Question: Matthew, James and John are former school mates who were doing business together. The business is not registered but they registered themselves as equals

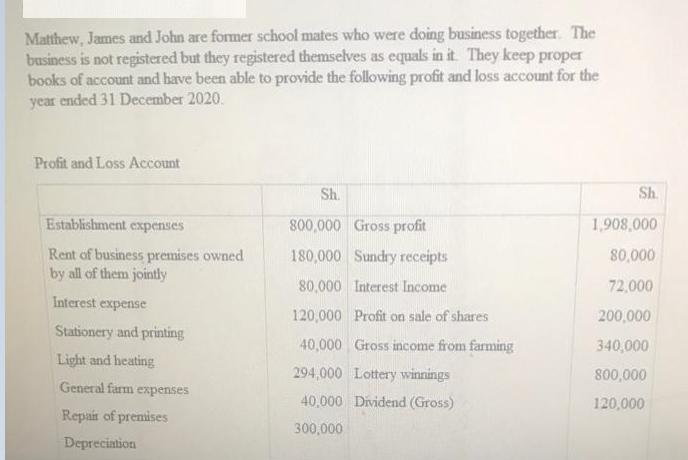

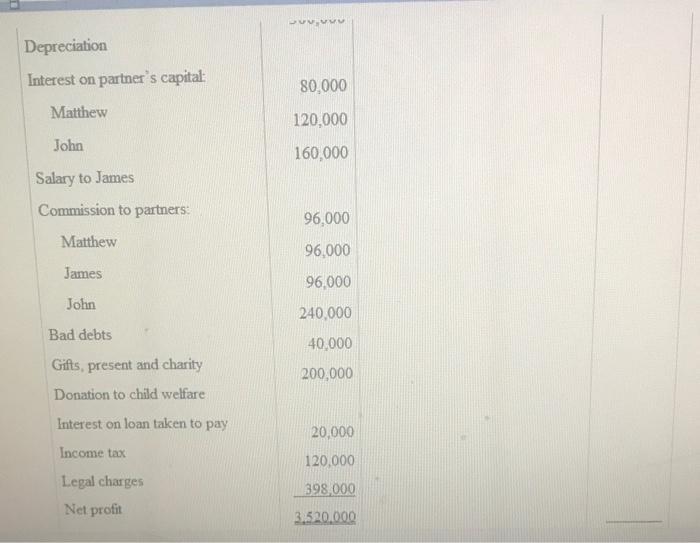

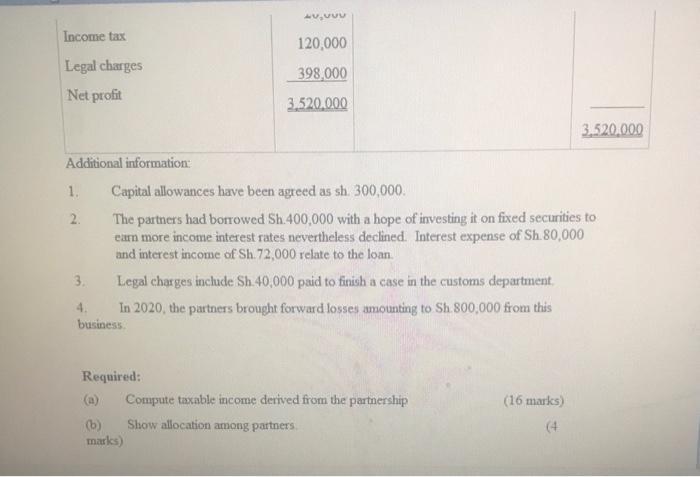

Matthew, James and John are former school mates who were doing business together. The business is not registered but they registered themselves as equals in it. They keep proper books of account and have been able to provide the following profit and loss account for the year ended 31 December 2020. Profit and Loss Account Sh. Sh. Establishment expenses 800,000 Gross profit 1,908,000 Rent of business premises owned by all of them jointly 180,000 Sundry receipts 80,000 80,000 Interest Income 72,000 Interest expense 120,000 Profit on sale of shares 200,000 Stationery and printing 40,000 Gross income from farming 340,000 Light and heating 294,000 Lottery winnings 800,000 General farm expenses 40,000 Dividend (Gross) 120,000 Repair of premises 300,000 Deprecintion Depreciation Interest on partner's capital: 80,000 Matthew 120,000 John 160,000 Salary to James Commission to partners: 96,000 Matthew 96,000 James 96,000 John 240,000 Bad debts 40,000 Gifts, present and charity 200,000 Donation to child welfare Interest on loan taken to pay 20,000 Income tax 120,000 Legal charges 398.000 Net profit 3.520.000 Income tax 120,000 Legal charges 398,000 Net profit 3,520.000 3.520.000 Additional information: 1. Capital allowances have been agreed as sh. 300,000. The partners had borrowed Sh.400,000 with a hope of investing it on fixed securities to earn more income interest rates nevertheless declined. Interest expense of Sh.80,000 and interest income of Sh.72,000 relate to the loan. 2. 3. Legal charges include Sh.40,000 paid to finioh a case in the customs department. In 2020, the partners brought forward losses amounting to Sh. 800,000 from this business. 4. Required: (a) Compute taxable income derived from the partnership (16 marks) (b) Show allocation among partners. (4 marks)

Step by Step Solution

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

636913ed965ff_241522.pdf

180 KBs PDF File

636913ed965ff_241522.docx

120 KBs Word File