Question: Question Two ( 5 0 Marks ) ZamFoods Ltd . is a Lusaka - based Agro - processing company listed on the Lusaka Securities Exchange

Question Two Marks

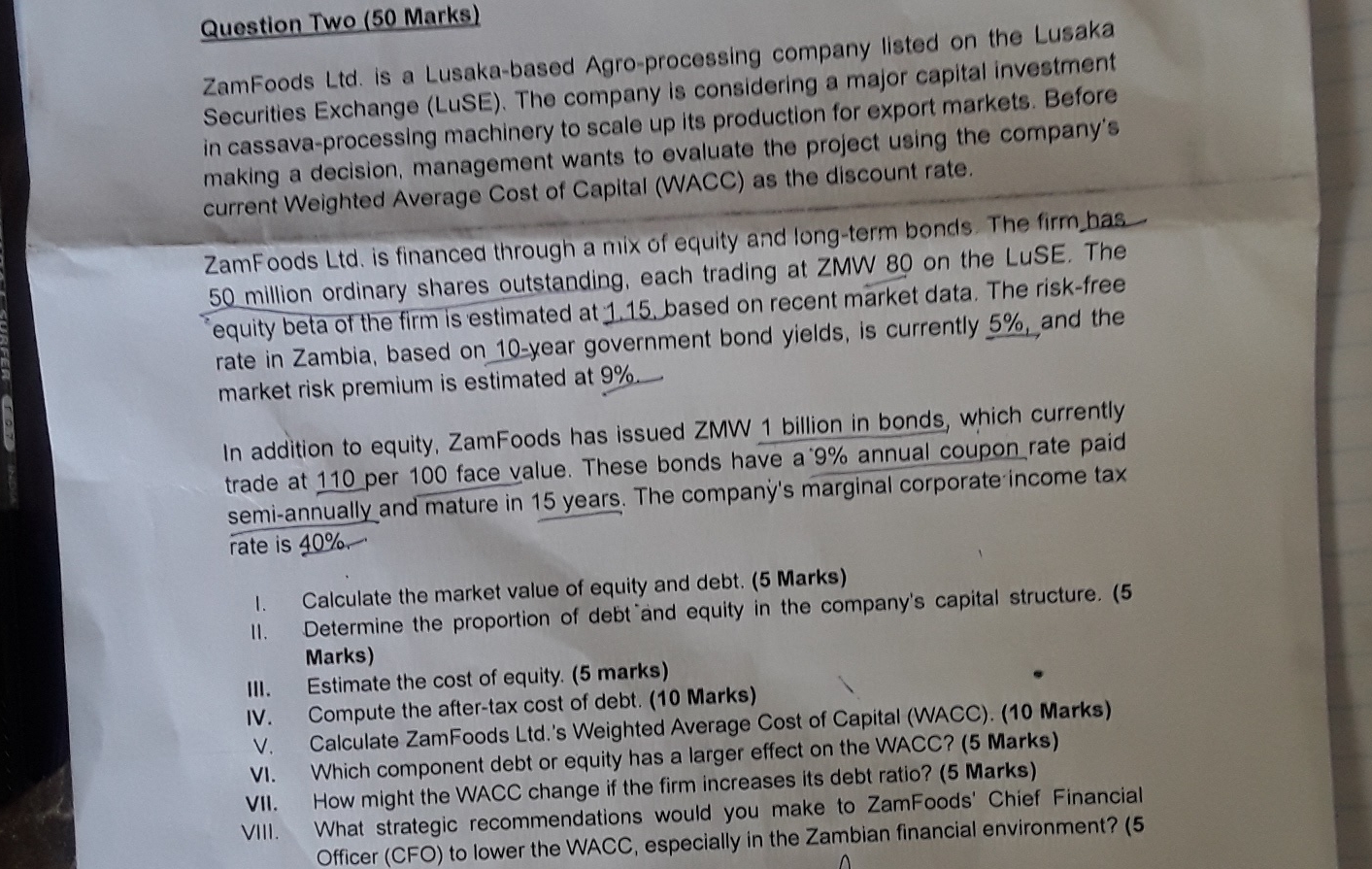

ZamFoods Ltd is a Lusakabased Agroprocessing company listed on the Lusaka Securities Exchange LUSE The company is considering a major capital investment in cassavaprocessing machinery to scale up its production for export markets. Before making a decision, management wants to evaluate the project using the company's current Weighted Average Cost of Capital WACC as the discount rate.

ZamFoods Ltd is financed through a mix of equity and longterm bonds. The firm has million ordinary shares outstanding, each trading at ZMW on the LUSE. The equity beta of the firm is estimated at based on recent market data. The riskfree rate in Zambia, based on year government bond yields, is currently and the market risk premium is estimated at

In addition to equity, ZamFoods has issued ZMW billion in bonds, which currently trade at per face value. These bonds have a annual coupon rate paid semiannually and mature in years. The company's marginal corporate income tax rate is

I. Calculate the market value of equity and debt. Marks

II Determine the proportion of debt 'and equity in the company's capital structure. Marks

III. Estimate the cost of equity. marks

IV Compute the aftertax cost of debt. Marks

V Calculate ZamFoods Ltds Weighted Average Cost of Capital WACC Marks

VI Which component debt or equity has a larger effect on the WACC? Marks

VII. How might the WACC change if the firm increases its debt ratio? Marks

VIII. What strategic recommendations would you make to ZamFoods' Chief Financial Officer CFO to lower the WACC, especially in the Zambian financial environment?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock