Question: QUESTION TWO (25 Marks) Assume you have E400 000.00 to invest in a portfolio of two risky securities plus a riskless asset. The following information

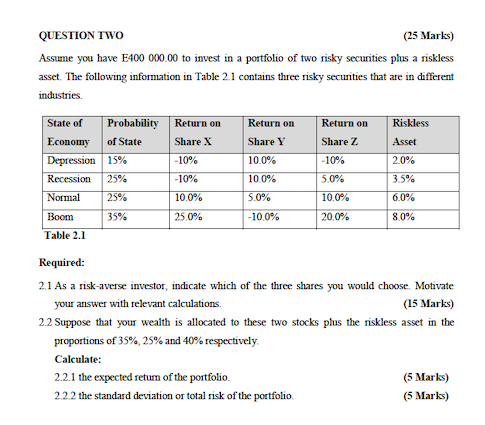

QUESTION TWO (25 Marks) Assume you have E400 000.00 to invest in a portfolio of two risky securities plus a riskless asset. The following information in Table 2.1 contains three risky securities that are in different industries State of Probability Return on Return on Return on Riskless Economy of State Share X Share Y Share 7 Asset Depression 15% -10% 10.0% -10% 2.0% Recession 25% -10% 100% 5.0% 3.5% Normal 25% 10.0% 5.0% 10.0% 6.0% Boom 35% 25.0% -100% 20.0% 80% Table 2.1 Required: 2.1 As a risk-averse investor, indicate which of the three shares you would choose. Motivate your answer with relevant calculations. (15 Marks) 2.2 Suppose that your wealth is allocated to these two stocks plus the riskless asset in the proportions of 35%, 25% and 40% respectively. Calculate: 2.2.1 the expected return of the portfolio (5 Marks) 2.2.2 the standard deviation or total risk of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts