Question: QUESTION TWO (15 marks) You are an analyst at a local bank and one of your corporate customers is interested in fixed rate USD funding.

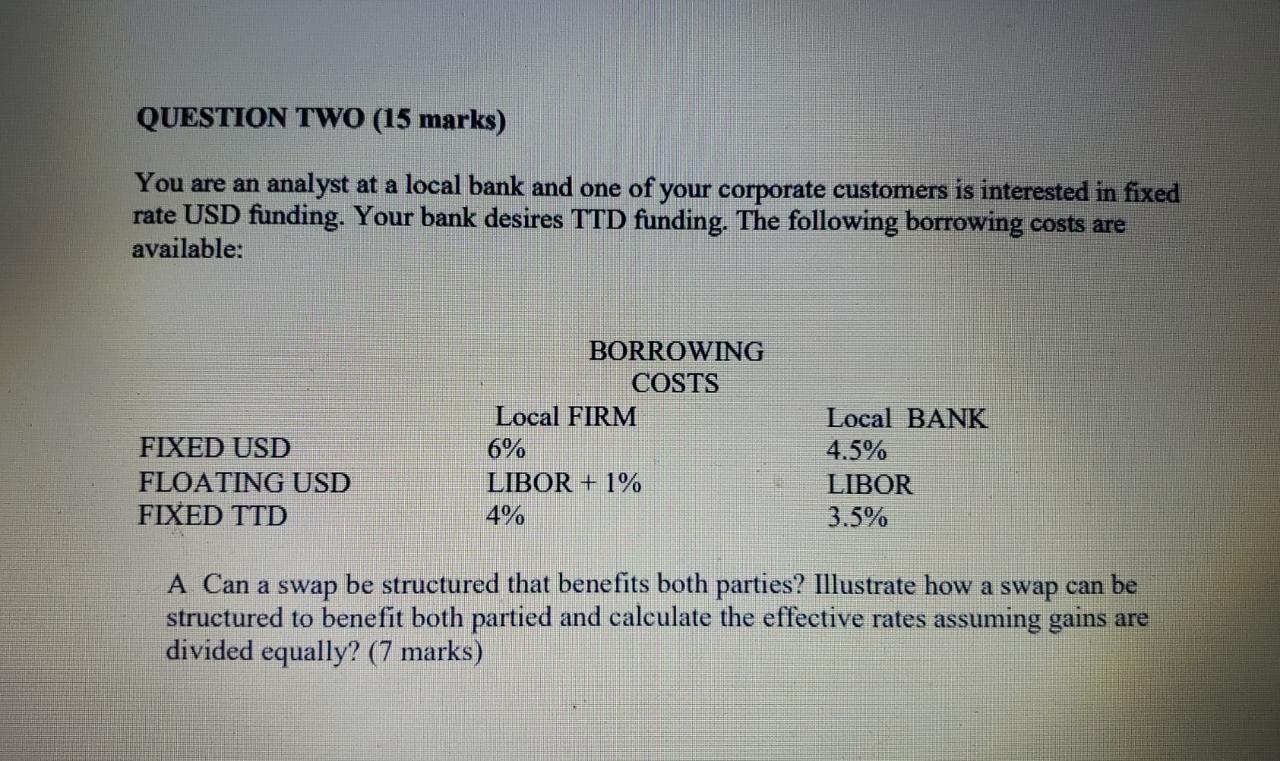

QUESTION TWO (15 marks) You are an analyst at a local bank and one of your corporate customers is interested in fixed rate USD funding. Your bank desires TTD funding. The following borrowing costs are available: BORROWING COSTS Local FIRM 6% LIBOR + 1% 4% FIXED USD FLOATING USD FIXED ITD Local BANK 4.5% LIBOR 3.5% A Can a swap be structured that benefits both parties? Illustrate how a swap can be structured to benefit both partied and calculate the effective rates assuming gains are divided equally? (7 marks) QUESTION TWO (15 marks) You are an analyst at a local bank and one of your corporate customers is interested in fixed rate USD funding. Your bank desires TTD funding. The following borrowing costs are available: BORROWING COSTS Local FIRM 6% LIBOR + 1% 4% FIXED USD FLOATING USD FIXED ITD Local BANK 4.5% LIBOR 3.5% A Can a swap be structured that benefits both parties? Illustrate how a swap can be structured to benefit both partied and calculate the effective rates assuming gains are divided equally? (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts