Question: SHOW WORKING PLEASE You are an analyst at a local bank and one of your corporate customers is interested in fixed rate USD funding. Your

SHOW WORKING PLEASE

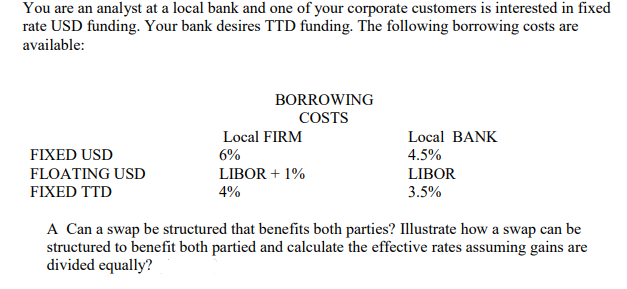

You are an analyst at a local bank and one of your corporate customers is interested in fixed rate USD funding. Your bank desires TTD funding. The following borrowing costs are available: BORROWING COSTS Local FIRM Local BANK FIXED USD 6% 4.5% FLOATING USD LIBOR + 1% LIBOR FIXED TTD 4% 3.5% A Can a swap be structured that benefits both parties? Illustrate how a swap can be structured to benefit both partied and calculate the effective rates assuming gains are divided equally? You are an analyst at a local bank and one of your corporate customers is interested in fixed rate USD funding. Your bank desires TTD funding. The following borrowing costs are available: BORROWING COSTS Local FIRM Local BANK FIXED USD 6% 4.5% FLOATING USD LIBOR + 1% LIBOR FIXED TTD 4% 3.5% A Can a swap be structured that benefits both parties? Illustrate how a swap can be structured to benefit both partied and calculate the effective rates assuming gains are divided equally

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts