Question: SECTION A This question is compulsory. CASE STUDY The Lusaka stock exchange has various Capital raising instruments and entities that could assist organizations and individuals

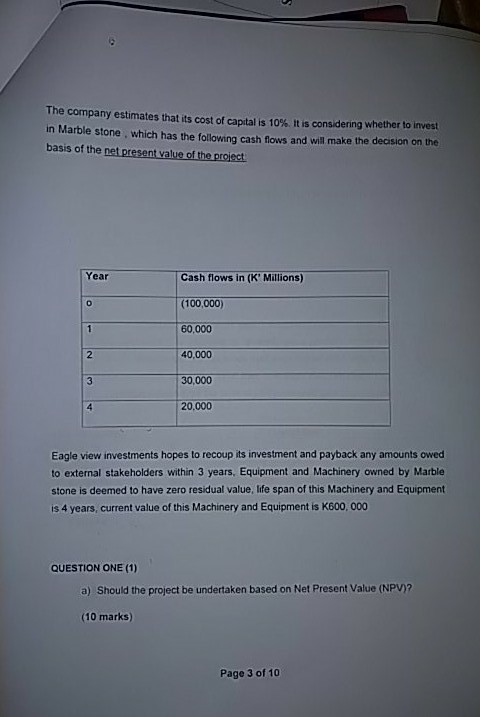

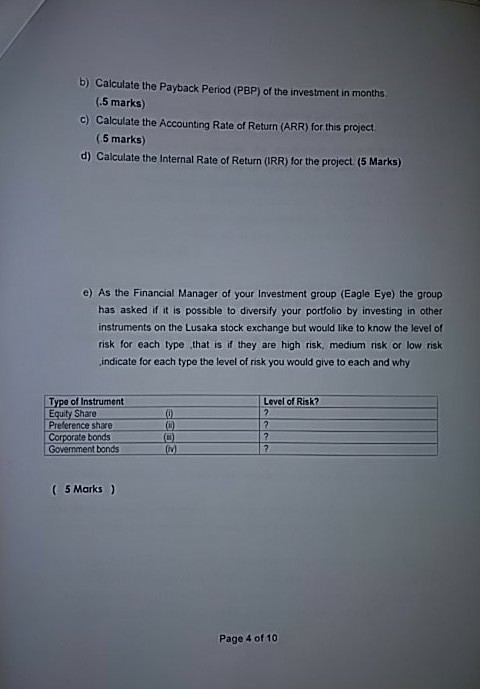

SECTION A This question is compulsory. CASE STUDY The Lusaka stock exchange has various Capital raising instruments and entities that could assist organizations and individuals with creating wealth and an investment Culture The advantage of entities that are listed is that they are able to raise funds for businesses, it gives an opportunity to broaden shareholding, it also helps improve the profile of the businesses Current news of the day on the market, indicates the following In 15 trades recorded today. 369,669 shares were transacted yielding a market turnover of K2, 924,320 Trading activity was recorded in SCBL, ZABR, ZMBF and ZNCO. The LUSE All Share Index (LASI) maintained its close of 4,258.14 points as there were no share price movements. The market closed on a capitalization of K56 529.102.118 including Shoprite Holdings and K22, 289,896,138 excluding Shoprite Holdings Due to the current market indicators your investment group that you have created with 30 students called Eagle eye investments have decided to invest in a company listed on the Lusaka stock exchange but you are uncertain if the return will be worthwhile, your group has therefore decided to make the desion based on the Net present value of the project. Information on Marble stone Itd Page 2 of 10 The company estimates that its cost of capital is 10% It is considering whether to invest in Marble stone which has the following cash flows and will make the decision on the basis of the net present value of the project Year Cash flows in (K Millions) (100,000) 60,000 40,000 30,000 20.000 Eagle view investments hopes to recoup its investment and payback any amounts owed to external stakeholders within 3 years, Equipment and Machinery owned by Marble stone is deemed to have zero residual value Ife span of this Machinery and Equipment is 4 years, current value of this Machinery and Equipment is K600,000 QUESTION ONE (1) a) Should the project be undertaken based on Net Present Value (NPV)? (10 marks) Page 3 of 10 b) Calculate the Payback Period (PBP) of the investment in months (.5 marks) c) Calculate the Accounting Rate of Return (ARR) for this project (5 marks) d) Calculate the Internal Rate of Return (IRR) for the project. (5 Marks) c) As the Financial Manager of your Investment group (Eagle Eye) the group has asked if it is possible to diversify your portfolio by investing in other Instruments on the Lusaka stock exchange but would like to know the level of risk for each type that is if they are high risk, medium risk or low risk indicate for each type the level of risk you would give to each and why Level of Risk? Type of Instrument Equity Share Preference share Corporate bonds Government bonds ? (M ( 5 Marks) Page 4 of 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts