Question: Question TWO: (10 Marks) For 2018, Mr. Mason Boardman has combined federal and provincial Tax Payable of $52,350. For this year, his employer withheld $61,600.

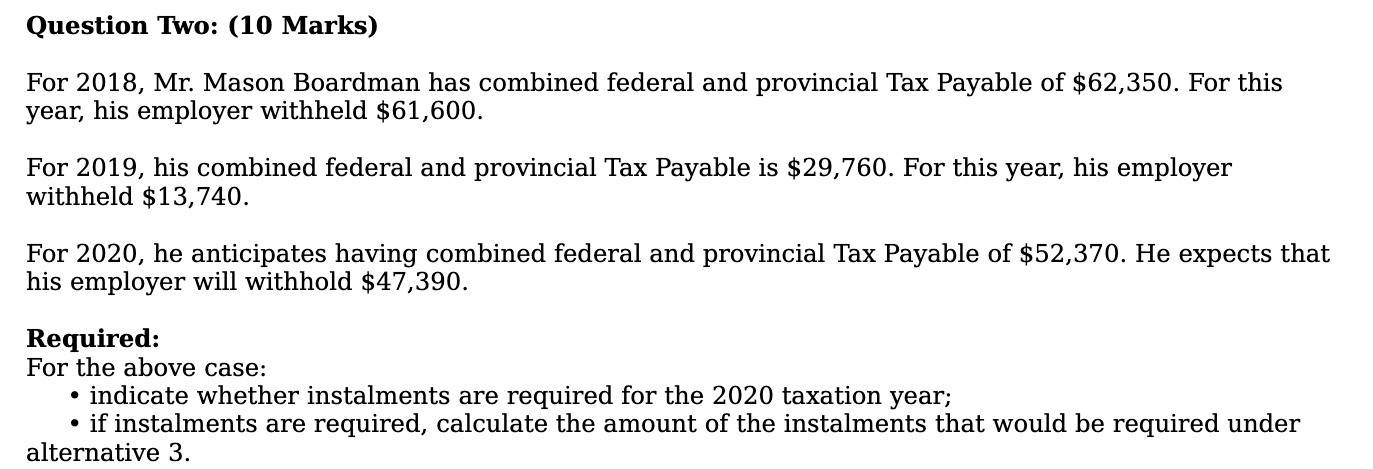

Question TWO: (10 Marks) For 2018, Mr. Mason Boardman has combined federal and provincial Tax Payable of $52,350. For this year, his employer withheld $61,600. For 2019, his combined federal and provincial Tax Payable is $29,760. For this year, his employer withheld $13,740. For 2020, he anticipates having cembined federal and provincial Tax Payable of $52,370. He expects that his employer will withhold $47,390. Required: For the above case: . indicate whether instalments are required for the 2020 taxation year; 0 if instalments are required, calculate the amount of the instalments that would be required under alternative 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts