers. Retail stores includes e-commerce, concept stores, factory, and warehouse outlet stores. Concept stores are larger stores where the company tests new marketing activities, hosts events, and showcases new product designs. Such locations include Times Square, Powell Street in San Francisco, Westfield London, Shinsaibashi district of Osaka and Harajuku in Tokyo. Factory stores are located in manufacturers direct outlet centers in US and international, while warehouse outlet stores are primarily in US and Canada and used to liquidate excess merchandise, discounted lines, and odd-sized inventory.

Skechers advertising and marketing motto is unseen, untold, unsold. Its omnichannel strategy includes print (specialized magazines such as Runners World, Seventeen, Mens Fitness), TV, online, outdoor, trend-influence, social media, promotions, in-store events, and celebrity endorsers. All of this is managed by in-house teams.

Consumers:

Skechers targets consumers are active, youthful and style-savvy. They design the lifestyle line to be comfortable, fashionable and marketable to the 12- to 24-year-old consumer, with a larger appeal to 5- to 50-year old consumer, and an exclusive selection for infants and toddlers. Skechers appeals to the professional and recreational athlete with their performance products geared for consumers who wants a more technical fitness shoe.

Whats next?

Skechers USA has a goal of reaching $6 billion in sales by 2020.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock