Question: QUESTION TWO ( 4 5 MARKS ) Norbit Ltd purchased machinery on 1 January 2 0 . 1 0 and the machinery is written off

QUESTION TWO MARKS

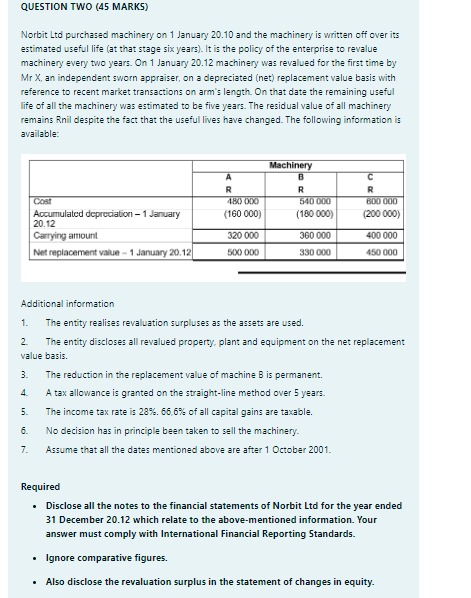

Norbit Ltd purchased machinery on January and the machinery is written off over its estimated useful life at that stage six years It is the policy of the enterprise to revalue machinery every two years. On January machinery was revalued for the first time by Mr X an independent sworn appraiser, on a depreciated net replacement value basis with reference to recent market transactions on arm's length. On that date the remaining useful life of all the machinery was estimated to be five years. The residual value of all machinery remains Rnil despite the fact that the useful lives have changed. The following information is available:

Additional information

The entity realises revaluation surpluses as the assets are used.

The entity discloses all revalued property, plant and equipment on the net replacement value basis.

The reduction in the replacement value of machine B is permanent.

A tax allowance is granted on the straightline method over years.

The income tax rate is of all capital gains are taxable.

No decision has in principle been taken to sell the machinery.

Assume that all the dates mentioned above are after October

Required

Disclose all the notes to the financial statements of Norbit Ltd for the year ended December which relate to the abovementioned information. Your answer must comply with International Financial Reporting Standards.

Ignore comparative figures.

Also disclose the revaluation surplus in the statement of changes in equity.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock