Question: QUESTION THREE Fox Plc plans to raise ( mathrm{K} 5 mathrm{~m} ) in order to expand its existing chain of retail outlets. It can raise

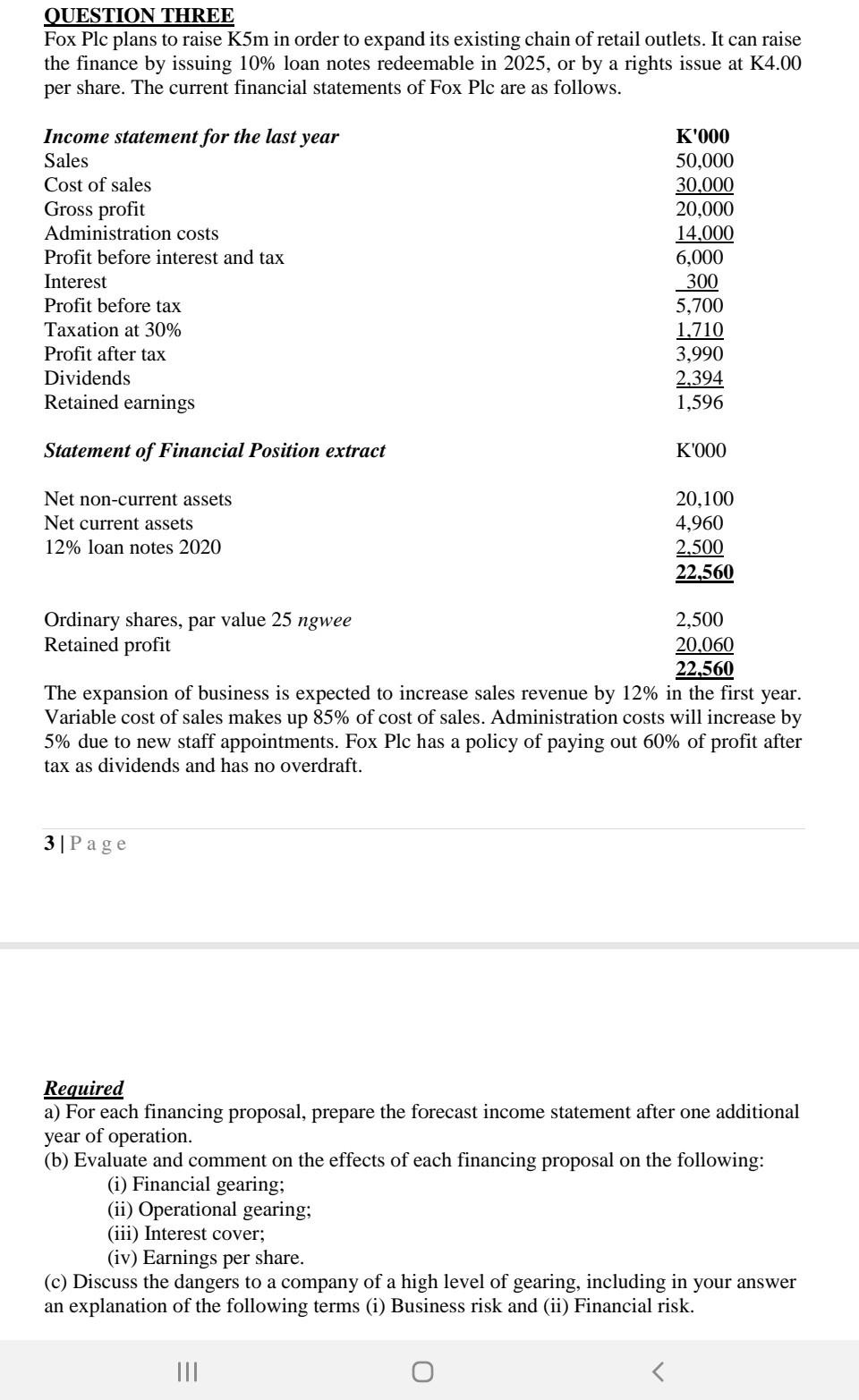

QUESTION THREE Fox Plc plans to raise \\( \\mathrm{K} 5 \\mathrm{~m} \\) in order to expand its existing chain of retail outlets. It can raise the finance by issuing \10 loan notes redeemable in 2025 , or by a rights issue at K4.00 per share. The current financial statements of Fox Plc are as follows. The expansion of business is expected to increase sales revenue by \12 in the first year. Variable cost of sales makes up \85 of cost of sales. Administration costs will increase by \5 due to new staff appointments. Fox Plc has a policy of paying out \60 of profit after tax as dividends and has no overdraft. \\( \\mathbf{3} \\mid \\mathrm{P} \\) ag e Required a) For each financing proposal, prepare the forecast income statement after one additional year of operation. (b) Evaluate and comment on the effects of each financing proposal on the following: (i) Financial gearing; (ii) Operational gearing; (iii) Interest cover; (iv) Earnings per share. (c) Discuss the dangers to a company of a high level of gearing, including in your answer an explanation of the following terms (i) Business risk and (ii) Financial risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts