Question: plz answer all sub-question as a whole. Thanks so much. QUESTION 4: Accounting for income tax WRITE YOUR ANSWERS TO QUESTION 4 IN THE INDIICATED

plz answer all sub-question as a whole. Thanks so much.

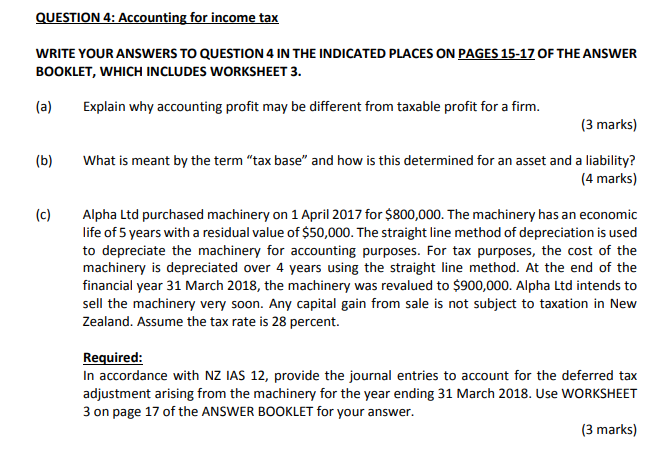

QUESTION 4: Accounting for income tax WRITE YOUR ANSWERS TO QUESTION 4 IN THE INDIICATED PLACES ON PAGES 15-17 OF THE ANSWER BOOKLET, WHICH INCLUDES WORKSHEET 3. (a) Explain why accounting profit may be different from taxable profit for a firm. (3 marks) (b) What is meant by the term "tax base" and how is this determined for an asset and a liability? (4 marks) Alpha Ltd purchased machinery on 1 April 2017 for $800,000. The machinery has an economic life of 5 years with a residual value of $50,000. The straight line method of depreciation is used to depreciate the machinery for accounting purposes. For tax purposes, the cost of the machinery is depreciated over 4 years using the straight line method. At the end of the financial year 31 March 2018, the machinery was revalued to $900,000. Alpha Ltd intends to sell the machinery very Zealand. Assume the tax rate is 28 percent (c) soon. Any capital gain from sale is not subject to taxation in New Required: In accordance with NZ IAS 12, provide the journal entries to account for the deferred tax adjustment arising from the machinery for the year ending 31 March 2018. Use WORKSHEET 3 on page 17 of the ANSWER BOOKLET for your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts