Question: Question Three a) Suppose that ( g ) is a function from ( A ) to ( B ) and ( f ) is a

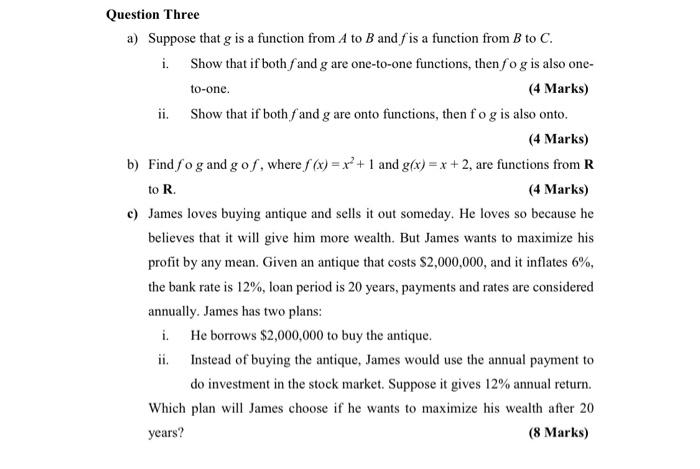

Question Three a) Suppose that g is a function from A to B and f is a function from B to C. i. Show that if both f and g are one-to-one functions, then fg is also oneto-one. (4 Marks) ii. Show that if both f and g are onto functions, then fg is also onto. (4 Marks) b) Find fg and gf, where f(x)=x2+1 and g(x)=x+2, are functions from R to R. (4 Marks) c) James loves buying antique and sells it out someday. He loves so because he believes that it will give him more wealth. But James wants to maximize his profit by any mean. Given an antique that costs $2,000,000, and it inflates 6%, the bank rate is 12%, loan period is 20 years, payments and rates are considered annually. James has two plans: i. He borrows $2,000,000 to buy the antique. ii. Instead of buying the antique, James would use the annual payment to do investment in the stock market. Suppose it gives 12\% annual return. Which plan will James choose if he wants to maximize his wealth after 20 years? (8 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts