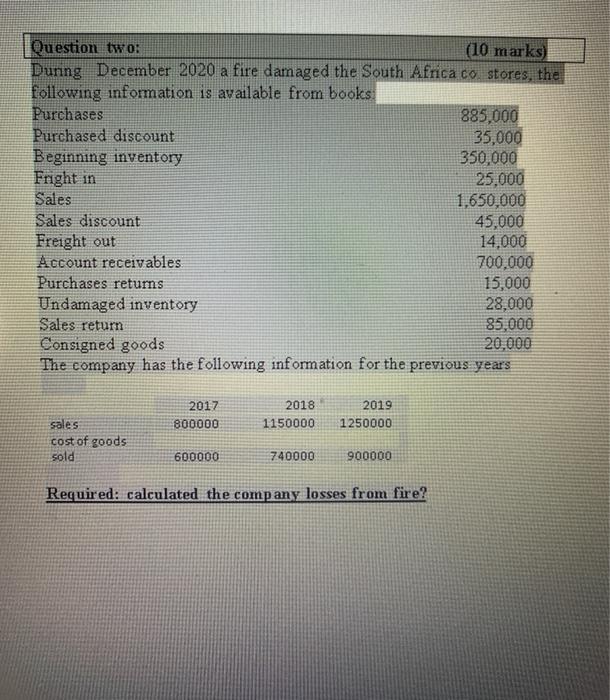

Question: Question two: (10 marks) During December 2020 a fire damaged the South Africa co stores, the following information is available from books Purchases 885,000 Purchased

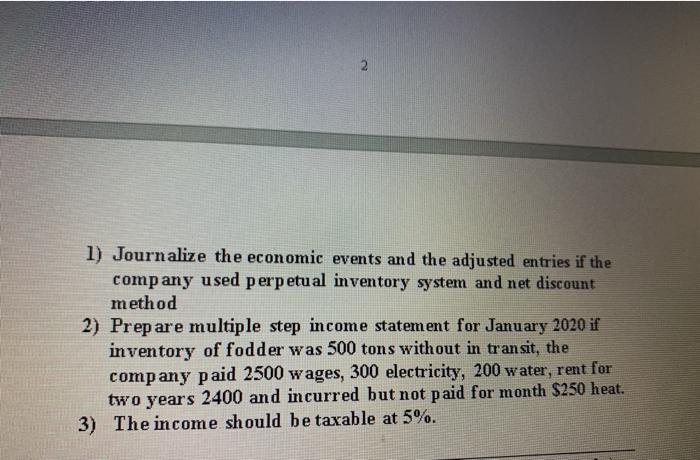

Question two: (10 marks) During December 2020 a fire damaged the South Africa co stores, the following information is available from books Purchases 885,000 Purchased discount 35,000 Beginning inventory 350,000 Fright in 25,000 Sales 1,650,000 Sales discount 45,000 Freight out 14,000 Account receivables 700,000 Purchases returns 15,000 Undamaged inventory 28,000 Sales return 85,000 Consigned goods 20.000 The company has the following information for the previous years 2017 800000 2018 1150000 2019 1250000 sales cost of goods sold 600000 740000 900000 Required: calculated the company losses from fire? 2 1) Journalize the economic events and the adjusted entries if the company used perpetual inventory system and net discount method 2) Prep are multiple step income statement for January 2020 if inventory of fodder was 500 tons without in transit, the company paid 2500 wages, 300 electricity, 200 water, rent for two years 2400 and incurred but not paid for month $250 heat. 3) The income should be taxable at 5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts