Question: Question Status: 5 V.? , 6 8:44 PM You have one LAST attempt left of this question for credit Options trade on the common stock

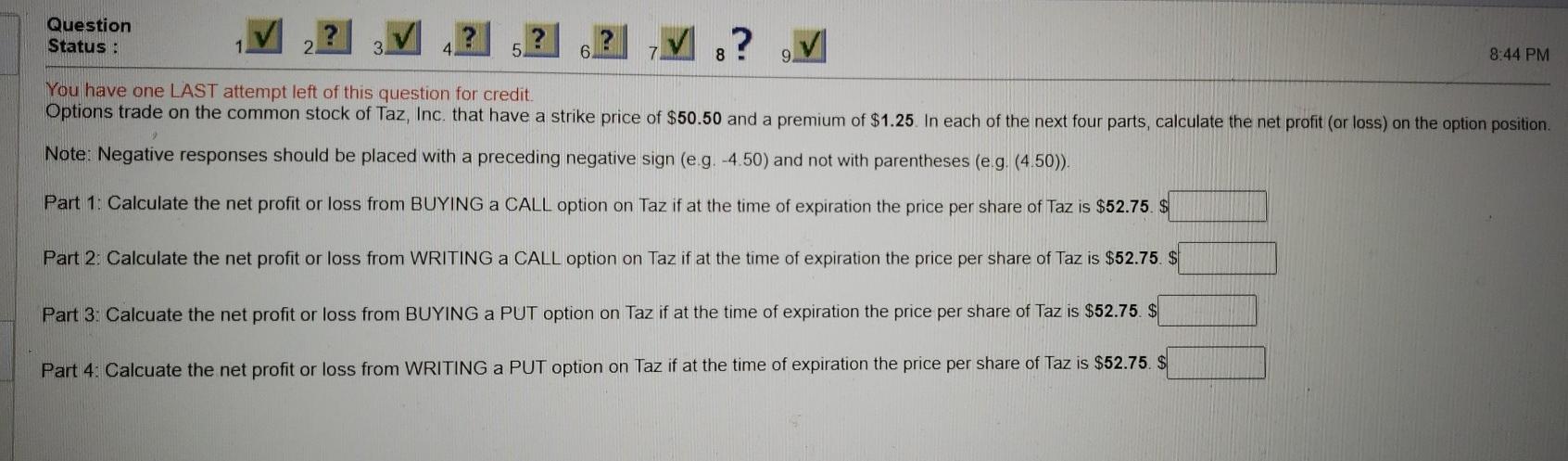

Question Status: 5 V.? , 6 8:44 PM You have one LAST attempt left of this question for credit Options trade on the common stock of Taz, Inc. that have a strike price of $50.50 and a premium of $1.25. In each of the next four parts, calculate the net profit (or loss) on the option position Note: Negative responses should be placed with a preceding negative sign (eg. -4.50) and not with parentheses (eg. (4.50)). Part 1: Calculate the net profit or loss from BUYING A CALL option on Taz if at the time of expiration the price per share of Taz is $52.75. $ Part 2: Calculate the net profit or loss from WRITING A CALL option on Taz if at the time of expiration the price per share of Taz is $52.75. $ Part 3: Calcuate the net profit or loss from BUYING A PUT option on Taz if at the time of expiration the price per share of Taz is $52.75. $ Part 4: Calcuate the net profit or loss from WRITING a PUT option on Taz if at the time of expiration the price per share of Taz is $52.75. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts