Question: Question to be answered : using the bonus method, who is getting a bonus with the initial contributions using the bonus method, jerry capital is

Question to be answered :

- using the bonus method, who is getting a bonus with the initial contributions

- using the bonus method, jerry capital is initially credit for how much

- using the bonus method , how much is the bonus with the initial contributions

- using the bonus method , blue capital is credit for how much

- using the bonus method, who is giving up a bonus with the initial contributions

- using the bonus method, with blue entry how much bonus is blue providing

- using the bonus method, after blue entry, Tom capital is credited for how much

- using the bonus method, Tom capital is initially credited for how much

- using the bonus method, after blue entry , how much is the cash account balance

- using the bonus method, Spike capital is initial for how much

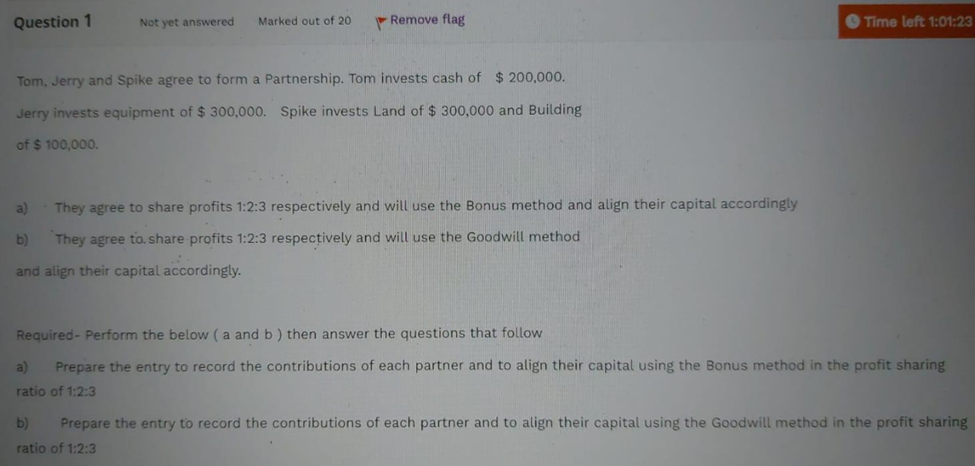

Tom, Jerry and Spike agree to form a Partnership. Tom invests cash of $200,000. Jerry invests equipment of $300,000. Spike invests Land of $300,000 and Building of $100,000 a) They agree to share profits 1:2:3 respectively and will use the Bonus method and align their capital accordingly b) They agree to. share profits 1:2:3 respectively and will use the Goodwill method and align their capital accordingly. Required-Perform the below ( a and b ) then answer the questions that follow a) Prepare the entry to record the contributions of each partner and to align their capital using the Bonus method in the profit sharing ratio of 1:2:3 b) Prepare the entry to record the contributions of each partner and to align their capital using the Goodwill method in the profit sharin ratio of 1:2:3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts